Relatively warm weather in the second half of February contributed to an increase in milk production in Europe. However, low butter stocks in warehouses, increased demand for raw materials in Western Europe, and high production costs did not facilitate a reduction in procurement prices, reports Georgii Kukhaleishvili, an analyst at the Association of Milk Producers of Ukraine.

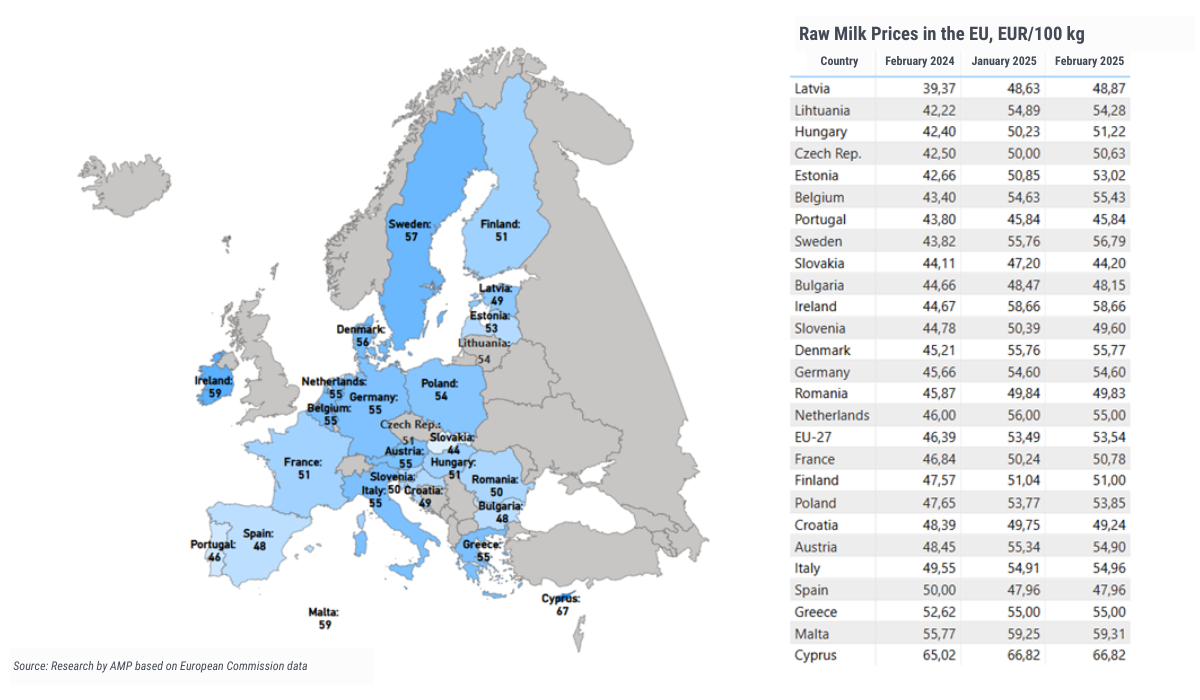

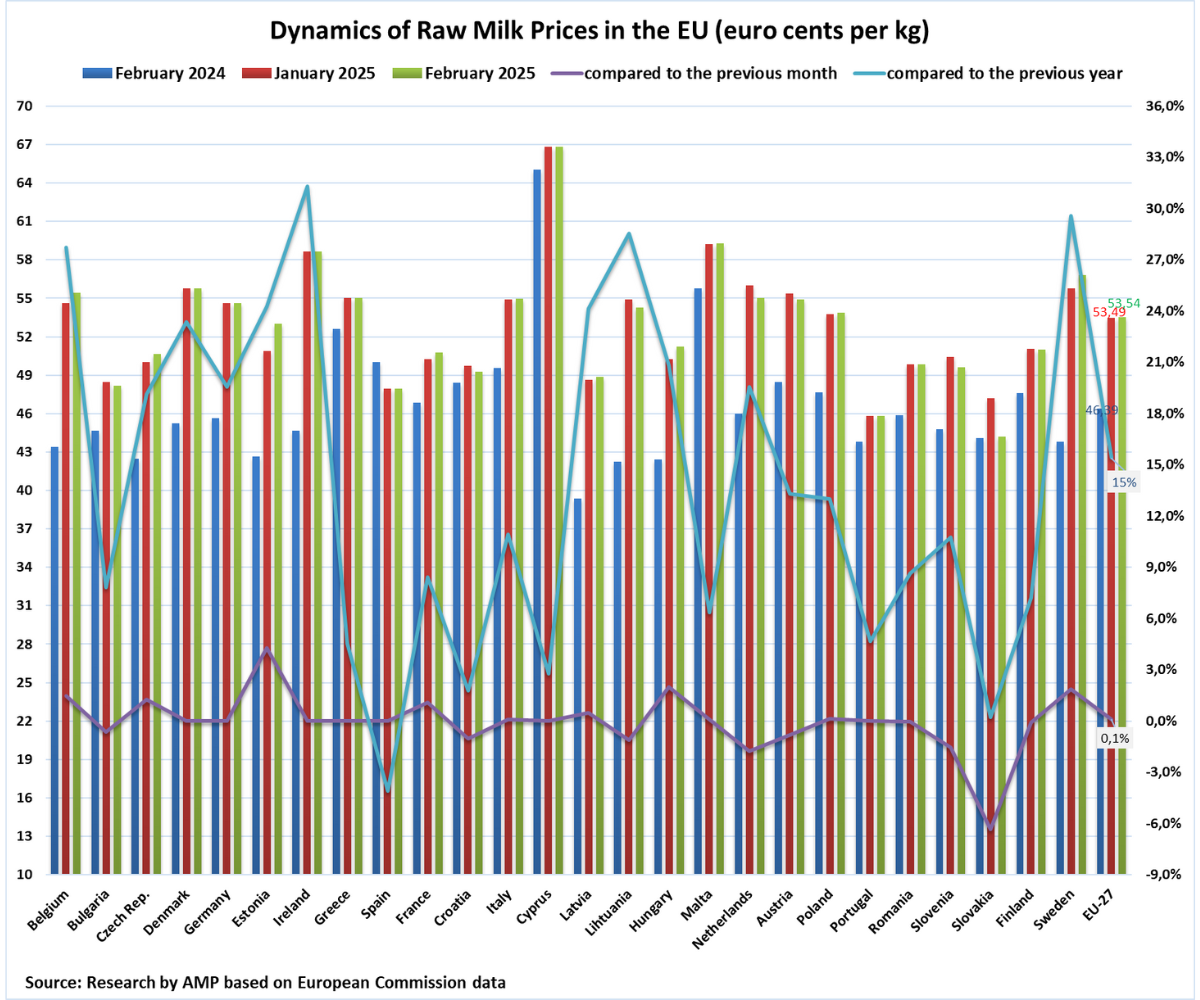

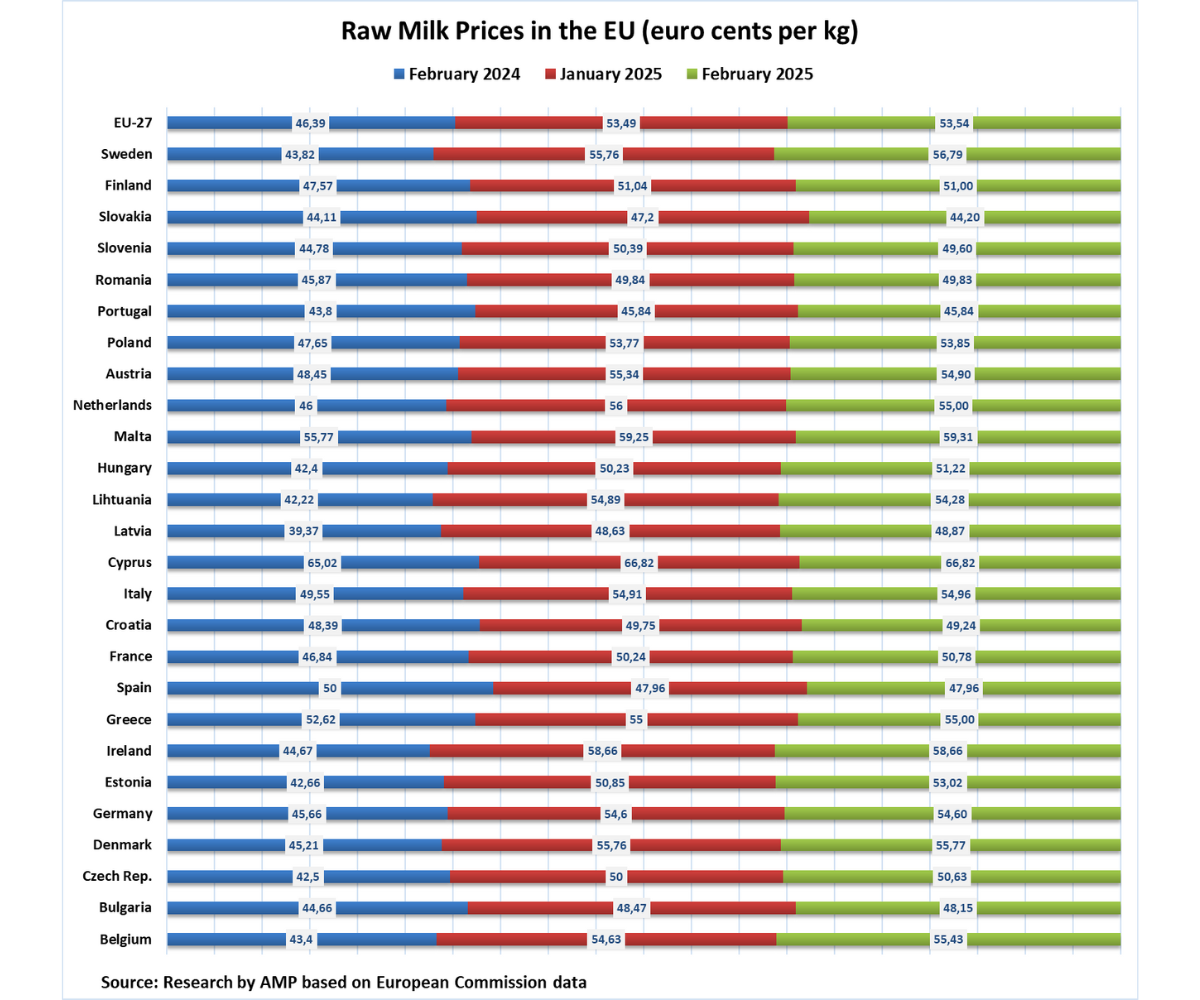

According to preliminary data from the European Commission, in February 2025, the average price of raw milk in the EU was 53.54 euro cents per kg, which is 0.1% higher than in January 2025. Compared to February 2024, milk prices in the EU increased by 15%. In February, the price of extra-grade milk in Ukraine was 44.59 euro cents per kg, corresponding to the price level of raw milk in Slovakia and Portugal.

Compared to January, raw milk prices increased in 10 EU member states. Among major dairy producers and exporters, prices for raw materials rose in France to 50.78 euro cents per kg (+1.1%), in Italy to 54.96 euro cents per kg (+0.1%), and in Poland to 53.85 euro cents per kg (+0.1%) compared to January 2025. The highest price increase was recorded in Estonia, reaching 53.02 euro cents per kg (+4.3%), and in Hungary, up to 51.22 euro cents per kg (+2%).

In February, procurement prices remained unchanged in Germany, Denmark, Ireland, Greece, Spain, Portugal, Romania, and Cyprus compared to January of the current year.

Over the past month, raw milk prices fell in eight countries. The largest price drop was observed in Slovakia, down to 44.20 euro cents per kg (-6.4%).

The highest raw milk prices were found in Cyprus (66.82 euro cents per kg), Malta (59.31 euro cents per kg), and Ireland (58.66 euro cents per kg). Farmers in Slovakia (44.20 euro cents per kg) and Portugal (45.84 euro cents per kg) received the lowest prices for milk.

Compared to February 2024, raw milk prices rose in 25 European countries, with a decrease recorded only in Spain (-4.1%). Over the past year, the largest price increases were observed in Ireland (+31.3%), Sweden (+30%), Lithuania (+28.6%), and Belgium (+27.7%).

Georgii Kukhaleishvili noted that in the second half of February, milk production in Europe began to grow under the influence of relatively warm weather and an “early spring,” which to some extent slowed the rise in raw milk prices. However, prices did not decline because the increase in yields was not observed in all regions. In February, there was a demand for cream in Western Europe amid low butter stocks and increased sales.

According to Rabobank, in the northwestern region of Europe, particularly in countries such as Denmark, Germany, the Netherlands, and Belgium, there are signs of reduced of yield due to prolonged declines in farm profitability, rising production costs, environmental restrictions, labor shortages, and stricter weather conditions. Tighter water quality requirements and reduced use of mineral fertilizers may accelerate the pace of milk production decline.

The issue of a declining cow population remains a concern. For instance, the number of dairy cows in Germany decreased in 2024 compared to 2023 and has not shown significant recovery as of early 2025. Cases of foot-and-mouth disease in Brandenburg led to a temporary suspension of dairy product exports from Germany to other countries at the beginning of the year.

In certain regions of Eastern Europe, there is a problem of insufficient rainfall and signs of drought, which may negatively affect harvests. For instance, in early February 2025, air temperatures in Eastern Europe were above the average seasonal level compared to the previous year.

Against the backdrop of rising commodity prices from New Zealand, where seasonal declines in milk production are occurring, the devaluation of the euro promotes increased exports from Europe and enhances the competitiveness of European products in foreign markets. This creates conditions for potential price increases in the future.

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News