In early August, the purchase price for raw milk in Ukraine increased due to high demand from processors who are trying to export more finished products to the EU before quotas are exhausted, reports Georghii Kukhaleishvili, an analyst at the Association of Milk Producers.

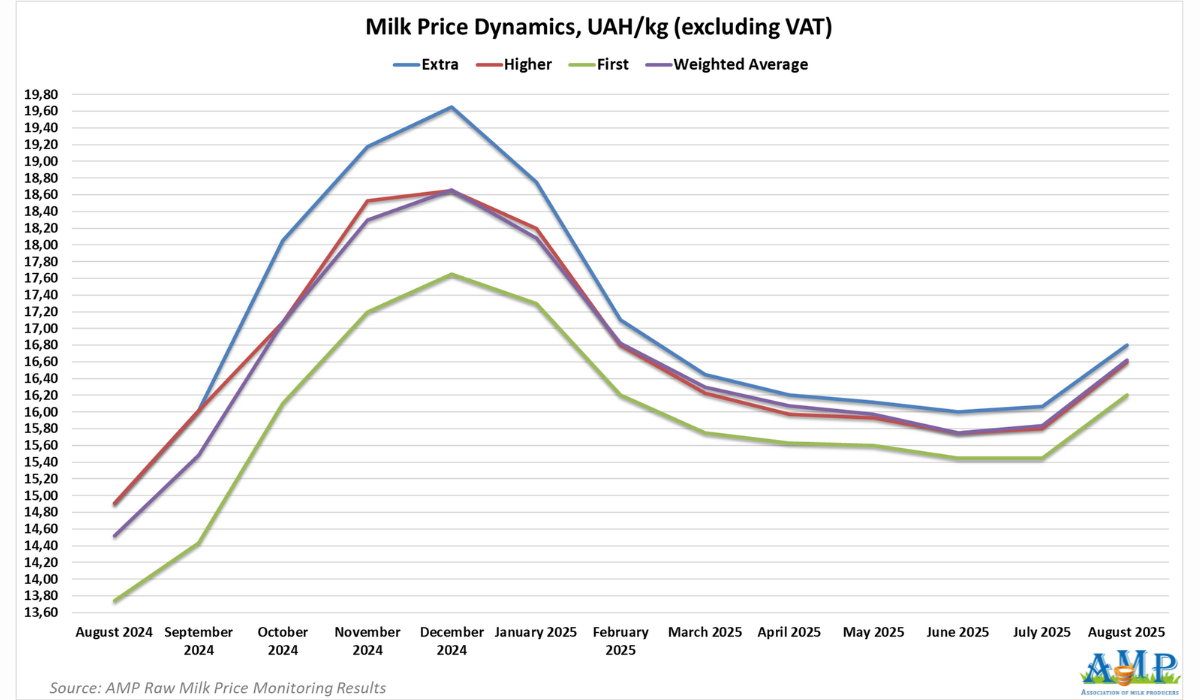

The average purchase price for extra grade milk as of August 5 was 16.80 UAH/kg without VAT, which is 66 kopiykas more than the previous month. The price range for this grade on farms varies from 16.10 to 17.20 UAH/kg without VAT. The lower price range increased by 60 kopiykas, and the upper one by 50 kopiykas.

Higher grade milk costs on average 16.60 UAH/kg without VAT, which is 75 kopiykas more than a month ago. Prices for higher grade milk ranged from 15.80 to 16.90 UAH/kg without VAT. The lower price range increased by 50 kopiykas, and the upper one by 55 kopiykas.

The average price for first grade milk was 16.20 UAH/kg without VAT, which is 75 kopiykas more than the previous month. The minimum price on farms was 15.50 UAH/kg. The maximum price was 16.50 UAH/kg. The lower price range increased by 50 kopiykas, and the upper one by 90 kopiykas.

Accordingly, the weighted average price for all three grades was 16.62 UAH/kg without VAT, which is 70 kopiykas more compared to the previous month.

Georghii Kukhaleishvili notes that in early August, demand for raw milk in Ukraine increased because milk processing enterprises are striving to ship as many finished products as possible to the EU duty-free before quotas are exhausted. In June 2025, the European Commission canceled autonomous trade measures (ATMs) and reinstated quotas and duties on Ukrainian dairy products. Subsequently, Ukraine and the EU revised the trade agreement, agreeing on new quotas for Ukrainian dairy product exports, subject to a gradual transition to EU standards by 2028. However, the new document has not been signed due to the position of Hungary, Poland, Romania, Bulgaria, and Slovakia regarding the duties and quotas for Ukrainian grain, which are also included in the agreement.

This is why they are offering higher purchase prices to milk producers to gain access to the available raw materials. EU quotas for butter and milk powder are almost exhausted. The trend of 2024, when raw milk became 74 kopiykas more expensive in August compared to July, is repeating itself. Although prices have increased for all milk grades, as well as for milk from household farms, due to the exhaustion of quotas, dairy product exports from Ukraine to the EU will likely be suspended within a month if new trade rules are not implemented soon.

About 20% of raw milk was processed for export, and after the EU quotas are exhausted, the finished products will accumulate in warehouses. However, a sharp drop in raw milk prices is unlikely in the coming months, as processors' warehouses are empty, and they will be able to gradually replenish commodity stocks. If the European Commission approves a new trade agreement with Ukraine in September, then dairy product exports to the EU should resume. However, a sharp jump in purchase prices should not be expected in September, as dairy products from warehouses are to be supplied to the EU. According to processors' forecasts, the average milk price in September could be 16.70 UAH/kg, and in October – 17.10 UAH/kg.

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News