Outbreaks of foot-and-mouth disease in European countries and the cancellation of the preferential duty-free regime by the EU for Ukrainian agricultural exporters create conditions for further reductions in raw milk prices in Ukraine, reports Georgii Kukhaleishvili, an analyst at the Association of Milk Producers of Ukraine (AMP).

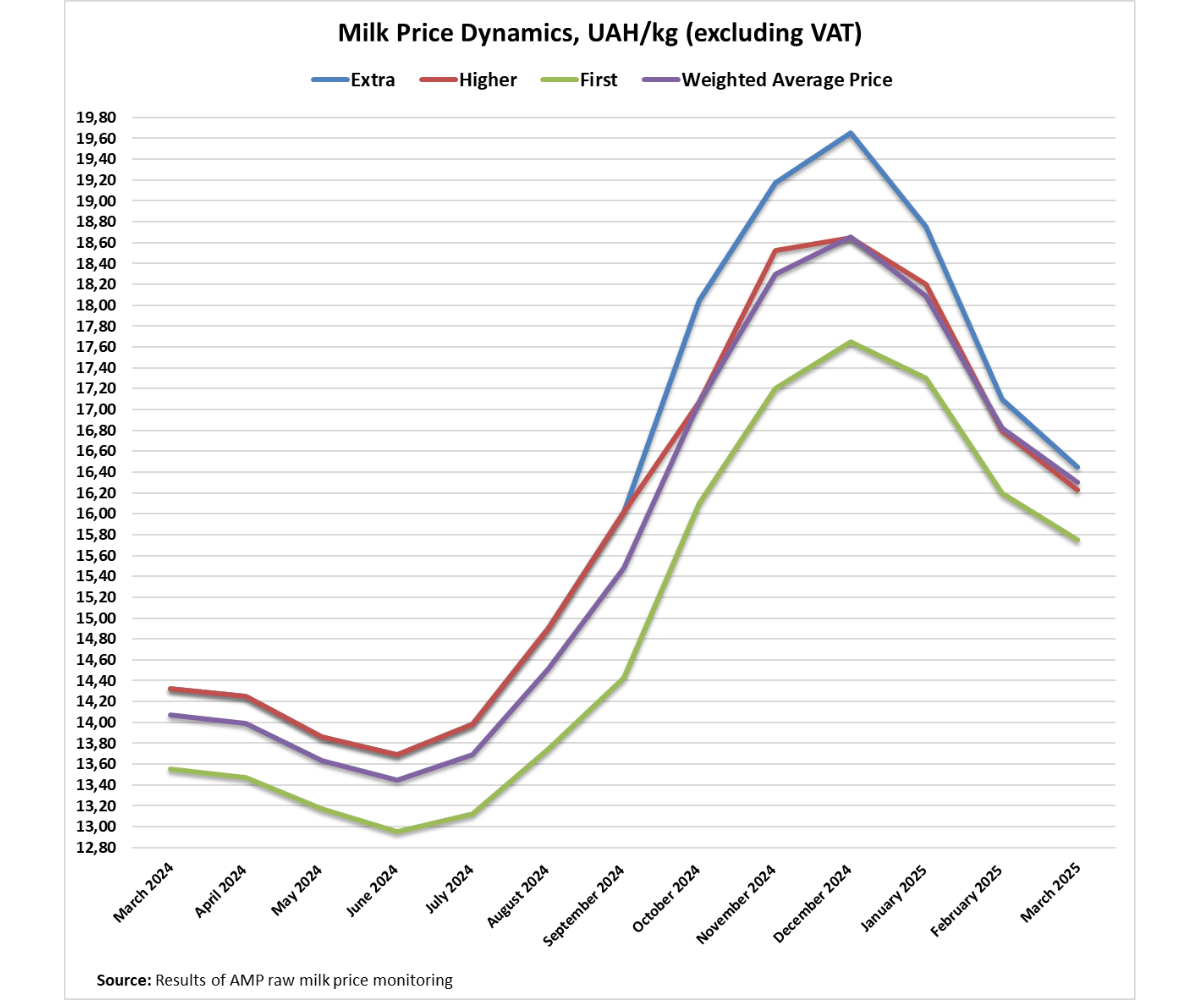

As of March 25, the average purchase price for extra-grade milk was 16.35 UAH/kg excluding VAT, which is 45 kopecks less than a month ago. Prices for this grade in farms ranged from 15.70 to 16.70 UAH/kg excluding VAT. The lower limit of the price range dropped by 80 kopecks, while the upper limit decreased by 30 kopecks over the last month.

The average price for higher-grade milk stood at 16.15 UAH/kg excluding VAT, which is 50 kopecks less than last month. Prices for higher-grade milk range between 15.50 and 16.30 UAH/kg excluding VAT. Compared to the monitoring results of the second half of last month, both the lower and upper limits of the price range fell by 50 kopecks.

The average price for first-grade milk was 15.65 UAH/kg excluding VAT, which decreased by 35 kopecks compared to the second half of last month. The minimum price in farms was 15.00 UAH/kg, down by 20 kopecks compared to last month. The maximum price was 16.00 UAH/kg, which fell by 20 kopecks.

Consequently, the weighted average price across the three grades amounted to 16.20 UAH/kg excluding VAT, which is 40 kopecks less than a month ago.

Georgii Kukhaleishvili notes that purchase prices in Ukraine continued to decline in the second half of March. However, the surplus of raw milk on the market, which puts pressure on purchase prices, has decreased compared to the first half of March due to increased export volumes of dairy products from Ukraine and a slight rise in domestic consumption. Consumers have become accustomed to high prices for dairy products. Dairy processing plants are stimulating the consumption of dairy products in Ukraine by offering promotional discounts on their goods in retail chains. The profitability of producing skimmed milk powder and butter has improved, but for cheese products and casein, it has worsened.

It is expected that by April 1, a slight reduction in raw milk prices by 20–30 kopecks may occur in Ukraine. In euro terms, raw milk prices in Ukraine are higher than those in New Zealand and South American countries, which actively export their dairy products to Asian and African countries, competing with Ukrainian and European exporters.

The outbreak of foot-and-mouth disease in Hungary and Slovakia, as well as the possibility of its spread to Poland and Austria, creates prospects for further reductions in purchase prices. Dairy processing plants in Poland and Austria export significant volumes of dairy products and, in the event of quarantine, may switch to producing long-lasting products, including butter and powdered milk. These goods are key articles of Ukrainian dairy exports. Accumulation of butter and powdered milk in European warehouses may lead to price reductions for similar products and raw milk in Ukraine.

Additionally, there is a risk of foot-and-mouth disease spreading to Ukraine from neighboring countries, which could result in significant losses for the dairy industry.

The elimination of the EU’s preferential tariff regime for Ukrainian agricultural products, including dairy products, on June 5, 2025, could be another factor in reducing raw milk prices in Ukraine. The reinstatement of tariffs is likely to lead to a reduction in dairy product exports from Ukraine, even to third countries, as these exports are carried out through seaports in Poland and Romania. Consequently, raw milk surpluses in Ukraine may increase, and purchase prices could drop further if this scenario unfolds

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News