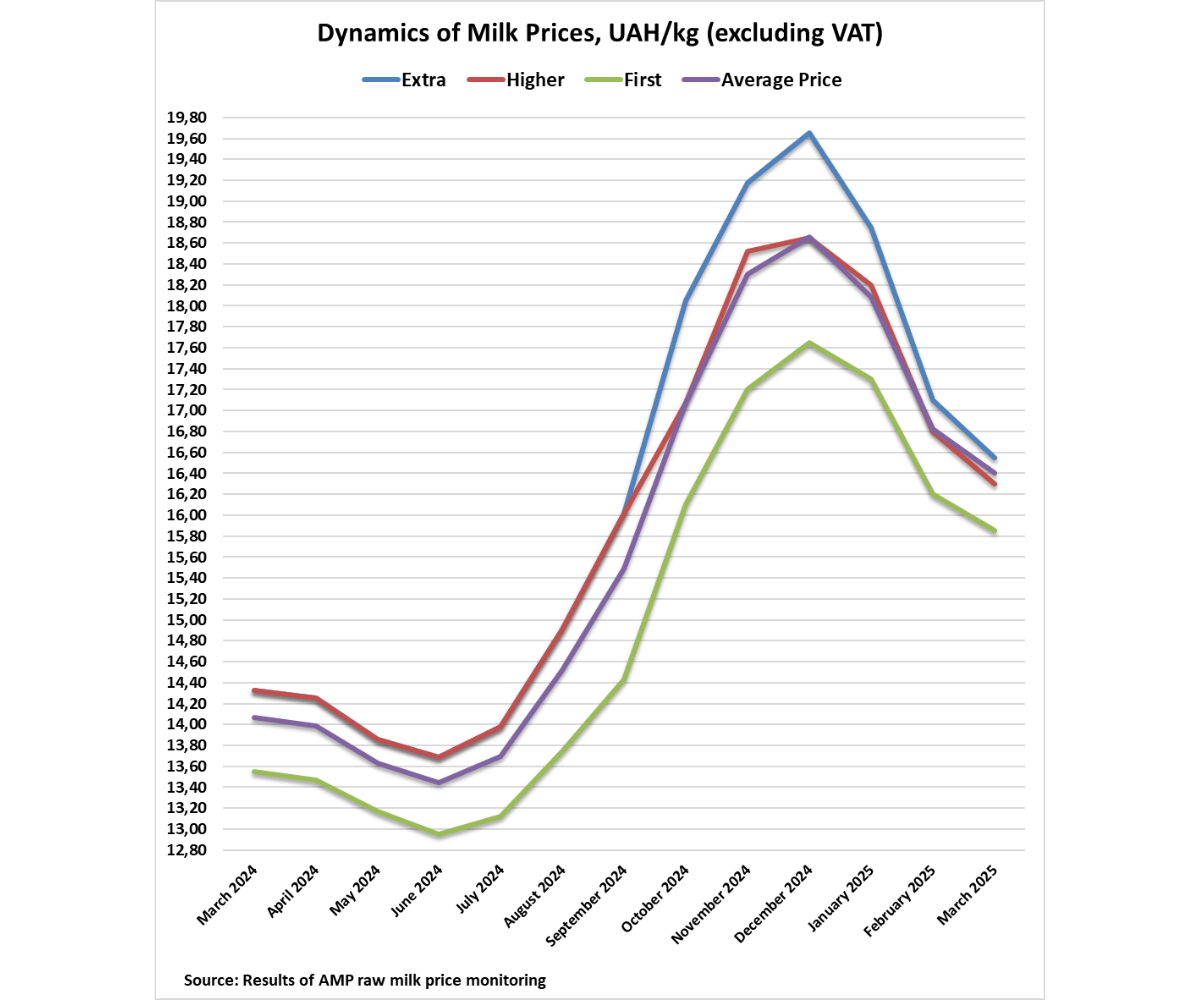

In the first half of March, there was a further decline in raw milk prices in Ukraine. Milk and finished product supply remains high, while domestic demand is low. However, there are signs of some stabilization in purchase prices in the second half of the month, reports Georgii Kukhaleishvili, an analyst at the Association of Milk Producers of Ukraine.

The average purchase price for extra-grade milk as of March 10 was 16.55 UAH/kg excluding VAT, which is 25 kopecks lower than a month ago. The price range for this grade at farms varies from 15.70 to 16.70 UAH/kg excluding VAT. The lower price range decreased by 80 kopecks, while the upper range dropped by 1.30 UAH.

Higher-grade milk averages 16.30 UAH/kg excluding VAT (-35 kopecks). Prices for higher-grade milk range from 15.50 to 16.50 UAH/kg excluding VAT. Compared to the first half of the previous month, the lower price range decreased by 70 kopecks, and the upper range fell by 1.00 UAH.

The average price for first-grade milk was 15.85 UAH/kg excluding VAT, which is 15 kopecks lower than the first half of the previous month. The minimum price at farms was 15.00 UAH/kg, which decreased by 1.00 UAH. The maximum price was 16.20 UAH/kg, down by 80 kopecks.

Consequently, the average weighted price for the three grades was 16.40 UAH/kg excluding VAT, which is 25 kopecks less than the previous period.

Georgii Kukhaleishvili notes that the decrease in raw milk prices in Ukraine at the beginning of March occurred due to an oversupply of raw milk and low demand for finished products in the domestic market. Surpluses of raw materials are putting pressure on purchase prices. Under current market conditions, the price gap between grades is narrowing. The effect of the milk price increase that occurred in Q4 2024 has been completely negated. The profitability of commodity production is declining. The production of butter, powdered milk, and casein has become unprofitable.

A factor compelling dairy enterprises to lower purchase prices is their outdated technological base. Over the past decade, dairy enterprises have been unable to transition to using more expensive milk from dairy farms. The economics of the domestic processing industry remain outdated, relying on a 50/50 mix of milk from dairy farms and households for processing and maintaining low purchase prices. In 2024, industrial milk accounted for 90% of the total milk supply.

Most dairy plants lack modern deep processing technologies and require modernization. Enterprises receive extra-grade milk of better quality and higher cost but produce finished products using the same yield standards as for lower-quality first-grade milk. Outdated equipment at dairy plants is energy-intensive, which raises the production cost of finished products.

Nonetheless, raw milk prices in Ukraine are gradually stabilizing under certain conditions. Dairy enterprises aim to restore consumer demand for dairy products through discounts and promotional offers in retail chains. With the arrival of spring, the ice cream season begins, and exports of canned dairy products from Ukraine increase, stimulating additional volumes of raw milk for processing. Therefore, a slight, targeted decrease in purchase prices may occur in the second half of March.

The development of price trends in the dairy market may also be influenced by external factors. There is uncertainty in the global dairy market. The global trade war initiated by U.S. President Donald Trump’s administration negatively affected the American dairy sector. Mexico, one of the key importers of U.S. dairy products, is now seeing an accumulation of American-made butter, powdered milk, and whey in warehouses, which puts downward pressure on prices. American exporters are shifting to markets in Asia and Africa, where European, New Zealand, and South American producers are already actively operating. This is likely to increase competition in these markets. Another challenge for Ukraine’s dairy industry is the potential threat of foot-and-mouth disease in Hungary. Ukraine has imposed a temporary ban on importing livestock products from the neighboring country.

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News

- Demand for Milk and Low Butter Stocks Prevent Price Declines in Europe

- Farms Participating in AMP to Receive Diesel Generators from José Andrés and the Longer Tables Fund