Global economic challenges, trade disputes, and production hurdles may compel dairy market operators to gradually re-evaluate their activities in the second half of 2025. Dairy fat prices have hit record highs since last autumn, but Rabobank warns that growing dairy product supply and unstable demand could destabilize the market.

PRODUCTION AND DEMAND

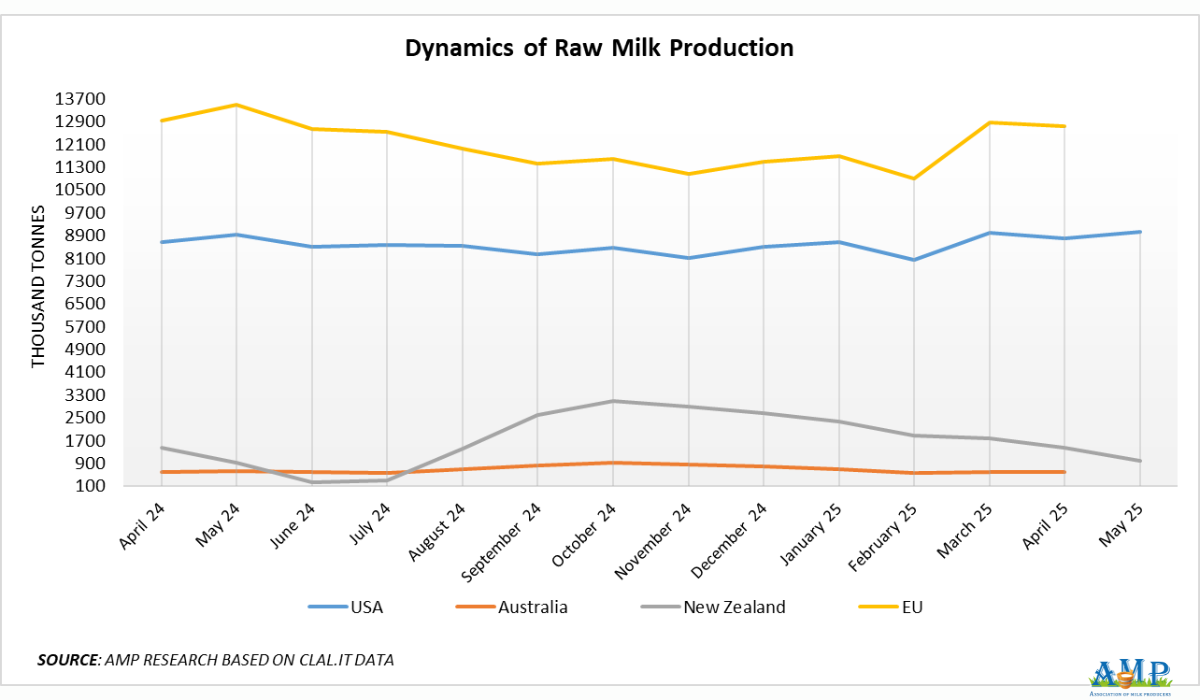

Europe. According to USDA, overall raw milk production in Europe is declining. Mainland Europe has been affected by the spread of the bluetongue virus, which limited milk production in spring. This led to a shortage of some key products, particularly butter, which is supporting high prices. Although the bluetongue outbreak has passed, the reduction in cow herds continues. According to GIRA, the cow population in the EU has decreased by 2.6%. Excessively dry weather is hindering the recovery of raw milk production. Rabobank forecasts a 0.4% increase in milk production in the EU in 2025, but GIRA expects a slight decrease in milk yields by 0.1%, partially offset by increased fat and protein production.

Cheese production in the EU is growing as processors prioritize cheesemaking over milk powder production. Increased cheese production capacity and high global demand for cheese also heighten competition for access to raw milk in the region. Milk production in Ireland may halt if the country loses its right to use nitrates in feed production. Increased production costs could force Irish farmers to reduce their livestock by 18%. The United Kingdom has been a notable exception. According to The Bullvine, the UK increased milk yields by 5.8% compared to May 2024 and, along with the US and New Zealand, boosted supplies of finished products to foreign markets, leading to a rise in supply that now outweighs demand.

Prices for skim milk powder in Europe remain relatively stable throughout the year. GIRA forecasts low demand for milk powder in the EU and the US, declining demand in China, and sustained demand from Algeria. Demand for milk powder in Southeast Asia remains active, which could lead to price increases in the fourth quarter, depending on the supply situation.

USA. According to clal.it, in May 2025, the US produced 9.04 million tonnes of raw milk, which is 3% more than in April and 1.3% more than in May 2024. From January to May 2025, milk yields in the US totaled 43.58 million tonnes, almost on par with last year (+0.5%). According to USDA, the milk yield situation in the US in June varied across regions. In the Northeastern US, raw milk production in late June was significantly higher than expected, while in the Southwest, it was seasonally low but sufficient to meet production needs. In the Central US, heat negatively affected cow comfort, leading to reduced milk yields.

In the Upper Midwest, milk yields decreased slightly, and due to the temporary closure of some cheese factories, more spot milk became available on the market. In the Western US, particularly California, milk production seasonally decreased but remained higher than last year. In Arizona and New Mexico, heat negatively impacted milk yields. In the mountain states of Idaho, Utah, and Colorado, production volumes increased compared to last year but remain stable or slightly decreasing on a weekly basis.

Rabobank forecasts that milk production may grow by 1% in the US, Argentina, and New Zealand by the end of the year. However, increased supply and ambiguous demand could put pressure on prices during certain periods. The US and China have taken a temporary pause in trade disputes. On May 12, Beijing lowered tariffs on key American dairy products from 125% to 10% for a period of 90 days. This relief covers supplies of whey and lactose products. However, this sudden easing immediately caused prices for these products to fall in China. American exporters are now in a state of uncertainty, complicating long-term supply planning and pricing.

Oceania. As reported by AHDB, in May 2025, average daily milk yields in Australia were approximately 200 thousand tonnes. According to Dairy Australia's forecast, raw milk production in Australia this season is expected to reach 8.3 million tonnes. However, according to dairy industry participants, this forecast is overly optimistic. According to Dr. Milena Bojovic, an expert in sustainable development and ecology at the University of Technology Sydney, extreme weather events this year have severely impacted key dairy regions in southern and eastern Australia.

Drought and water shortages have affected the southern and eastern regions of Australia, where the country's main dairy production is concentrated. Due to the drought, water levels in many reservoirs are lower than last year. This has led to a significant increase in prices for irrigation water and feed. Many farmers are forced to reduce their livestock to conserve remaining feed and water. In New South Wales, conversely, extreme rainfall caused floods. The floods caused damage and worsened conditions for sowing agricultural crops. Both drought and floods have negatively affected farm productivity.

Australian farms are facing pressure from high operating costs. Compared to other types of livestock farming in Australia, dairy farming requires significantly more capital investment in equipment, especially specialized milking equipment. Purchase prices are also a concern for farmers. According to the Sentinel-Times, transportation costs have also risen due to longer milk collection routes, increased fuel prices, and higher transport tariffs. The moderate increase in the purchase price, just announced by dairy companies, has disappointed many farmers who don't believe this increase is sufficient to cover rising costs. Logistics have become particularly expensive for companies forced to transport milk between states during the off-season.

There are concerns about labor shortages. Many young Australians don't want to engage in farming. The total number of dairy farms in Australia is decreasing—from over 6,000 in 2015 to 4,160 in 2023. RaboResearch expects that in the 2025/26 season, milk production in Australia will decrease by 0.4% compared to the previous season, should yields continue to fall due to drought.

As reported by clal.it, in May 2025, milk yields in New Zealand amounted to 993 thousand tonnes, which is 32% less than in April, but 8.3% more than in May 2024. From January to May 2025, milk yields in New Zealand totaled 8.46 million tonnes, which is 1.1% more than last year. According to FAS, milk production in New Zealand in the 2024/25 marketing year reached 21.7 million tonnes, exceeding the 2024 figure and the five-year average (21.6 million tonnes). Despite reduced yields in recent months in the North Island due to drought, the satisfactory condition of pastures at the beginning of the season contributed to a 3% increase in raw milk production as of March. According to The Bullvine, an additional 15.5 thousand tonnes of product were sent from New Zealand for the 383rd GDT auction, equivalent to a month's raw milk production from approximately 50 thousand cows, and likely led to a decline in the price index following the new auction.

New Zealand's Ministry for Primary Industries forecasts an increase in export earnings to $27 billion for the season due to higher global dairy product prices. Supplies of New Zealand dairy products to China will likely remain high due to decreased domestic milk production in China and strengthening demand. The "Free Trade Agreement between New Zealand and China," effective from January 2024, provides an additional competitive advantage to New Zealand products with zero tariffs. As of the end of March, dairy product exports to China increased across all categories except whole milk powder. Although whole milk powder remains the basis of New Zealand's exports, its share in export earnings is shrinking, giving way to products with higher added value and specialized items — cheese, butter, infant formula, and protein products.

DAIRY MARKET PRICES

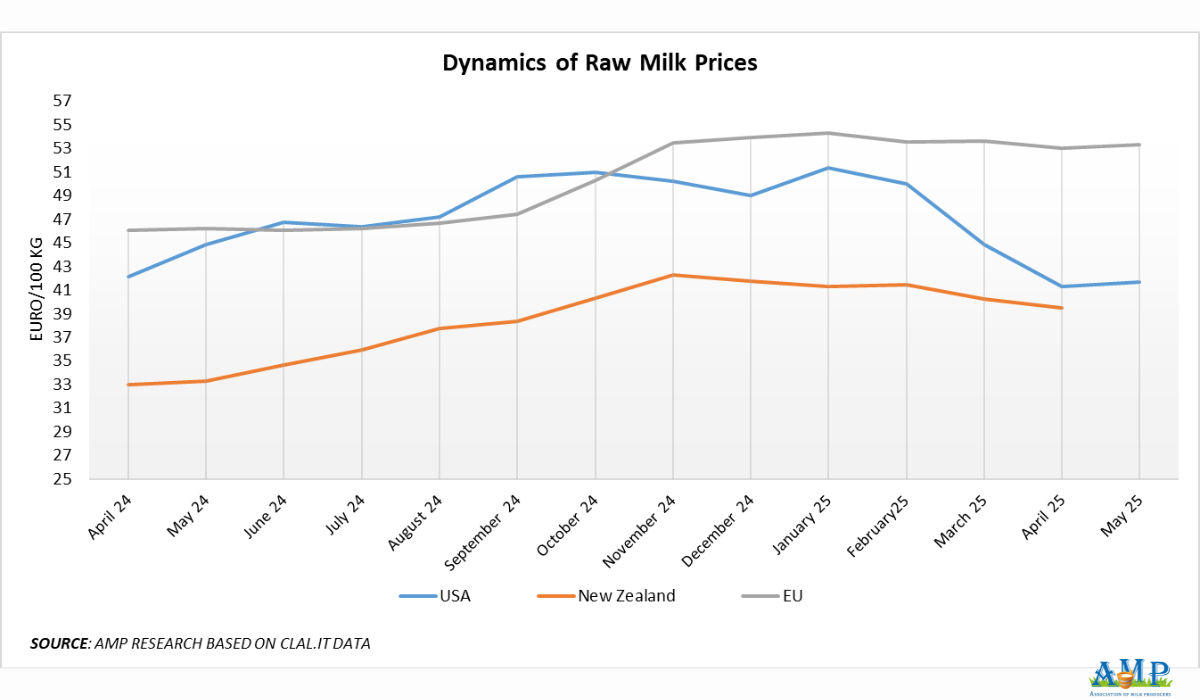

Europe. According to preliminary data from the European Commission, in May 2025, the average raw milk price in the EU was 53.34 euros per 100 kg, which is 0.6% more than in April 2025. Compared to May 2024, milk in the EU has become 16% more expensive. This price increase is most likely due to reduced milk yields in European countries.

USA. According to clal.it, in May 2025, the price of raw milk in the US was 41.64 euros per 100 kg, which is 0.85% more than in April, but 7.18% less than in May 2024. The growth in purchase prices in the US has likely slowed down amid an increased supply of raw milk in the domestic market.

Oceania. According to FoodProcessing, several companies in Australia announced an increase in milk purchase prices at the end of the 2024/25 dairy season. As RaboResearch analyst Michael Harvey noted, average base prices reached approximately 8.40 Australian dollars per kilogram of milk solids. The increase in raw material prices is driven by increased profitability from selling dairy products in export markets. Minimum purchase prices for the upcoming 2025/26 season in southern Australia are around 9 Australian dollars per kilogram of milk solids.

Fonterra forecasts a starting milk price in New Zealand for the 2025/26 season at 10 New Zealand dollars per kilogram of milk solids. This is the highest figure in history, paving the way for farmers to have a second consecutive season with double-digit payouts and stable profits. At the same time, the unusually wide range in Fonterra's forecast, from 8 to 10 New Zealand dollars per kilogram of milk solids, indicates potential market instability amid the uncertain macroeconomic situation.

Follow us on Facebook

Related News