Farms of all categories have increased their cattle population compared to February 2025. However, the number of cows has slightly decreased. Active demand for cattle and beef is observed in external markets, reports Georgii Kukhaleishvili, an analyst at the Association of Milk Producers of Ukraine (AMP).

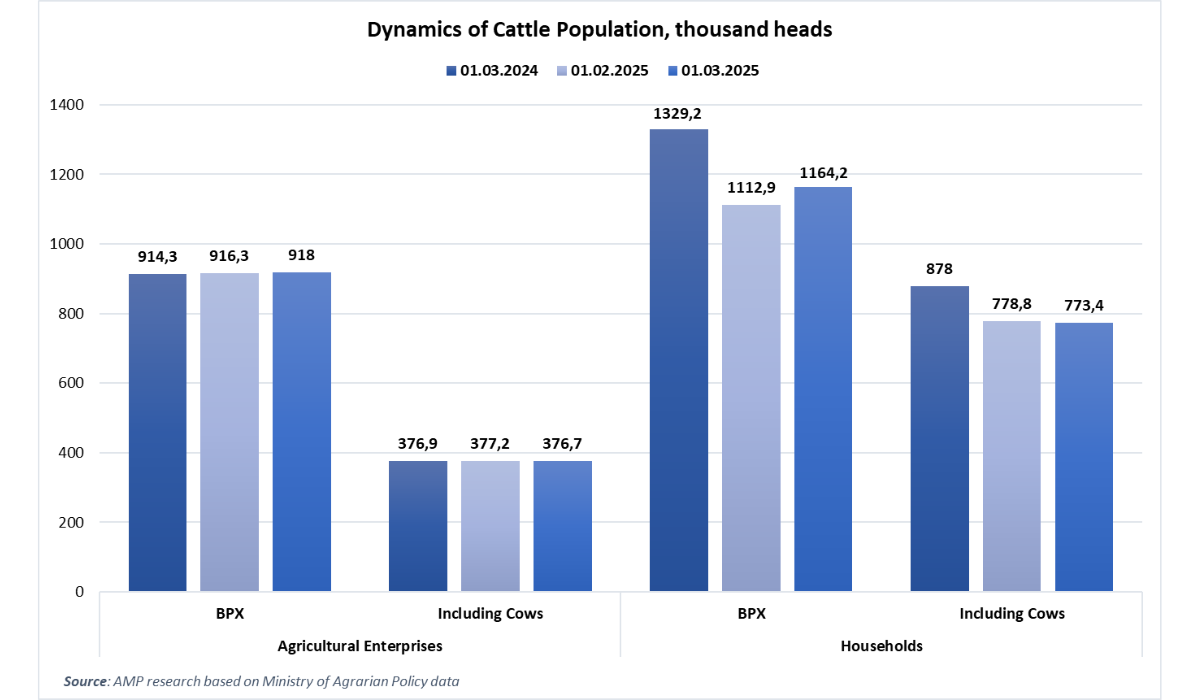

According to preliminary data from the Ministry of Agrarian Policy and Food of Ukraine, as of March 1, 2025, the household and industrial sectors in Ukraine collectively maintain a cattle population of 2,082,200 heads, including 1,150,100 cows. Compared to February 1, 2025, the cattle population in Ukraine increased by 53,000 heads (+3%), while the number of cows decreased by 6,000 heads (-1%). Compared to March 1, 2024, the cattle population decreased by 161,000 heads (-7%), including cows, which declined by 105,000 heads (-8%). Around 44% of the cattle population is maintained by industrial enterprises, while 56% is kept in households.

In the industrial sector, the cattle population stands at 918,000 heads, which is 2,000 heads (+0.2%) more than on February 1, 2025. The number of cows is 376,700 heads, down by 1,000 (-0.1%) in the past month. Over the past year, the cattle population in enterprises grew by 4,000 heads (+0.4%), while the number of cows decreased by 200 heads (-0.1%).

In the household sector, the cattle population stands at 1,164,200 heads, an increase of 51,000 heads (+5%) compared to February 1, 2025. The number of cows in households as of March 1, 2025, is 773,400 heads, which is 5,000 heads less (-1%) than a month ago. Over the past year, the household cattle population decreased by 165,000 heads (-12%), while the number of cows fell by 105,000 heads (-12%).

Georgii Kukhaleishvili notes that despite the reduction in cattle population among producing countries, global demand for beef continues to rise. This year, reductions in production are expected in four major beef-producing and exporting countries in South America: Brazil, Argentina, Uruguay, and Paraguay. The largest reductions in the coming months are likely to occur in Brazil and New Zealand. The ongoing rise in livestock and beef prices serves as a compelling argument for increasing cattle population to boost exports. However, cattle population in Ukraine have decreased compared to last year's levels.

The reduction of cattle population in Ukraine has been an ongoing issue for many years due to the lack of an effective state support program for dairy farming. The situation has worsened since the start of Russia's full-scale invasion. A typical scenario for frontline regions involves the loss of some cattle due to shelling by Russian occupiers. Many farmers have abandoned their cows on occupied territories. These animals are unaccounted for or have been confiscated by Russian occupiers and sold for meat. Injured cows are culled by farmers, further contributing to the decline in herd sizes.

Currently, there are prerequisites for relocating farms from the Dnipropetrovsk and Sumy regions to other parts of Ukraine due to increased Russian missile and bombing attacks on border and frontline areas. Farmers can transfer only a portion of their herds, as most farms in Ukraine were built in the 1970s and 1980s and no longer meet the requirements for keeping animals. The lack of facilities suitable for housing cows creates conditions for further herd reductions.

In addition to frontline regions, cattle population have declined at agricultural enterprises in Zakarpattia, Volyn, and Chernivtsi regions. This is likely associated with efforts to enhance efficiency and sell unproductive cows. The outbreak of foot-and-mouth disease in Hungary and its spread to Slovakia poses a potential risk of increased herd culling if the disease spreads to western Ukrainian regions.

Many farmers are not investing in herd expansion during the war due to a lack of working capital. According to the study "Ukraine: The Impact of War on the Profitability of Agricultural Production" conducted by UCAB, the Ministry of Agrarian Policy and Food of Ukraine, and supported by GFDRR, farmers' production costs are rising faster than product prices due to increasing feed costs, electricity prices, currency depreciation, and the reduced purchasing power of the population.

There is cautious optimism regarding the growth of dairy farms in relatively safe regions of Ukraine, where, despite the war, existing facilities are being modernized, new capacities are being built, and high-yield herds are being expanded. According to AMP estimates, at least 40 farms are currently implementing these measures.

According to preliminary data from the Ministry of Agrarian Policy and Food of Ukraine, an increase in the number of cows was observed at agricultural enterprises in the following regions: Ternopil (+11%), Mykolaiv (+9%), Lviv (+4%), Khmelnytskyi (+5%), Cherkasy (+3%), Vinnytsia (+2%), and Kyiv (+1%) compared to March 1 of last year.

Regionally, approximately 54% of the total cattle population is maintained by farms of all categories in the following regions:

- Khmelnytskyi Region – 194.9 thousand heads

- Poltava Region – 172 thousand heads

- Vinnytsia Region – 161.5 thousand heads

- Ternopil Region – 129.3 thousand heads

- Odesa Region – 124.4 thousand heads

- Chernihiv Region – 122 thousand heads

- Cherkasy Region – 121.4 thousand heads

- Zhytomyr Region – 109 thousand heads

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News