According to Teagasc data, in 2025, milk production volumes are showing mixed dynamics in the main dairy product exporting regions. As reported by Agriland, demand for dairy products in the first half of 2025 was positive, driven by increased shipments to the Middle East and Southeast Asia, despite a decrease in import volumes from China.

Production and Demand

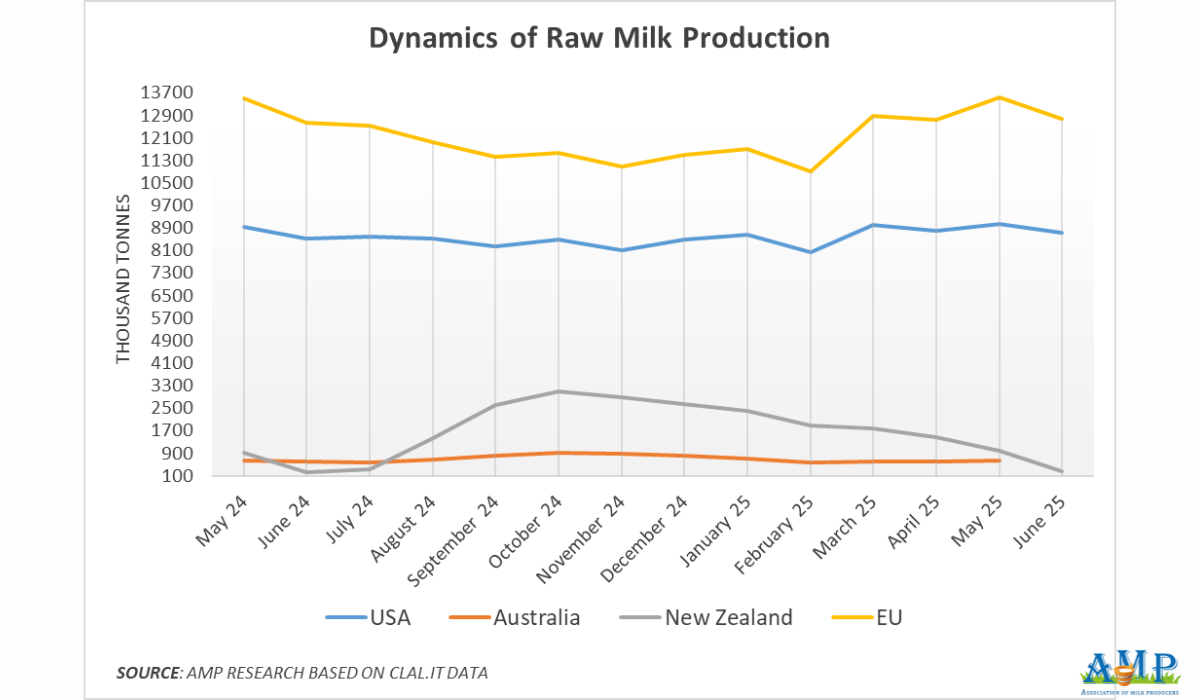

Europe. According to clal.it, in June 2025, milk yields in the EU amounted to 12.71 million tonnes, which is 6% less than in May but 1% more than in June 2024. From January to June 2025, the EU produced 75 million tonnes of raw milk, a 0.4% decrease compared to the same period last year. According to Teagasc, milk yields decreased in Germany and the Netherlands in 2025, remained stable in France and Spain, and increased in Ireland and Poland. However, the USDA predicts a slight increase in milk production in Western Europe in 2025, despite a reduction in the dairy herd size. According to preliminary USDA data, the decline in milk production in Europe in July 2025 was smaller than in July 2024.

Additional pressure on the dairy industry is coming from the spread of diseases among cows. The French Ministry of Agriculture is taking measures to stop the rapid spread of Lumpy Skin Disease (LSD) in cattle. Since the first case was detected in June, 32 infections have already been confirmed. The ministry purchased a large batch of vaccines from the European reserve and ordered the rapid culling of infected herds.

Compared to 2024, the EU increased its production of cheese and whey, but the production of skim milk powder and whole milk powder decreased amid unfavorable market conditions. As reported by Agriland, demand for dairy products in the first half of 2025 was positive, driven by increased shipments to the Middle East and Southeast Asia, despite a decline in import volumes from China. According to CLAL, Brazil reduced its imports of whole milk powder in January-June 2025 compared to the same period in 2024.

On the other hand, the USDA suggests an increase in demand for whole milk powder from China due to the growth of the urban population, an increase in citizens' purchasing power, and greater consumption of proteins and dairy products. The growth in the consumption of powdered milk formulas may be supported by the Chinese government's introduction of a state subsidy system for childcare as part of the country's efforts to support families and stimulate the birth rate. This is beneficial for the EU and other producers and exporters of dairy products. A new trade agreement between the EU and the US is also expected to facilitate agricultural trade, particularly by simplifying sanitary requirements for dairy products.

According to Chosun Biz, Polish dairy products are rapidly gaining market share in South Korea due to their high quality and competitive prices. Since 2022, Korea has increased its imports of Polish sterilized milk by 84%. Polish producers supply premium dairy products to Korean consumers. Poland is promoting its dairy products through culinary master classes, tastings, and awareness campaigns about the benefits of Polish products.

According to an AHDB forecast, milk production in the United Kingdom could grow by 0.7% annually until 2034. As reported by Agriland, production growth in Ireland and the United Kingdom is due to favorable weather conditions and increased farm profitability. The main challenges for the British dairy industry remain price volatility, labor shortages, a reduction in the number of dairy farms and cow herds, and the threat of diseases.

USA. According to clal.it, in June 2025, the US produced 8.72 million tonnes of raw milk, which is 3% less than in May but 2.5% more than in June 2024. From January to June 2025, milk yields in the US totaled 52.38 million tonnes, a 1% increase compared to the previous year. According to the USDA, in July, milk production in the US was low in most eastern regions, but there was enough raw material to meet processing needs.

In late July, the production of packaged milk increased due to the approaching start of the school year. Cheesemakers purchased additional volumes of raw milk on the spot market, taking advantage of production shutdowns at other dairy processing plants. For example, butter producers are not using their full capacity, and demand for raw milk from ice cream producers is also declining.

In the central region, high temperatures negatively affected milk yields, although in the Midwest, cooler nights improved the situation. In California, production decreased due to the heat, although overall milk yields exceeded expectations, and a year-over-year increase was observed. In the mountain states, production varied from stable to slightly lower, and milk demand remained stable. Demand for cream increased, and its availability was limited.

Oceania. According to the FAS/Canberra forecast, raw milk production in Australia could decrease by less than one percent to 8.6 million tonnes in 2025, after a notable 2.4% increase in 2024, which marked the first significant rise in milk yields since 2020. According to the USDA, the Australian dairy industry is facing difficult times due to a prolonged drought, particularly in the state of Victoria, and a sharp increase in the cost of production materials. The cost of electricity, fuel, and fertilizers, especially urea, has risen. However, record volumes of winter crops could help partially reduce costs if feed supply increases in certain regions, such as northern New South Wales and Queensland.

In Australia, the consolidation of dairy companies continues with the aim of responding more effectively to challenges and reducing operating costs. In July, the Australian Competition and Consumer Commission (ACCC) approved the merger of dairy processing companies Lactalis and Fonterra. The acquisition of Fonterra's assets by the French group Lactalis will create a powerful dairy giant in Australia. Both companies purchase and process raw milk in the states of Victoria and Tasmania.

According to clal.it, in June 2025, milk yields in New Zealand amounted to 261 thousand tonnes, which is 74% less than in May but 14.5% more than in June 2024. From January to June 2025, milk yields in New Zealand totaled 8.71 million tonnes, a 1.4% increase compared to last year. According to the USDA, a new dairy season has begun in New Zealand. June's milk yield figures exceeded previous records. Thanks to favorable weather and early calving, farmers expect milk yields to increase in July.

Furthermore, the export of New Zealand dairy products has grown significantly. The total value of shipments of milk powder, butter, and cheese amounted to $1.8 billion, a 22% increase compared to last year. The biggest buyers of New Zealand products were China and the EU, while exports to the US decreased slightly. The Fonterra cooperative also holds a 30% share of the cheese market and a 40% share of the milk protein market in Japan. Japan has reduced its dairy production by more than 10% since 2000 due to the unpopularity of farming among young people.

Dairy Market Prices

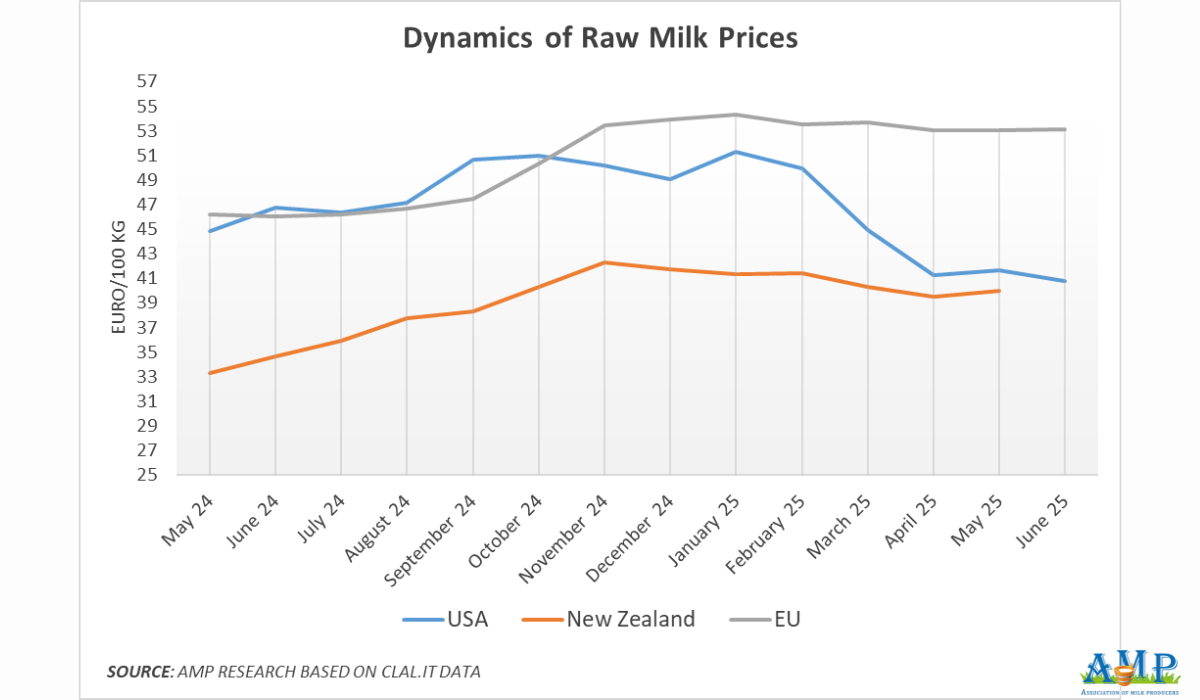

Europe. According to preliminary data from the European Commission, in June 2025, the average price for raw milk in the EU was 53.15 euro cents per kg, which is 0.2% more than in May 2025. Compared to June 2024, the price of milk in the EU increased by 15%. Raw milk prices in the EU remain higher than the five-year average, which is explained by stable demand in retail and the food service sector.

USA. According to clal.it, in June 2025, the price of raw milk in the US was 40.78 euros per 100 kg, which is 2% less than in May and 12.72% less than in June 2024. The decrease in raw milk prices was likely due to production shutdowns at certain butter and ice cream producers. Despite the reduction in milk yields in the summer, the supply of raw milk was sufficient to meet processing needs.

Oceania. According to the USDA, despite a slight increase in the average purchase price for milk to 9.50 Australian dollars per kilogram of milk solids in June, farmers are calling for an upward revision of pricing policy, as they are suffering losses due to rising production costs.

The Fonterra cooperative forecasts a starting milk price in New Zealand for the 2025/26 season at 10 New Zealand dollars per kilogram of milk solids. This is the highest figure in history, paving the way for farmers to have a second consecutive season with double-digit payouts and stable profits. At the same time, the extremely wide price range of 8 to 10 New Zealand dollars per kilogram of milk solids indicates potential market instability amid an uncertain macroeconomic situation.

Follow us on Facebook

Related News