According to DCA Market Intelligence, "bearish sentiment" prevailed in the dairy market after the 382nd GDT auction. International futures markets show downward trends in both New Zealand and the EU, while in the US, "bearish" signals are less pronounced. According to The Bullvine, an additional 15.5 thousand tonnes of product were sent from New Zealand for the 383rd GDT auction, equivalent to a month's raw milk production from approximately 50 thousand cows. This likely led to a noticeable decline in the price index following the new auction, reports Georghii Kukhaleishvili, an analyst at the Association of Milk Producers.

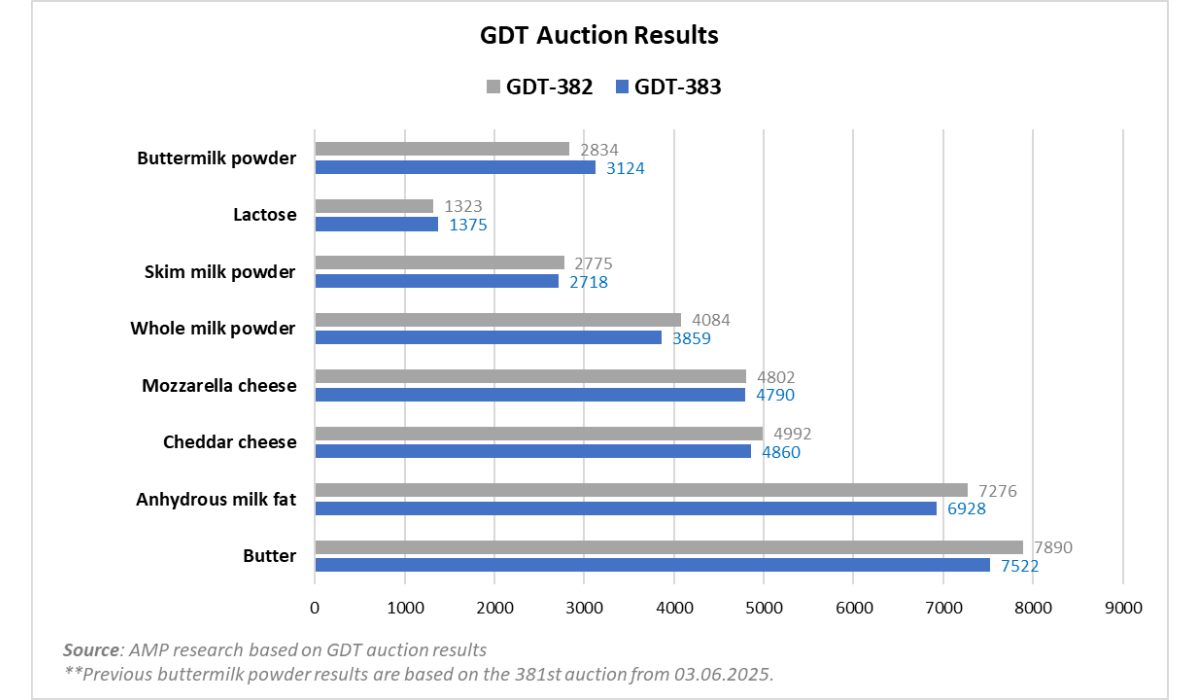

On Tuesday, July 1st, the 383rd GDT auction took place, with the price index reaching 1246, a decrease of 53 points (-4.1%) since the previous auction. The average price for dairy products was $4,274 per tonne, which is $115 less than the results of the previous trading. During the auction, 25,705 tonnes of commodities were sold, an increase of 10,496 tonnes compared to the last auction. The minimum offer was recorded at 24,046 tonnes, and the maximum at 29,995 tonnes. A total of 161 dairy market operators participated in the trading, which is 14 fewer companies than on June 16.

Following the auction, the price for anhydrous milk fat was $6,928 per tonne, a 4.2% decrease from the previous trading. The global market shows some imbalance in dairy fat production across different regions. According to USDA, in June, dairy fat prices increased in Europe amid shrinking product inventories and milk output. At the same time, as reported by The Bullvine, compared to May 2024, New Zealand increased raw milk production by 8.3%, the USA by 1.6%, and the UK by 5.8%. These countries have boosted their supplies of finished products to foreign markets, leading to an increase in supply that now exceeds demand. According to The Bullvine, the offer of anhydrous milk fat at this auction increased by 119%. Auction organizers predict an 8% increase in the price of anhydrous milk fat in August, but a 4.7% decrease in September.

The price for butter at this auction was $7,522 per tonne, a 4.3% decrease from the previous auction. As reported by The Bullvine, the offer of butter at this auction increased by 83.9%. Excessively high butter prices in recent months have negatively impacted demand. According to USDA, butter exports from the EU remain weak due to high domestic prices that limit the product's competitiveness in foreign markets. Butter prices are also high in Oceania. As reported by Fiji's Competition and Consumer Commission, the rise in butter prices is due to high international demand, climate adversities, and increasing shipping costs. The prolonged drought in New Zealand's North Island has led to reduced milk production and directly impacted butter output.

Butter stocks are growing in the American market. According to USDA, US butter producers are actively processing large volumes of cream. Some enterprises are freezing produced butter, preparing for increased demand in the second half of the year. Consumer demand for butter in the US is stable, but demand in export markets is growing, especially due to competitive prices for American butter compared to offerings from competitors in other regions. Against the backdrop of the Israeli-Iranian conflict, demand for butter from Middle Eastern countries has increased; they purchased about a third of all butter at the last auction to build up reserves. Demand for butter in China remains uncertain, given domestic restrictions. According to GDT forecasts, butter may fall by 5.5% in August and 4.5% in September.

The price for whole milk powder was $3,859 per tonne, a decrease of 5.1% compared to the previous trading. According to The Bullvine, the product offer at this auction increased by 76.6%. As reported by USDA, whole milk powder production in the US remained limited and primarily aimed at fulfilling contractual obligations. A significant drop in demand restrained price growth in the American market. As reported by The Bullvine, dairy product stocks are accumulating in New Zealand due to a certain improvement in milk yields at the end of the season and weak demand in export markets, particularly in China, which is reducing whole milk powder imports in favor of skim milk powder and cheese. According to USDA, the share of whole milk powder in New Zealand's total exports has decreased due to increased exports of other dairy products.

Traditionally, demand for milk powder decreases in summer. Most importers from Southeast Asia and the Middle East close contracts in spring, so July-August sees a traditional "summer calm" in GDT auctions and the spot market, when milk powder sales slow down and product prices decline. At the same time, during holidays and vacations in Europe and the USA, the workload of food industry enterprises decreases, and the need for milk purchases from schools disappears, which further weakens spot demand for milk powder.

Although, as reported by USDA, this year Algerian buyers showed interest in purchasing whole milk powder from South America. In Europe, demand for whole milk powder is strong this summer due to lower raw milk production compared to 2024, and spot product inventories were limited. According to GDT forecasts, a 0.7% decrease in whole milk powder prices is likely in August and a 5.1% decrease in September.

Skim milk powder dropped to $2,718 per tonne (-1.7%). According to USDA, demand for American skim milk powder, both in the US domestic market and in export markets, continues to decline. A particularly noticeable slowdown in demand comes from the key importer — Mexico, although shipment volumes remain relatively high. Skim milk powder inventories remain limited, but demand for the product is sluggish. In Europe, skim milk powder prices have risen, but domestic demand is shrinking. Due to hot weather in Europe, milk yields are decreasing, leading to a shortage of spot batches of skim milk powder.

In the Oceania market, demand for skim milk powder remains stable. Demand from China still exceeds domestic production, even considering the overall decrease in consumption since 2021. Demand for skim milk powder from South America varies from stable to strong, especially from buyers in Brazil and Algeria. At the same time, the South American market is experiencing a shortage of spot batches of the product, indicating excess demand compared to producers' capabilities. Auction organizers expect a 0.5% decrease in skim milk powder prices in August, but forecast a 0.2% price increase in September, towards the end of the holiday season.

Cheddar cheese fell to $4,860 per tonne (-2.8%), and Mozzarella cheese fell to $4,790 per tonne (-0.2%). According to USDA, in Europe, cheese production is prioritized over milk powder, although consumer prices have fallen by 2.4% over the past month. At the same time, export activity remains high. In the US, large cheese inventories exist, but domestic market demand is stable. In Oceania, cheese prices are also strengthening, partly due to increased demand in export markets in the second half of 2025. As reported by Kua Yu-long, CEO of Chinese company Milkground Food Tech, demand for cheese in China is growing again after several years of stagnation caused by price wars and a narrow focus on producing children's snacks.

Producers have reoriented towards a wider range of consumers, including adults, due to the growing popularity of cheese consumption in work snacks, fitness supplements, and light meals. This has contributed to increased sales and production capacity utilization. The popularity of Western cuisine and cheese-based baked goods stimulates demand expansion, especially in the B2B segment. Euromonitor forecasts that by 2027, the annual growth in cheese, butter, and cream consumption in China will be 7-11%. Companies are investing in their own cheesemaking facilities in China to reduce import dependence. Auction organizers assume that Cheddar cheese may fall by 1.8% in September. A 0.1% decrease in Mozzarella cheese prices is predicted for September.

Lactose increased to $1,375 per tonne (+4.2%). According to USDA, citing market participants, demand for the product is strong in both the US market and export markets. Auction organizers predict a 4.3% decrease in the product's price in September, on the eve of the acute respiratory disease season and increased demand for medications that use lactose in their production.

Buttermilk powder increased to $3,124 per tonne (+9.3%). According to USDA, demand for buttermilk powder in the US shows signs of growth, especially amid limited supply. Producers primarily work to fulfill contracts, leaving only a small portion of volumes for spot sales. Buttermilk powder inventories are decreasing, and market participants predict their scarcity until the end of the third quarter. There is demand for buttermilk from ice cream manufacturers. Reduced butter production in summer is also likely to limit the supply of buttermilk for drying. Auction organizers predict a 15.9% price increase for the product in August and a 9.3% increase in September.

The next GDT auction will take place on July 15.

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News