According to IFCN estimates, global milk production volumes are expected to increase by 11 million tonnes in 2025 compared to last year. The weather in Southern Hemisphere countries was favorable, leading to production growth in Oceania and Latin America. Farmers in Europe and the US enjoyed good profits, which also stimulated increased production. Furthermore, demand for milk components rose, contributing to increased production of milk powder and protein products. At the same time, milk production is shrinking in China due to weaker domestic demand, so the volume of finished product imports is also not increasing. IFCN analysts believe that the current price drop is temporary, and in the long term, dairy fat and protein are expected to become more expensive, as these components remain scarce. According to the IFCN forecast, the world could face a milk deficit of more than 20 million tonnes (in milk equivalent) by 2035. Most likely, demand will partially remain unmet, prices will rise, and competition in domestic and foreign markets will intensify.

Production and Demand

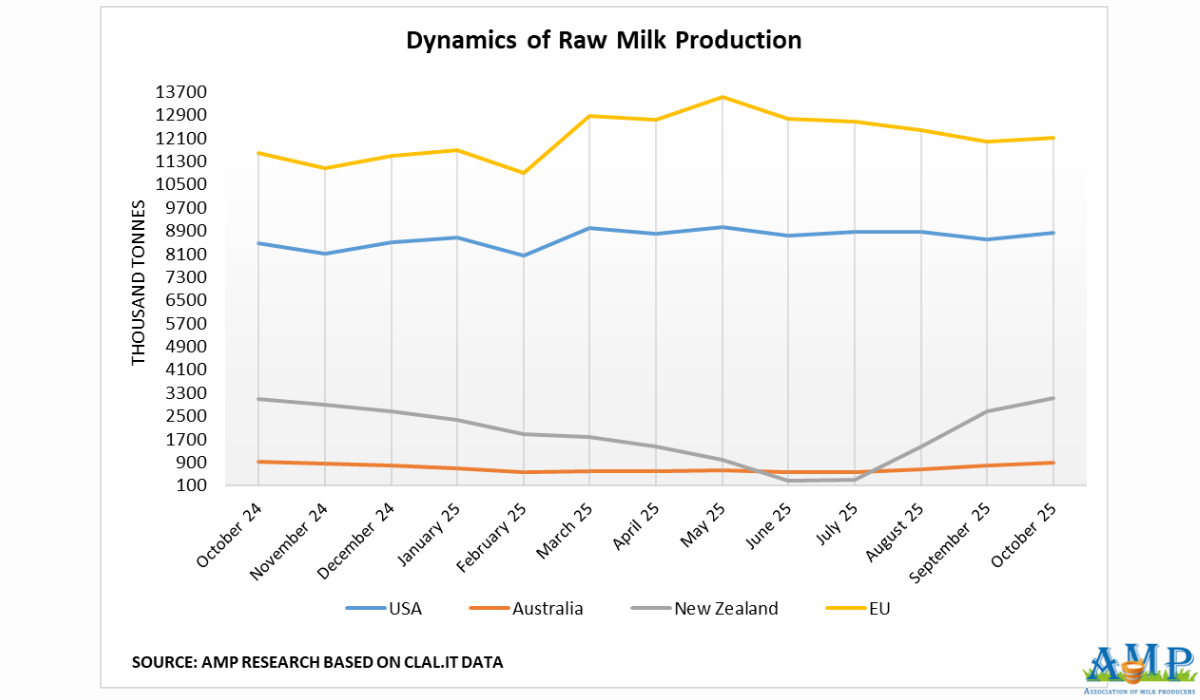

Europe. According to clal.it, milk yield volumes in the EU in October 2025 amounted to 12.13 million tonnes, which is 1% more than in September and 5% more than in October 2024. In January–October 2025, raw milk production volumes in the EU amounted to 124.14 million tonnes, which is only 0.8% more than in the same period last year. According to IFCN, the growth rates of milk production in Europe have been relatively low since 2022, but a significant revival in milk yields occurred from August 2025. Consequently, the milk production growth reached over 5% year-on-year, which has not been observed in the market since 2015. Farmers increased milk yields against the backdrop of relatively high raw milk prices and low feed prices. The fat and protein content in milk increased by 1–1.5% in the European market this year.

Raw milk production mainly grew in North-Western Europe (Germany, France, Belgium, Netherlands, Ireland) due to high farmer margins, less cow culling, favorable weather conditions, and good grass quality on pastures in spring and summer. Due to the increase in milk yield, high milk prices began to gradually decline. Production is growing very actively in Eastern Europe, namely in Poland. Growth is also observed in Scandinavian countries, particularly Sweden, due to the rising popularity of dairy products among consumers. Southern Europe has been more affected by climate and weather factors, and production growth is in line with average annual rates.

According to IFCN experts, the economic stability of farms in the EU is negatively affected by environmental and regulatory restrictions, including limits on production volumes and cuts in funding under the Common Agricultural Policy. The European dairy industry is pressured by unfavorable weather and cow diseases such as Foot-and-Mouth Disease and Bluetongue, as they increase farmers' costs for biosecurity measures and raise the overall cost of production.

Consolidation of farms and milk processing enterprises is observed in Europe. Over the last 30 years, the number of farms in Europe has decreased from 4.88 million to 800 thousand. The larger the farm, the more milk can be collected and delivered to the processing enterprise, the stronger its negotiating position on procurement prices. Milk processing enterprises are also merging to secure the necessary volumes of raw milk despite the reduction in the number of farms.

USA. According to clal.it, milk yield volumes in the US in October 2025 amounted to 8.83 million tonnes, which is 3% more than in September and 4% more than in October 2024. In January–October 2025, raw milk production volumes in the US amounted to 87.60 million tonnes, which is 2% more than in the same period last year. Betty Berning, economist at High Ground, notes that raw milk production in the US in 2025 is growing at the fastest rate in the last 20 years. October was the fifth consecutive month where milk yield growth rates exceeded 3%. The largest production growth is observed in regions where new processing capacities are being commissioned, namely in the Central Plains (Texas, Kansas, South Dakota), the Great Lakes region, and Idaho. According to the National Milk Producers Federation, the US dairy industry volume could reach $11 billion by 2026.

One of the reasons for this surge is a sharp increase in the dairy cow herd. From June 2024 to September 2025, the cow herd grew from 9.32 million to 9.58 million head. The number of cows increased despite the ongoing reduction in the beef cattle herd and the lowest US beef inventories since the late 1970s. According to the USDA, the total cattle population in the US has decreased by 7 thousand head since December 2024. According to High Ground economist Betty Berning, American farmers quickly increased their dairy cow herd because they cross-bred over half of their cows with beef bulls. This resulted in hybrid calves whose value exceeded $1,000.

Favorable feed prices contributed to increased milk production. According to USDA calculations, in the autumn of 2024, farmer income after feed costs was at a record high, allowing them to increase milk production. The entry of a large volume of high-fat milk into the market led to increased production of cheese and butter. Skim milk powder inventories also increased. There is high demand for whey protein concentrate and isolate in the US, and its production volumes have reached a maximum.

However, the problem the market faced was the fall in raw milk and finished product prices. Therefore, a correction or reduction in market volumes is likely in 2026. Dairy market analyst Chris Walkland believes that the surplus milk supply may decrease due to the rapid reduction of the cow herd in the US. According to Betty Berning's forecast, milk production is expected to grow by 2.8% in 2025 after three years of stable production. Significant milk yields are likely in the first half of 2026, especially in the spring, followed by a gradual decline below the 2025 level if the cow herd is reduced.

Oceania. As reported by clal.it, milk yield volumes in New Zealand in October 2025 amounted to 3.13 million tonnes, which is 17% more compared to September and 2% more compared to October 2024. In January–October 2025, milk yield volumes in New Zealand amounted to 16.26 million tonnes, which is 1.6% more than last year. According to IFCN, New Zealand's share in global milk production is 2–3%, but its share in global dairy product trade is one-third. Since only 5 million people live in the country, the domestic market is too small to absorb all locally produced milk. Therefore, surplus milk is exported in the form of commodity goods.

Despite the reduction in cow numbers, overall milk production in New Zealand has been stable over the last 10 years. In New Zealand, cows graze on pastures all year round, allowing farmers to maintain low production costs and preserve profitability. Milk production in the first four months of the current season significantly exceeded the figures of recent years, making large surpluses likely. Farmers increased milk yields, taking advantage of an attractive procurement price that is above the break-even point.

IFCN reports that the New Zealand Halter technology—a cow collar controlled via an app and satellite technology—was also supposed to contribute to increased milk yield. The device allows farmers to control cow feeding, provides information on their location and the amount of feed consumed on pasture, and helps gather cattle from pasture to barn, reducing labor costs. According to IFCN, one New Zealand farmer received an additional 35,000 kg of dry milk solids per year on a farm with 440 cows.

According to clal.it, milk yield volumes in Australia in October 2025 amounted to 896 thousand tonnes, which is 11% more compared to September, but 2% less compared to October 2024. In January–October 2025, Australia produced about 6.57 million tonnes of raw milk, which is 2.5% less compared to the same period last year. According to the USDA, drought persisted in New South Wales and the southern regions of Western Australia in October 2025, and reservoir levels in many places were significantly lower than the average for the last five years. The cost of urea and diammonium phosphate decreased, while potash fertilizer prices rose due to increased demand from buyers in the Northern Hemisphere.

Dairy Market Prices

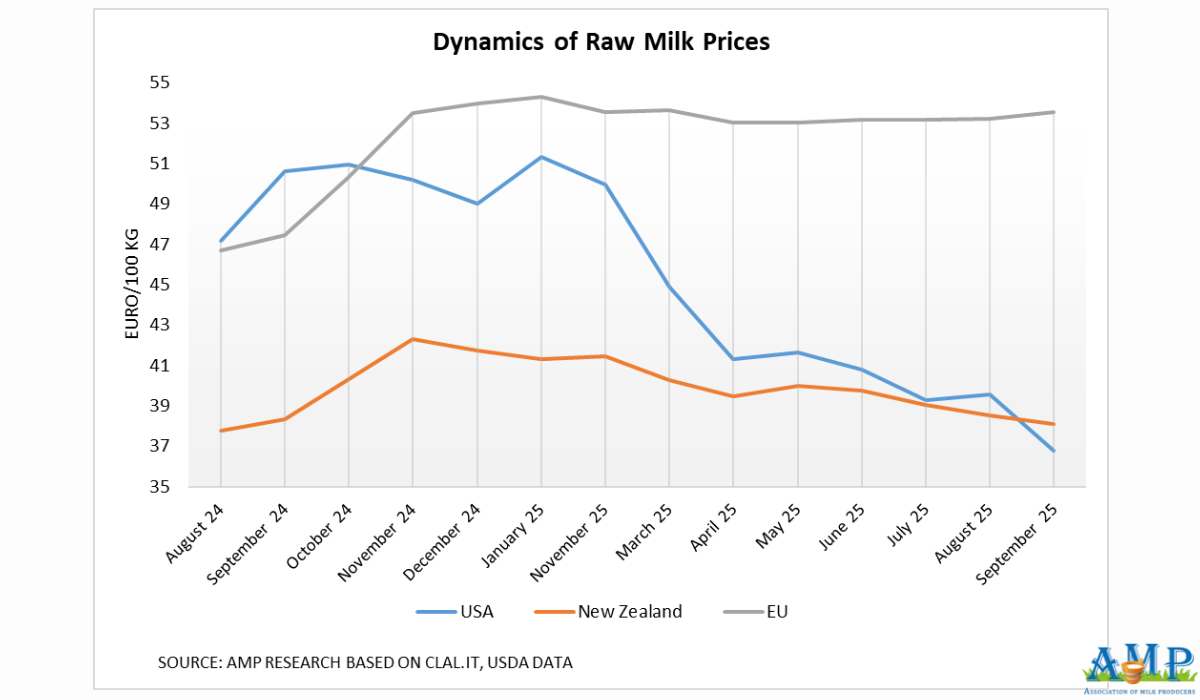

Europe. According to preliminary data from the European Commission, the average raw milk price in the EU in October 2025 was 52.91 euro cents per kg, which is only 0.94% less than in September 2025. Compared to the price as of October 2024, milk in the EU became 2.3% more expensive. According to IFCN, milk prices in the EU have remained higher than the global level since 2022. However, the increase in raw milk production is putting pressure on procurement prices, and this trend will continue. The weighted average milk price may fall below €40 per 100 kg, after which stabilization is expected.

Today, the EU and the UK are in a corridor of high prices, unlike dairy exporters such as the US, Latin America, and New Zealand. According to IFCN estimates, almost a quarter of the world's milk is currently produced at very high prices, which is not competitive in the long term. It is likely that milk prices in Europe will decrease to maintain the competitiveness of European dairy products in the global market. The gradual increase in demand for dairy products is likely to help balance the market. A significant collapse in procurement prices is unlikely in the short term.

USA. According to AgProud, the weighted average regional uniform milk price under the Federal Milk Marketing Order System in October 2025 was $18.50 per hundredweight (about €35.05 per 100 kg equivalent), which is $1.10 lower compared to September. Milk prices are likely falling amidst increased milk yields. According to High Ground economist Betty Berning, the drop in the milk price parallel with a gradual increase in feed costs led to higher farm expenses. Under these conditions, revenue from red meat sales became a critically important source of farm income this year. Farmers are forced to send their animals to slaughter, so a certain correction or reduction in the dairy market is likely in 2026.

According to market analyst Kari Murphy, the American dairy industry is pressured by unfavorable macroeconomic factors such as rising inflation, unemployment, and household debt burden (auto loans, mortgages, student loans). Since the beginning of the year, about 1.1 million people have been laid off in the US, the highest number since the pandemic. The current level of consumer confidence is the lowest since 2022 and slightly below the 1981 level, prior to the US farm sector crisis. Americans are saving money, postponing purchases, and cutting spending in food service establishments, which affects reduced demand for butter and cheese and weakens prices. On the other hand, people are eating at home more often, which is beneficial for retail sales of dairy products. A driver of demand for the dairy aisle in American supermarkets is the GLP-1 weight control drugs, taken by almost 14 million people, which promote demand for high-protein products such as yogurt, cottage cheese, Mozzarella cheese, and other fresh cheeses.

Oceania. According to Bendigo Bank, any increase in procurement prices in Australia is likely to be driven by competition between processors or price support for farmers during another season with high production costs, rather than high revenues. As leading milk producers consistently report year-on-year growth in milk yield, prices are likely to remain under pressure. In particular, the company Saputo met farmers halfway and increased procurement prices, which led to an increase in the weighted average milk price to A$9.15–9.25 per kg of dry milk solids in the Southern region.

According to IFCN, there are no direct subsidies in New Zealand, so farmer profitability is entirely dependent on the market milk price. Prices were high last season, standing at NZ$10–11 per kg of dry milk solids. However, amidst the increased raw milk supply in New Zealand and other producing countries, the company Fonterra revised its forecast for the procurement price for the 2025/2026 season downwards to NZ$9.50–10.00 per kg of dry milk solids. According to Fonterra Chairman Miles Hurrell, NZ$9.50 per kg of dry milk solids could be the optimal average price for the new season.

Press Service of the Association of Milk Producers

Follow us on LinkedIn

Related News