The industrial sector is slowing down raw milk production rates against the backdrop of declining procurement prices, surpluses of finished products, and sluggish market demand, reports Georghii Kukhaleishvili, analyst at the Association of Milk Producers (AMP).

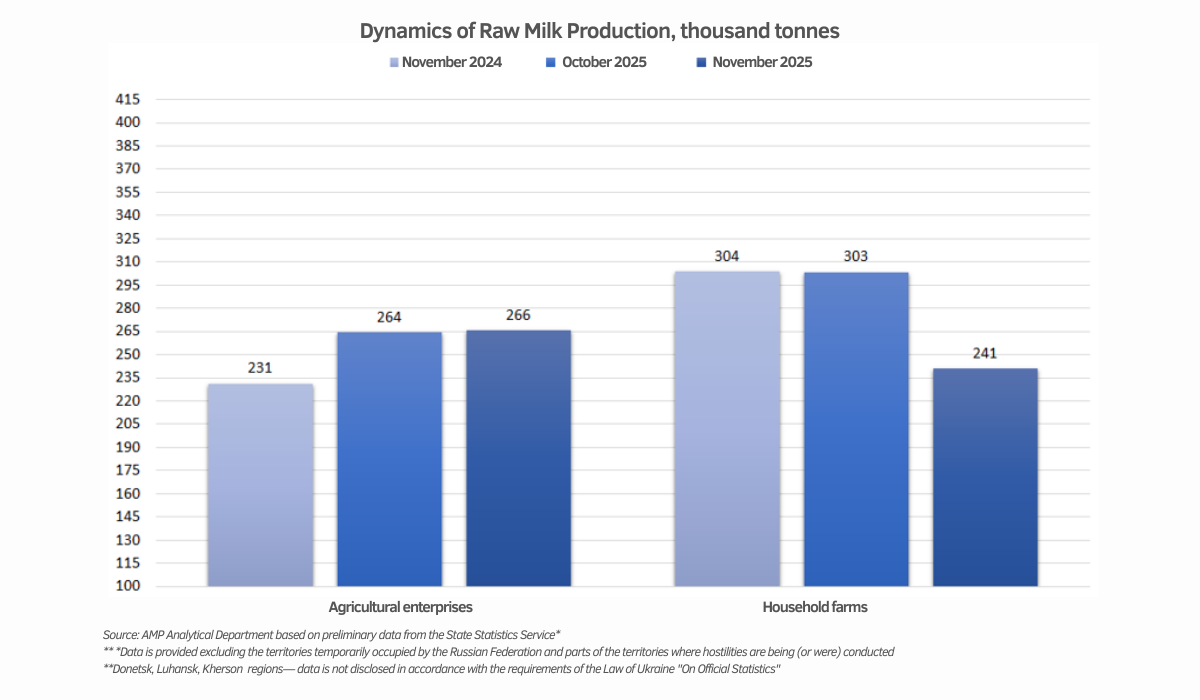

According to preliminary data from the State Statistics Service, in November 2025, farms of all categories produced 507,000 tonnes of raw milk, which is 61,000 tonnes less (-11%) compared to October of the current year and 28,000 tonnes less (-5%) compared to November 2024. In January–November 2025, milk yields in Ukraine totaled 6.38 million tonnes, down 299,000 tonnes (-4%) relative to the same period last year. In November 2025, the share of enterprises in raw milk production was 52%, while household farms accounted for 48%.

Enterprises produced 266,000 tonnes of raw milk in November 2025, which is 1,000 tonnes more (+0.5%) compared to October 2025, and 35,000 tonnes more (+15%) compared to November 2024. In January–November 2025, dairy farms produced 2.91 million tonnes of raw milk, which is 221,000 tonnes more (+8%) relative to the previous year's period.

In household farms, milk yields in November 2025 amounted to 241,000 tonnes, which is 62,000 tonnes less (-21%) than in October 2025 and 63,000 tonnes less (-21%) than in November 2024. In January–November 2025, the household sector produced 3.47 million tonnes of raw milk, down 520,000 tonnes (-13%) from the previous year.

In January–November 2025, raw milk production volumes were increased by agricultural enterprises in the following regions: Zakarpattia (+36%), Khmelnytskyi (+23%), Lviv (+20%), Kharkiv (+15%), Rivne (+12%), Ternopil (+12%), Vinnytsia (+10%), Mykolaiv (+10%), Kyiv (+7%), Poltava (+7%), Volyn (+6%), Zhytomyr (+6%), Cherkasy (+5%), Chernihiv (+5%), and Ivano-Frankivsk (+4%). Overall, dairy farms in 15 regions increased their milk yields.

During the first 11 months of 2025, approximately 55% of raw milk was produced by agricultural enterprises in these regions:

- Poltava region – 435.2 thousand tonnes;

- Cherkasy region – 356.3 thousand tonnes;

- Khmelnytskyi region – 288 thousand tonnes;

- Vinnytsia region – 263.3 thousand tonnes;

- Chernihiv region – 260.3 thousand tonnes.

Georghii Kukhaleishvili notes that raw milk production volumes in Ukraine are shrinking primarily due to the household sector, which is ceasing to play a vital role in the dairy industry. It is likely that if individual peasant households do not undergo consolidation by 2030, their milk will no longer reach processing plants and will be used only for self-consumption. To remain in the industry, individual households must unite into cooperatives to form commercial milk batches or independently increase their cow herds and develop craft dairy production.

The industrial sector compensates for the shrinking share of household farms and demonstrates stability in raw milk production. Despite blackouts and Russian missile and bomb strikes, the growth rates of raw milk production in Ukraine's industrial sector since the beginning of 2025 have been among the best in Europe and the world.

However, in November, milk yields in the industrial sector slowed down due to falling procurement prices, surpluses of raw materials and finished products, weak domestic demand, and the crisis in the global dairy market. A global imbalance between milk supply and demand exists. The simultaneous increase in raw milk production in various regions has led to commodity surpluses that markets cannot quickly absorb, driving down procurement prices across different producer regions.

It is estimated that in 2026, milk production will decrease to approximately 6.8 million tonnes. This reduction will occur both in the household sector (-10% compared to 2025) and on dairy farms. Under the pressure of low raw milk prices, the industrial sector will suspend its production growth; specifically, farms with more than 600 head will work on cost optimization until the market situation stabilizes. The closure of certain farms with fewer than 400 head is also probable. Stabilization of both the dairy product and raw milk markets is expected in the second half of 2026.

Ukrainian milk producers who manage to preserve their cow herds and invest in sustainability will likely gain advantages after 2026. It is predicted that in 2027, global supply will begin to lag behind demand, and the market will enter a recovery phase, with a potential shortage of high-quality raw milk in 2028. Most likely, in 2029–2030, the EU will enter a structural deficit, increasing the need for milk powder and butter—a demand that Ukraine, with its lower production costs, could satisfy. Ukraine has a chance to secure a position in the dairy markets of North Africa and the Middle East, as the EU will struggle to compete on cost with commodities produced in the USA, Latin America, and Oceania.

Regarding beef production, according to preliminary estimates from the State Statistics Service, in January–November 2025, cattle slaughter volumes at enterprises amounted to 115.86 thousand tonnes (11.13 thousand tonnes in November).

The largest share (57%) of cattle for slaughter was realized by agricultural enterprises in the following regions:

- Kyiv region – 16.98 thousand tonnes;

- Poltava region – 14.55 thousand tonnes;

- Cherkasy region – 13.01 thousand tonnes;

- Vinnytsia region – 11.02 thousand tonnes;

- Chernihiv region – 10.61 thousand tonnes.

Press Service of the Association of Milk Producers

Follow us on LinkedIn

Related News: