Ukraine increased its cattle exports to foreign markets compared to the same period last year. However, in February, the physical export volumes were lower than in January 2025 despite stable demand in external markets. Nevertheless, revenue from sold animals increased, reports Georgii Kukhaleishvili, an analyst at the Association of Milk Producers of Ukraine.

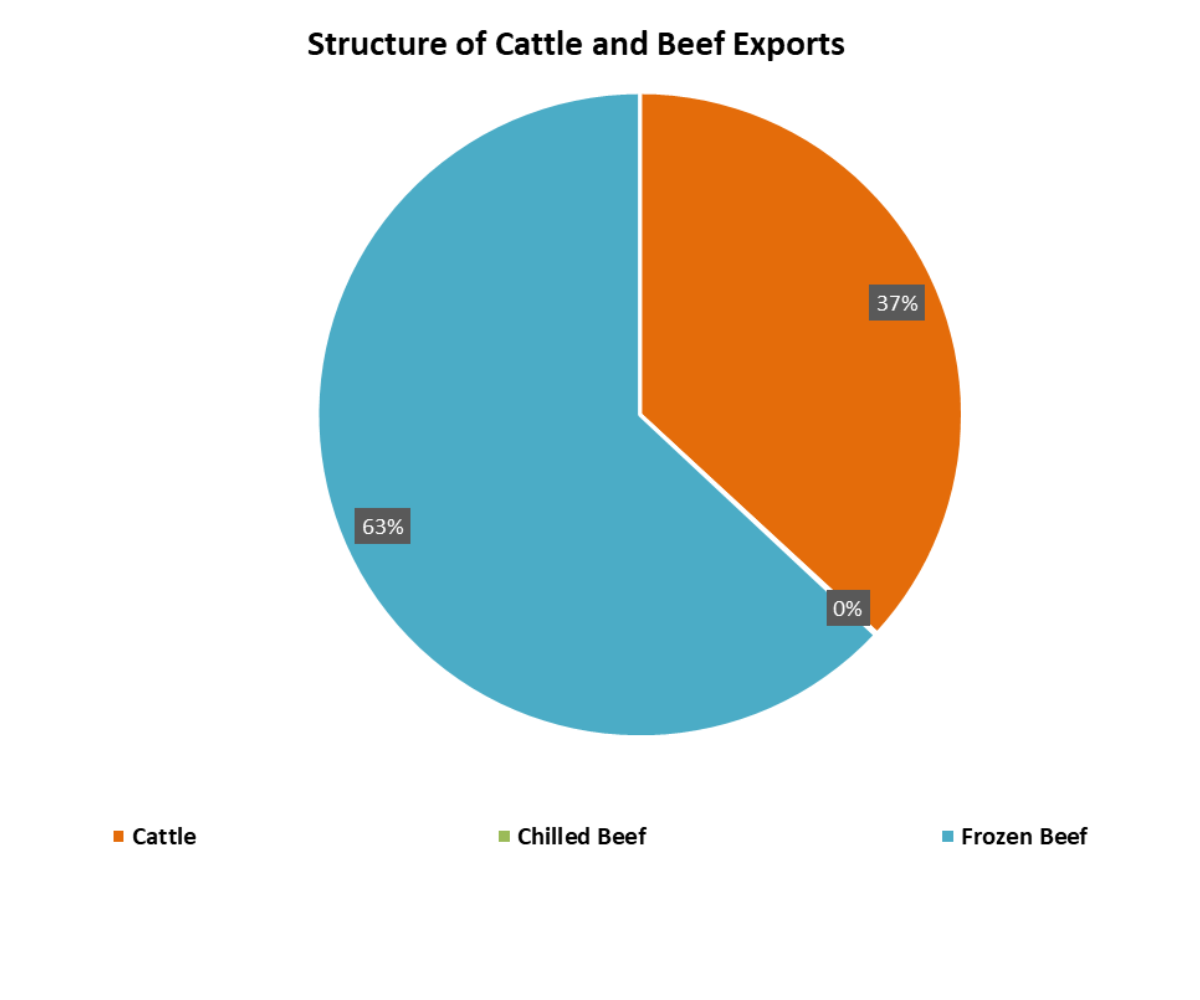

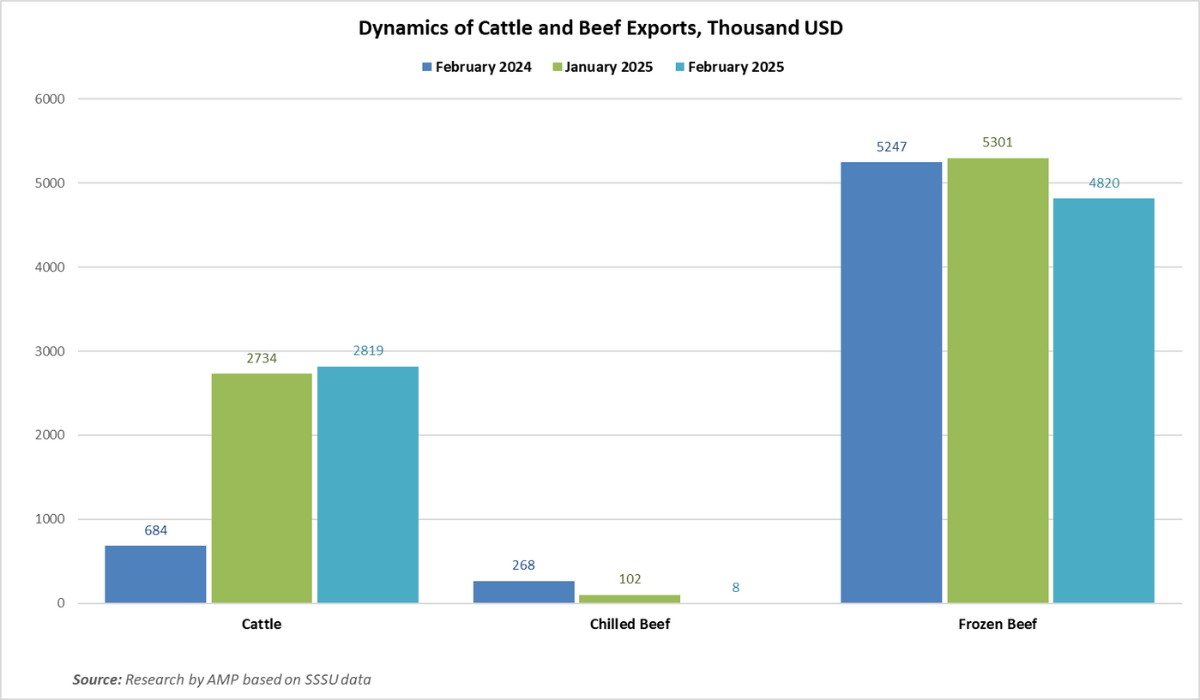

According to preliminary data from the State Statistics Service of Ukraine (SSSU), in February 2025, Ukraine exported 1.3 thousand tons of cattle in live weight, which is 8% less than in January 2025 but 167% more than in February 2024. Revenue from exported animals amounted to $2.81 million, 3% higher than in January 2025 and 312% higher than in February 2024. In January-February 2025, Ukraine exported 2.72 thousand tons of cattle in live weight (+158%) worth $5.55 million (+275%).

In February 2025, Ukrainian exporters supplied 600 kg of fresh or chilled beef to foreign markets, which is 97% less than in January of the current year and 99% less than in February 2024. Export revenue for the delivered product amounted to $8,000, which is 92% less than in January 2025 and 97% less than in February 2024. In January-February 2025, Ukraine exported 22 tons of chilled beef (-49%) worth $110,000 (-60%).

The physical export volumes of frozen beef in February 2025 amounted to 1.32 thousand tons, which is 6% less than in January of the current year but 8% more than in February 2024. Revenue for the delivered product was $4.82 million, which is 9% less than in January 2025 and 8% less than in February 2024. In January-February 2025, Ukraine exported 2.7 thousand tons of frozen beef (+8%) worth $10.12 million (-7%).

Georgii Kukhaleishvili notes that despite price increases, the beef trade remains stable, and demand for cattle remains high. According to the New Zealand publication The Press, global demand for beef grew by 6% in 2024. Rabobank forecasts that after reaching its peak in 2024, global beef production may decline in 2025. A reduction in beef supply in the global market is expected. In Q1 2025, beef production may decrease by 2% compared to the same period last year, and in Q2 – by 3%. Despite a decrease in cattle populations in producing countries, global demand for beef continues to grow. This year, reductions in beef production are expected in four of the largest beef-producing and exporting countries in South America—Brazil, Argentina, Uruguay, and Paraguay. The most significant reductions in the coming months are likely to occur in Brazil and New Zealand.

According to Rabobank, in 2025, beef exports from South America will likely remain stable due to reduced domestic consumption in the region's countries. Against the backdrop of protectionist policies by the Trump administration in the USA, there are prerequisites for increasing Brazilian meat exports to China. Ricardo Santin, President of the lobbying organization ABPA, believes that increased exports to China, which is already one of the main buyers of Brazilian meat, will likely offset higher feed costs. However, the situation with Chinese import demand remains uncertain due to the economic downturn. For example, in 2024, New Zealand reduced its physical beef exports to China by 14%. Last year's growth in global demand was driven by other countries.

Notably, Brazil is negotiating with Japan to resume beef exports after a 12-year ban imposed due to cases of bovine spongiform encephalopathy (BSE). According to Southern Ag Today, Brazil's return to the Japanese market could impact the USA's position, which currently accounts for 43% of Japan's beef import demand. If Brazil can meet the quality standards of the USA, competition in this market could intensify significantly.

Active demand for New Zealand beef exists in the USA. Sirma Karapeeva, CEO of the Meat Industry Association, stated that in the USA, lean beef from New Zealand is mixed with American beef to produce patties. American beef is considered too fatty for burgers in its pure form. Import demand for beef in the USA may be linked to a 1% reduction in the country's cattle population over the past year.

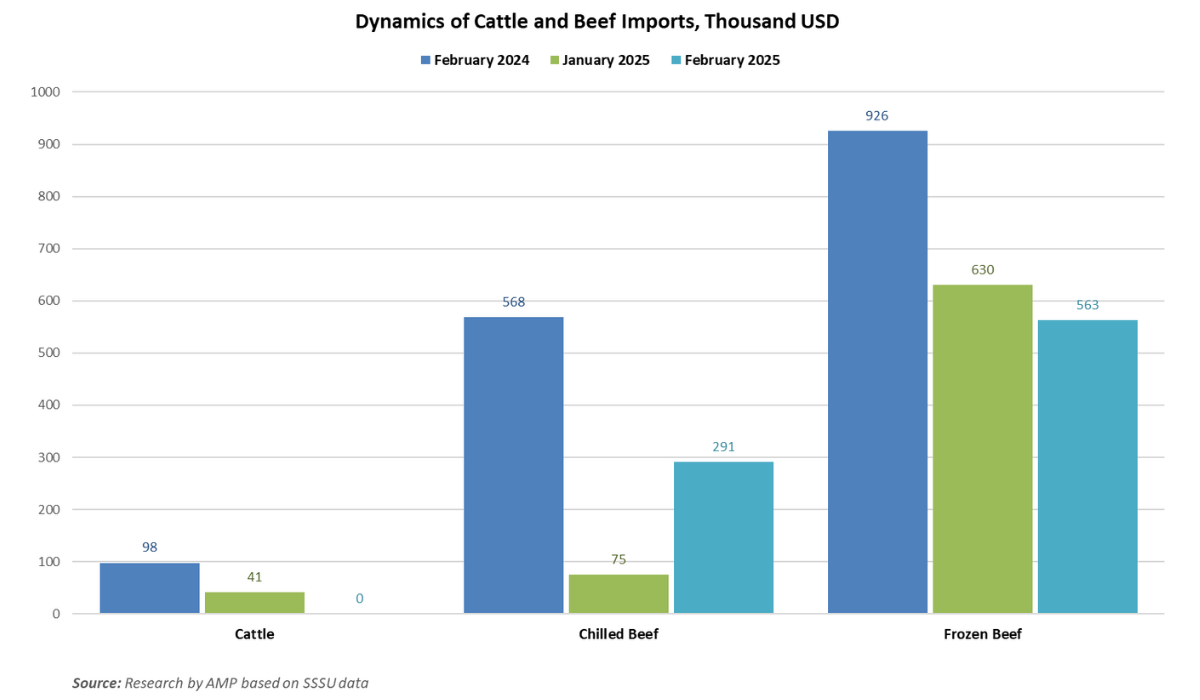

In February 2025, Ukraine did not import any cattle in live weight. Imports of chilled beef increased to 13 tons (+166%), while imports of frozen beef decreased to 88 tons (-16%) compared to January 2025. Imports of chilled beef decreased by 36%, and imports of frozen beef decreased by 52% compared to February 2024. In January-February 2025, Ukraine reduced imports of live-weight cattle to 7 tons (-92%), chilled beef to 18.3 tons (-24%), and frozen beef to 192.9 tons (-56%) compared to the same period last year.

The foreign trade balance in February 2025 was positive and amounted to 6.79 million tons.

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News