According to AHDB, global milk production in 2024 was significantly impacted by rising production costs in regions such as Argentina, Australia, China, Ireland, New Zealand, the Netherlands, California, and the Upper Midwest of the United States. Key factors driving these costs included increased prices for feed and fertilizers, which substantially affected milk production costs directly on farms. Additional pressures came from the war in Ukraine, adverse weather conditions, rising energy prices, trade disputes, higher labor and logistics costs, supply chain disruptions, and post-COVID-19 inflation. Increased interest rates on loans also contributed to higher production costs. These factors are likely to continue affecting the dairy industry throughout 2025.

Production and Demand

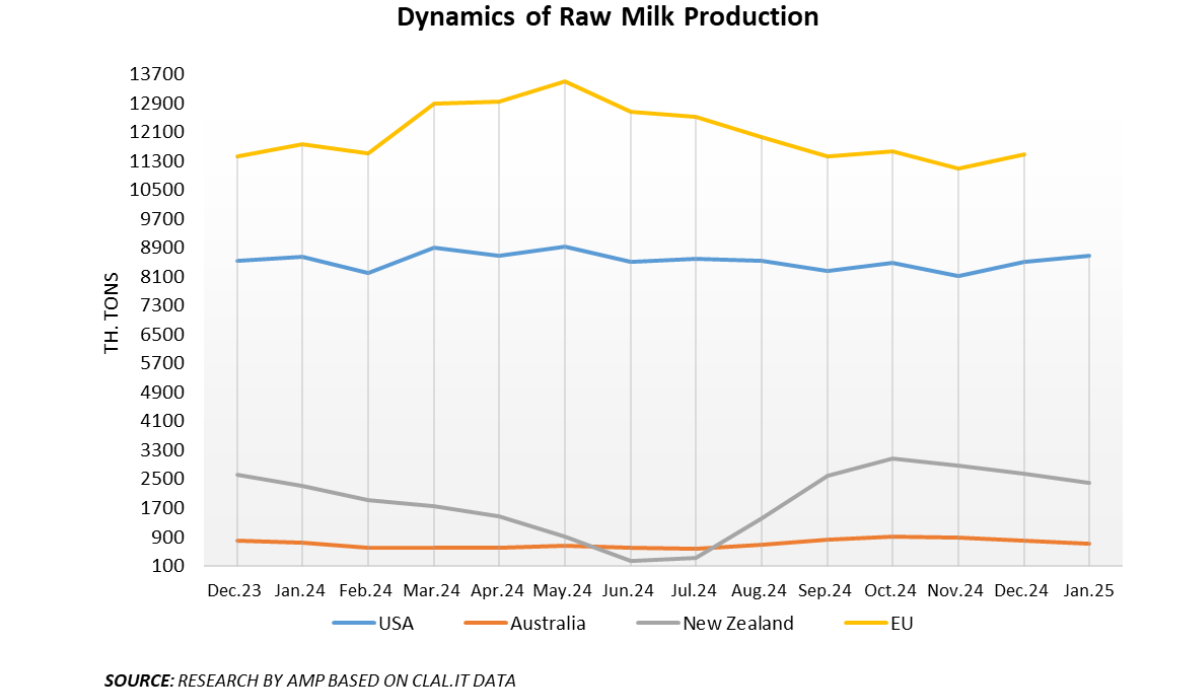

Europe: According to clal.it, raw milk production volumes in the EU reached 145.66 million tons in 2024, which is 0.7% higher than in 2023. Rabobank reports that in the northwestern region of Europe, particularly in countries such as Denmark, Germany, the Netherlands, and Belgium, there are signs of declining milk yields due to prolonged farm unprofitability, environmental restrictions, labor shortages, and harsher weather conditions. Stricter water quality requirements and reduced use of mineral fertilizers may accelerate the pace of milk production decline. According to Dairy Site, the prolonged decline in milk purchase prices, combined with persistently high production costs, continues to put pressure on dairy farmers, particularly in EU countries such as Germany, France, Spain, and Poland. Last year, small-scale dairy producers either left the industry or merged with larger farms.

According to USDA, raw milk production in Europe began to rise in February, but not in all regions. The issue of a declining cow population remains a problem. The dairy cow population in Germany decreased in 2024 compared to 2023 and has yet to show significant recovery as of early 2025. In certain regions of Eastern Europe, there are issues with insufficient rainfall and signs of drought, which may negatively affect crop yields. For instance, in early February 2025, air temperatures in Eastern Europe were above the average seasonal level compared to the previous year.

According to the USDA GAIN report, milk production in the EU is likely to decrease to 149.4 million tons (-0.2%) in 2025 due to a declining cow population, low farm profitability, environmental restrictions, and outbreaks of animal diseases. Reduced milk production will be partially offset by decreased consumption of liquid milk, leading to a slight decline in its use in processing. European dairy processing enterprises must carefully decide which products to manufacture from the available raw milk. However, it is predicted that cheese production will remain a priority for the EU dairy industry due to stable domestic consumption and sustained export demand. Demand for high-quality cheeses is increasing in export markets. It is likely that the growth in cheese production in Europe in 2025 will occur at the expense of reduced production of butter, skimmed milk powder, and whole milk powder.

However, certain risks for European exporters of cheese and butter are posed by U.S. President Donald Trump's protectionist policies. According to Rabobank, if the U.S. imposes a 25% tariff on certain European cheeses, they may be replaced by domestic alternatives. For example, Petite Camembert from California could substitute French Camembert. At the same time, companies with well-known high-quality cheese brands will still have an advantage, as their products lack substitutes and are less sensitive to price changes.

According to AHDB, milk production in the United Kingdom is expected to increase by 1.1% in 2025. After a challenging start to the season, the British dairy industry is showing signs of recovery. Higher milk prices and more competitive feed prices are encouraging farmers to boost production. Favorable weather conditions have allowed cows to remain on pasture longer, leading to increased yields. In spring, when production volumes traditionally rise, prices may decrease as milk supply grows while consumer demand stabilizes. Despite the positive dynamics, the industry may face risks such as fluctuations in raw material prices or disease outbreaks that could disrupt this growth trend.

AHDB reports that demand for milk in UK retail will remain stable; however, average household consumption may slightly decline as workers return to offices, reducing home consumption. Cheese demand will continue to grow thanks to promotional campaigns and the popularity of at-home dining, while butter consumption may decline due to competition from plant-based alternatives. Meanwhile, yogurt sales are expected to grow due to healthy eating trends.

United States: According to clal.it, raw milk production in the U.S. reached 8.66 million tons in January 2025, which is 2% higher than in December and 0.1% higher than January 2024. In 2024, raw milk production volumes in the U.S. totaled 102.37 million tons, down 0.5% from 2023. USDA data indicates that in the second half of February 2025, milk production in eastern U.S. regions, particularly the Northeast, Southeast, and Florida, increased seasonally, with strong demand for raw milk from dairy processors. Fat content in raw materials reached high levels, and warm, almost "spring-like" weather significantly boosted milk and cream supply.

USDA also reports that milk production in California is rising. While some herds have not yet recovered from the avian flu outbreak, demand for all classes of milk remains stable. According to the California Department of Agriculture, since the first detection of the H5N1 virus on California dairy farms, a total of 748 infected farms have been recorded, 329 of which have fully recovered and been released from quarantine. In Arizona, Idaho, Utah, and Colorado, milk yields are also seasonally increasing. The balance between milk production and processing remains stable, with no difficulty finding buyers for raw milk.

Oceania: According to clal.it, January milk yields in Australia reached 708,000 tons, down 11% from December and 2.7% from January 2024. In 2024, Australian farmers produced 8.41 million tons of raw milk, up 1.5% from the previous year. The Milk Production Cost Monitoring in Australia reports that milk production costs rose in January 2025. In several dairy regions, rainfall was below average, limiting available water. Prices for slaughter cows increased by 41% compared to last year. Additionally, January saw fertilizer prices rise due to reduced exports from China and production constraints in other regions.

According to clal.it, milk yields in New Zealand in January 2025 totaled 2.38 million tons, down 10% from December but up 3% from January 2024. In 2024, milk yields in New Zealand reached 21.53 million tons, a 1.3% increase from 2023. Seasonal declines in milk yields are occurring in New Zealand. According to Dairy Producer, milk production in New Zealand is expected to grow by 0.5 billion pounds in 2025 as farmers expand herds and improve feeding and management practices in response to rising global dairy prices.

Dairy Market Prices

Europe: According to preliminary data from the European Commission, in January 2025, the average price of raw milk in the EU was 54.30 euro cents per kg, which is 0.4% lower than in December but 17% higher than in January 2024. Milk prices rose due to increasing production costs, environmental restrictions, and demand for cheese and butter in foreign markets.

USA: According to clal.it, in January 2025, the price of raw milk in the USA was 51.32 euros per 100 kg, which is 4.68% higher than in December and 26.29% higher than in January 2024. It is likely that in December, purchase prices in the USA increased due to heightened demand for raw milk from dairy processing enterprises.

Oceania: According to a forecast by Bendigo Bank Agribusiness, the average milk price in Australia in 2025 is expected to exceed 8.00 Australian dollars per kg of milk solids. Bendigo Bank Agribusiness suggests that milk production in Australia will remain low in the near future, while global dairy product prices will continue to rise. Therefore, a reduction in milk prices for the next season is unlikely. It is still unknown whether dairy processing enterprises will respond to improved margins by raising prices this season.

According to clal.it, in January, raw milk in New Zealand cost 41.32 euros per 100 kg, which is 0.96% lower than in December 2024 but 23.2% higher than in January 2024. USDA reports that New Zealand lowered its forecasted price for raw milk for the 2024/2025 season due to declining prices for most products following 374 GDT trading events.

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News