As a result of the GDT auction, the price index remained unchanged, which could be due to sluggish demand for skimmed milk powder on export markets and an uncertain situation in the dairy fat market amidst the U.S. trade war, reports Georgii Kukhaleishvili, an analyst at the Association of Milk Producers of Ukraine.

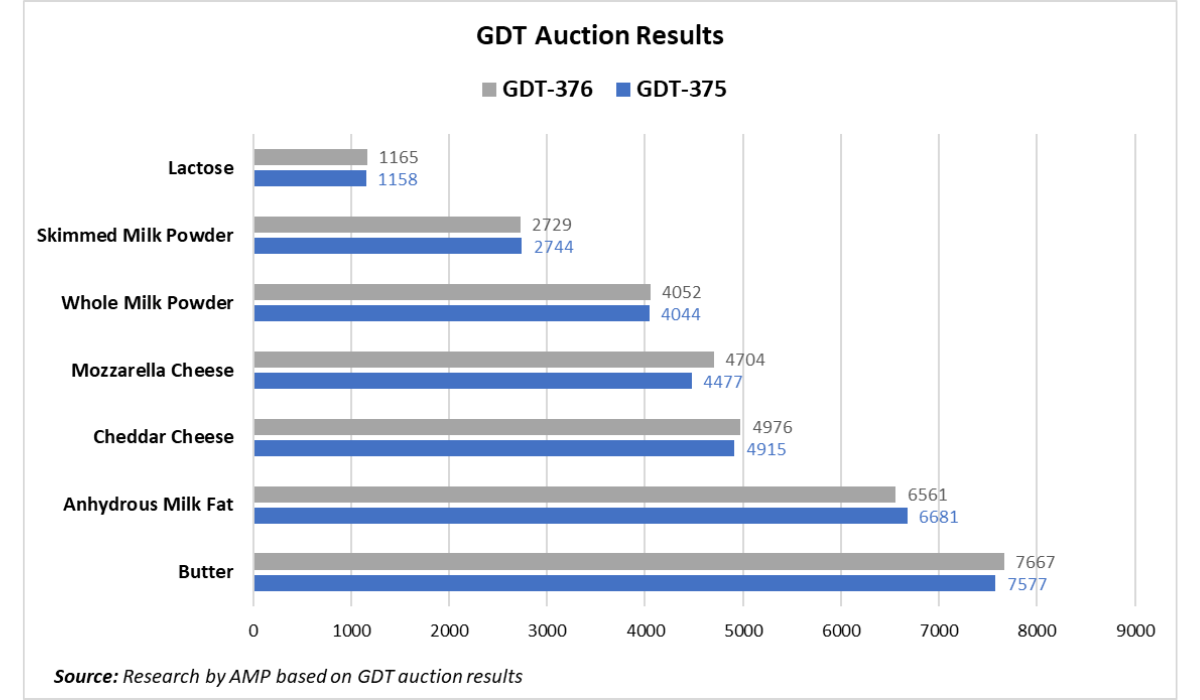

On Tuesday, March 18, the 376th GDT auction took place, during which the price index stood at 1251, unchanged since the previous auction on March 4. The average price for dairy products was $4,245 per ton, $36 higher than the results of the previous auction. During the auction, 19,540 tons of commodity goods were sold, which is 1,437 tons less than the previous auction. The minimum supply was 18,741 tons, while the maximum was 23,239 tons. A total of 175 dairy market operators participated, one less than on March 4.

As per the auction results, the price of anhydrous milk fat was $6,561 per ton, which is 0.8% less compared to the previous auction. The global market situation remains uncertain. According to Dairy News Today, Mexico imports this product from New Zealand for further re-export to the USA. Following the imposition of 25% tariffs on goods from Mexico and Canada by the administration of U.S. President Donald Trump, doubts have arisen regarding future deliveries of anhydrous milk fat to America. Likely, the loss of access to the U.S. market may suppress demand for this product. Mexico purchases approximately 10% of the anhydrous milk fat produced by New Zealand. According to the OECD forecast, U.S. tariffs may lead to an economic downturn in Mexico, which is likely to negatively affect demand for dairy products on the domestic market. Auction organizers forecast a price drop of 2.8% in April and 1.3% in May for anhydrous milk fat.

The price of butter at this auction was $7,667 per ton, which is 1.1% higher compared to the previous auction results. According to USDA, butter demand in Europe is active in retail chains and among wholesale buyers, against the backdrop of reduced milk yields in certain areas of Western Europe and declining product stock reserves. Butter prices are rising in Oceania amidst active export market demand and seasonal reductions in milk production in the region. Last week, butter sales in U.S. supermarkets were more active than during the same period last year. However, demand slowed among food industry enterprises.

The global trade war initiated by U.S. President Donald Trump's administration negatively impacted the American dairy industry. Mexico was one of the key importers of dairy products from the U.S., and now butter produced in America is accumulating in warehouses. American exporters are redirecting to markets in Asia and Africa, where producers from Europe, New Zealand, and South America are already actively operating. Likely, this could lead to intensified competition in these sales markets. According to GDT organizers, butter prices may rise by 1.7% in April and 1.3% in May.

The price of whole milk powder was $4,052 per ton, increasing by 0.2% compared to the previous auction results. According to USDA, whole milk powder prices fell in South America and New Zealand due to sluggish demand in export markets. In South America, demand activation for this product is expected at the end of Q2. Whole milk powder demand in the EU is active, and prices are rising. However, demand for EU products on external markets remains uncertain due to recent outbreaks of foot-and-mouth disease in Hungary and Germany. With reduced import demand for whole milk powder in China, European companies have the opportunity to scale down production and exports while allocating milk raw materials for butter, cheese, and other products manufacturing.

According to AHDB, demand for powdered milk in China remains weak due to excessive domestic supply and economic slowdown. Cautious consumer spending restrains demand growth. Additional challenges for exporters include currency exchange rate volatility and uncertainty regarding new tariffs introduced by the Trump administration. Simultaneously, milk production growth in China is slowing due to declining purchase prices, the negative effects of a Q3 drought, and the exit of local dairy farmers. Rabobank estimates that milk yields in China may decrease by 1.5% in 2025, potentially prompting a 2% increase in China’s dairy import volumes.

In the USA, demand for whole milk powder is stable, but last week's production volumes were lower than the same period last year due to rising temperatures. Amidst tariff disputes between the USA and Mexico, challenges have arisen for the American dairy industry. Mexico, a key importer of U.S. dairy products, is now accumulating milk powder in storage. Meanwhile, American exporters are reorienting toward markets in Asia and Africa, where producers from Europe, New Zealand, and South America are already active. Auction organizers anticipate a 0.1% increase in the price of whole milk powder in April and a 0.8% rise in May.

Skimmed milk powder fell to $2,729 per ton (-0.4%). According to USDA, U.S. skimmed milk powder prices have been declining for four consecutive weeks, as buyers procure limited volumes to meet immediate needs. Challenges in selling the product arose after the announcement of 25% tariffs on Mexican goods. Mexico, previously a key importer of skimmed milk powder, now faces redirected American supply to Asia and Africa. However, European supply is constrained by reduced milk yields in certain regions. Yet external demand for European skimmed milk powder is mixed due to foot-and-mouth disease outbreaks in Hungary and Germany. Active demand for skimmed milk powder persists in South America due to seasonal milk production declines.

Last week, dairy market operators in Oceania and South America reported some demand revival for the product on external markets, particularly in Africa. According to USDA, South Africa’s dairy industry has growth potential thanks to improving economic factors. Milk production growth remains hindered by weather conditions and livestock diseases over the past five years. Nevertheless, internal demand for dairy products and from potential trade partners is increasing. The number of dairy farmers in South Africa has decreased by 60% over the past decade. Further strain was added by a foot-and-mouth disease outbreak in 2024. Positive prospects, however, emerge through improved milk processing, reduced inflation, and recovering household incomes. Auction organizers forecast a 2.5% price increase for skimmed milk powder in April but a 0.9% decrease in May.

Cheddar cheese increased in price to $4,976 per ton (+1%), while the price of Mozzarella rose to $4,704 per ton (+5.1%). According to USDA, cheese production in Oceania is declining, prices are rising due to seasonal reductions in milk output, and demand for the products of local cheesemakers remains active on export markets. In the USA and Europe, cheese inventory levels align with existing demand. Purchase activity among American and European food processing enterprises is slow, but cheeses are actively sold in supermarkets. Auction organizers predict that Cheddar cheese may rise in price by 0.8% in April and 0.9% in May. Mozzarella prices are expected to increase by 4.9% in May.

Lactose increased in price to $1,165 per ton (+0.5%). According to USDA, lactose inventories in the USA are declining, and domestic demand for the product is stable. Export demand for lactose is mixed, with concerns about reduced exports to China during the U.S. trade war. Auction organizers forecast a 0.5% increase in lactose prices in May.

No results were published for buttermilk powder following the auction. According to USDA, production volumes of buttermilk powder in the USA are increasing, but demand for the product remains sluggish. Buyers mostly procure small quantities of buttermilk powder to meet situational needs.

The next GDT auction is scheduled for April 1.

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News