Increased raw milk production, slow demand, and significant stock inventories of commodity products are putting pressure on procurement prices, according to Georghii Kukhaleishvili, analyst at the Association of Milk Producers (AMP).

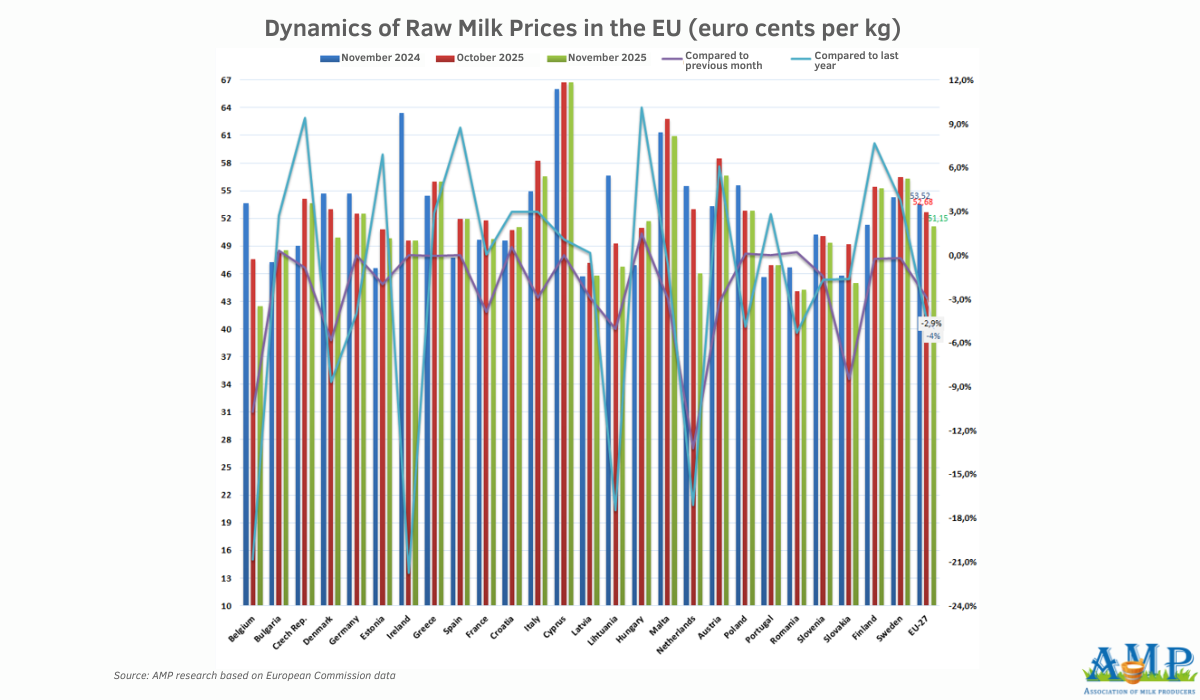

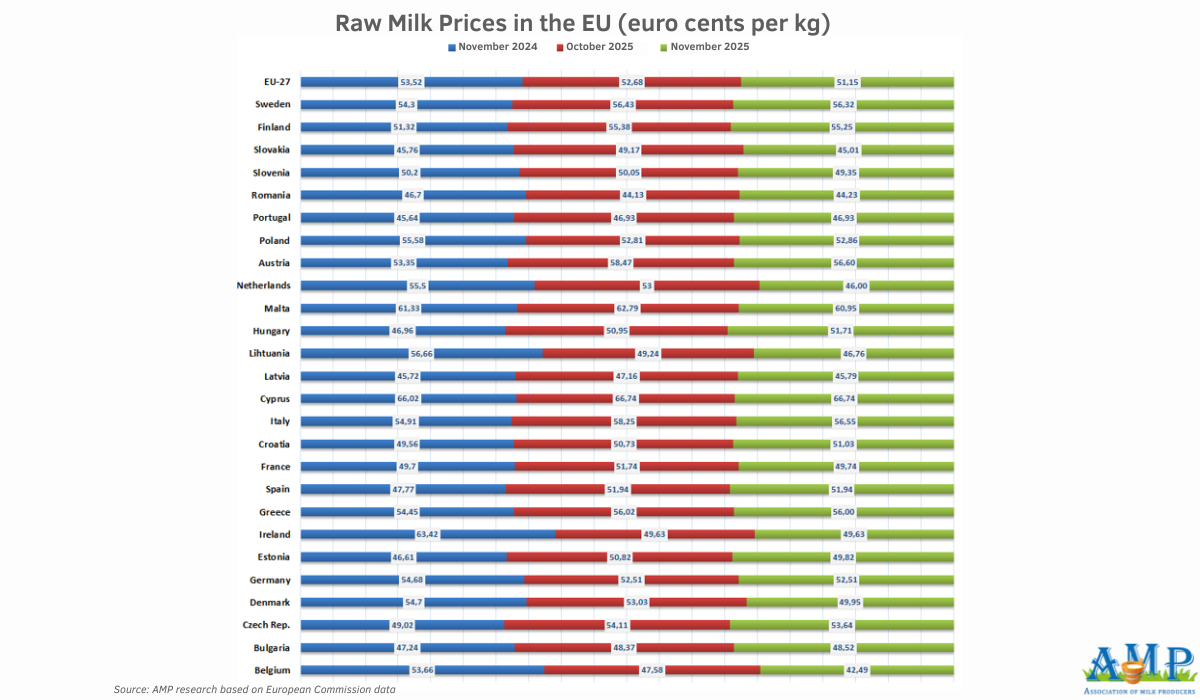

According to preliminary data from the European Commission, the average price for raw milk in the EU in November 2025 was 51.15 euro cents per kg, which is 2.9% less than in October 2025. Compared to the price as of November 2024, milk in the EU became 4% cheaper. In October, the price for Extra grade milk in Ukraine was 38.74 euro cents per kg.

Compared to October, the price for raw milk slightly increased in 5 EU member states: in Bulgaria to 48.52 euro cents per kg (+0.31%), Croatia to 51.03 euro cents per kg (+0.59%), Hungary 51.71 euro cents per kg (+1.49%), Poland to 52.86 euro cents per kg (+0.09%), and Romania to 44.23 euro cents per kg (+0.23%).

In November, procurement prices did not change in Germany, Ireland, Spain, Portugal, and Cyprus compared to October of the current year.

Over the last month, raw milk became cheaper in 16 countries, including such leading dairy product exporters as France, the Netherlands, Denmark, and Italy. The largest price reductions were observed in Denmark to 49.95 euro cents per kg (-5.81%), Belgium to 42.49 euro cents per kg (-10.70%), and France to 49.74 euro cents per kg (-3.8%).

The most expensive raw milk is in Cyprus (66.74 euro cents per kg) and Malta (60.95 euro cents per kg). The lowest prices for milk are received by farmers in Belgium (42.49 euro cents per kg).

Compared to November 2024, raw milk prices increased in 15 European countries. Relative to the same period last year, milk became most expensive in Czechia (+9.42%), Hungary (+10.11%), and Spain (+8.73%).

The price of milk decreased in 11 countries. Milk became cheapest in Ireland (-21.74%) and Belgium (-20.82%) compared to the same period last year.

Georghii Kukhaleishvili notes that the increase in raw milk production is putting pressure on procurement prices in Europe, and this trend will continue. According to IFCN data, the growth rates of milk production in Europe have been relatively low since 2022, but a significant revival in milk yields occurred from August 2025. Consequently, milk production growth reached over 5% year-on-year, which has not been observed in the market since 2015. Raw milk production mainly grew in North-Western Europe (Germany, France, Belgium, Netherlands, Ireland) due to high farmer margins, less cow culling, favorable weather conditions, and good grass quality on pastures in spring and summer. Due to the increased milk yield, high milk prices began to gradually decline. The fat and protein content in milk increased by 1–1.5% in the European market this year.

At the same time, consumer demand for fatty dairy products in the EU recovered slowly after the inflationary pressure of 2022–2023. The consumption of butter and cheese decreased in the EU's hotel and restaurant business, in food service enterprises, and in households. Under unstable conditions in the global dairy market, many milk processing enterprises in 2024–2025 reoriented themselves towards the production of long-shelf-life products, such as hard cheeses, butter, and dry milk products. In particular, cheese was the main processing direction in the EU. Significant stock inventories of unsold commodity products are putting pressure on raw milk prices. It is likely that inventories will normalize in the 3rd–4th quarter of 2026 due to the decline in milk yield volumes in the EU amid reduced farmer profits.

Press Service of the Association of Milk Producers

Follow us on LinkedIn

Related News