In early July, raw milk prices in Ukraine remained stable, but are expected to rise amid increasing butter prices. Following an updated trade agreement with the EU, Ukraine received expanded quotas for dairy product exports, which facilitated the resumption of supplies and led to a raw material shortage in the domestic market, reports Georghii Kukhaleishvili, an analyst at the Association of Milk Producers.

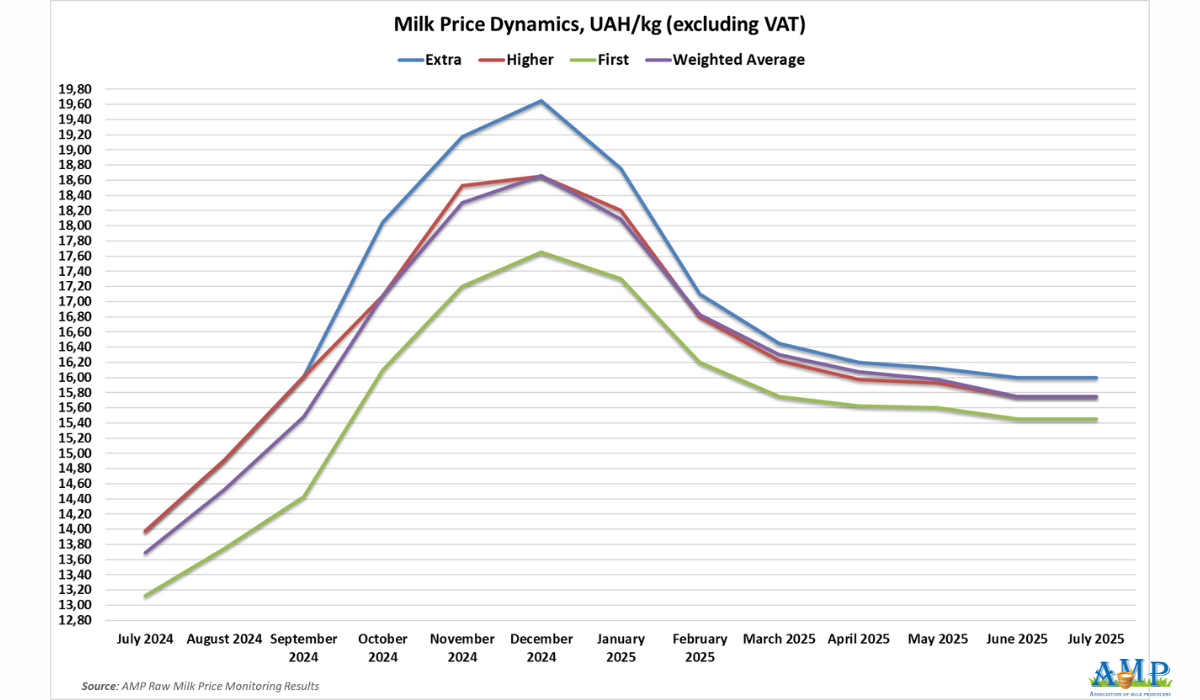

The average purchase price for extra grade milk as of July 9 was 16.00 UAH/kg without VAT. The price range for this grade in farms varies from 15.50 to 16.50 UAH/kg without VAT.

Higher grade milk costs an average of 15.75 UAH/kg without VAT. Prices for higher grade milk range from 15.30 to 16.20 UAH/kg without VAT.

The average price for first grade milk was 15.45 UAH/kg without VAT. The minimum price in farms was 15.00 UAH/kg. The maximum price was 15.60 UAH/kg.

Compared to early June 2025, prices within the middle of the price corridor, as well as minimum and maximum prices for all three grades, remained unchanged.

Accordingly, the weighted average price of the three grades was 15.80 UAH/kg without VAT and has not changed over the past month.

Georghii Kukhaleishvili notes that Ukraine is observing an upward trend in raw milk prices in the short term due to increasing demand for commodities supplied to Europe. The EU and Ukraine have revised their trade agreement, agreeing on new quotas for Ukrainian dairy product exports, with a gradual transition to EU standards by 2028. In June, after the cancellation of autonomous trade measures (ATMs) and the reintroduction of quotas and duties on Ukrainian dairy products by the European Commission, milk processing enterprises adopted a wait-and-see approach and exported the smallest volumes of commodities to Europe in the last five years.

However, following negotiations, the European Commission approved customs clearance procedures and increased quotas for Ukrainian suppliers for butter from 5 to 7 thousand tonnes, for skim milk powder from 5 to 15.4 thousand tonnes, and abolished quotas for whole milk powder, fermented and cultured dairy products, including yogurts and kefirs. As a result, Ukraine resumed dairy product supplies to Europe, and a slight raw milk shortage even emerged in the domestic market, similar to early July 2024. Milk processing plants began searching for cheaper milk.

The profitability of dairy product production has improved in Ukraine, and rising butter prices also influence purchase prices. It is likely that in the second half of July and August, purchase prices may be revised upwards, provided butter prices continue to rise. A factor that could restrain demand for raw milk in Ukraine from processors is the decrease in cheese production volumes and the increased supply of imported cheeses in the domestic market. Deepening trade disputes between the US and the EU could lead to a reduction in European dairy product supplies to the American market, accumulation of surpluses in member states, weakening prices, and decreased interest in Ukrainian products from European buyers. However, Ukrainian companies are gradually reorienting towards markets in the Middle East and Africa.

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News