There is a certain global shortage of beef, which contributes to rising prices for meat and livestock and encourages producers to increase export volumes, according to Georghii Kukhaleishvili, analyst at the Association of Milk Producers (AMP).

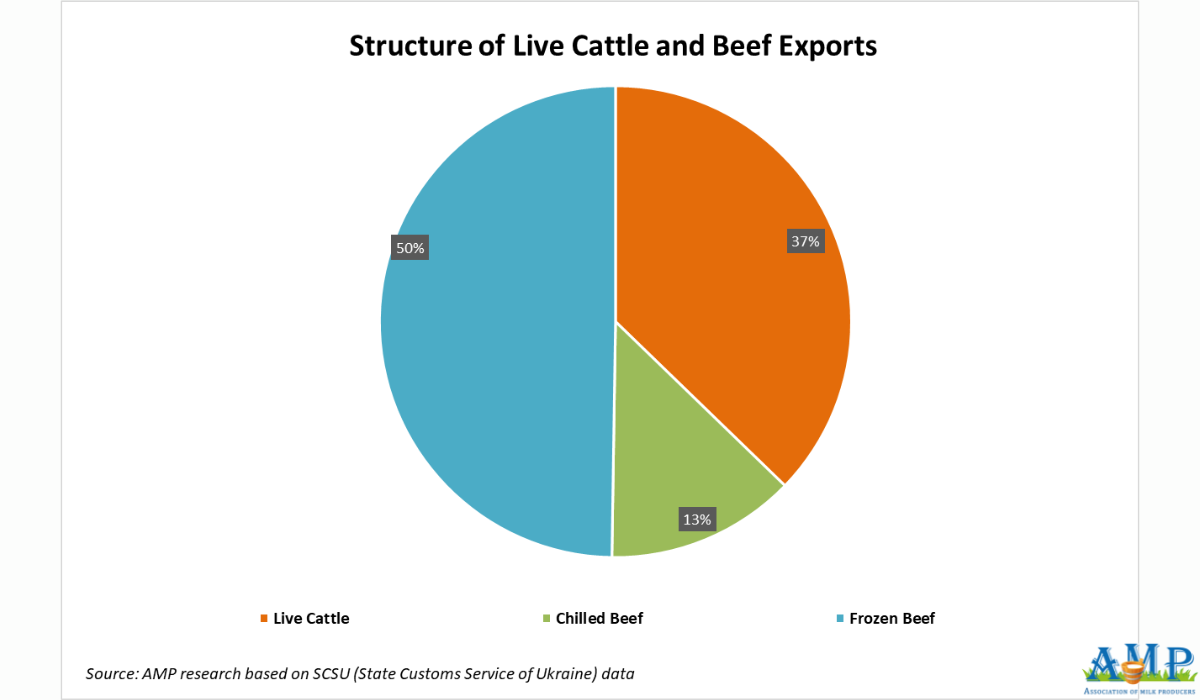

According to preliminary data from the State Customs Service of Ukraine (SCSU), in October 2025, Ukraine exported approximately 1.65 thousand tonnes of live cattle, which is 197% more than in September 2025, but 31% less than in October 2024. Monetary revenue for the exported animals amounted to $5.39 million, which is almost 7 times more than in September 2025 and 6% more than in October 2024. From January to October 2025, Ukraine exported 14.94 thousand tonnes of live cattle (+16%), totaling $34.61 million (+42%). Over the 10 months of 2025, the key export destinations for Ukrainian cattle were Lebanon (84%), Kazakhstan (9%), and Libya (6.4%).

In October 2025, Ukrainian exporters supplied 251 tonnes of fresh or chilled beef to foreign markets, which is almost 141% more than in September of the current year and almost 417 times more than in October 2024. Export revenue for the supplied goods was $1.88 million, which is 203% more than in September 2025 and 247 times more than in October 2024. From January to October 2025, Ukraine shipped 475 tonnes of chilled beef (-46%) to foreign markets, totaling $3.19 million (-43%). The key export destinations for fresh beef from Ukraine since the beginning of 2025 were Turkey (44%), Georgia (25%), Jordan (16%), Azerbaijan (10%), and Moldova (5%).

The physical export volumes of frozen beef from Ukraine in October 2025 amounted to 1.53 thousand tonnes, which is 30% more than in September of the current year but 29% less than in October 2024. Monetary revenue for the supplied goods was nearly $7.21 million, which is 32% more than in September 2025, but 12% less than in October 2024. From January to October 2025, Ukraine exported 15.33 thousand tonnes of frozen beef (+4%), totaling $64 million (+8%). Since the beginning of the year, the largest shipments of frozen beef have been made to Azerbaijan (33%), China (28%), Uzbekistan (16%), Kazakhstan (8%), and Moldova (6%).

Georghii Kukhaleishvili notes that demand for beef in export markets is outpacing supply. This is pushing prices up and encouraging producers to increase supply volumes. According to the AHDB forecast, the shortage of red meat is likely to persist in the medium term. Reduced supply and sustained global demand for beef contribute to rising prices and demand for cattle. The reduction in supplies from New Zealand supports both procurement prices for farmers and export prices. New Zealand farmers are working to restore their herds, which could contribute to increased beef supply in the coming years.

Despite rising prices, active import demand for beef remains in the US and China, where production is decreasing. Chinese consumers support supplies from Brazil and Australia. From January to September 2025, Brazil increased its beef exports by 16.6% compared to the same period last year. However, the slowdown in slaughter volumes in South American countries may lead to a reduction in the product supply in the region. Beef production in Australia reached record levels in 2025, and export volumes to the US and China have increased. However, the AHDB forecasts a certain decline in production volumes in 2026 and 2027 due to herd stabilization.

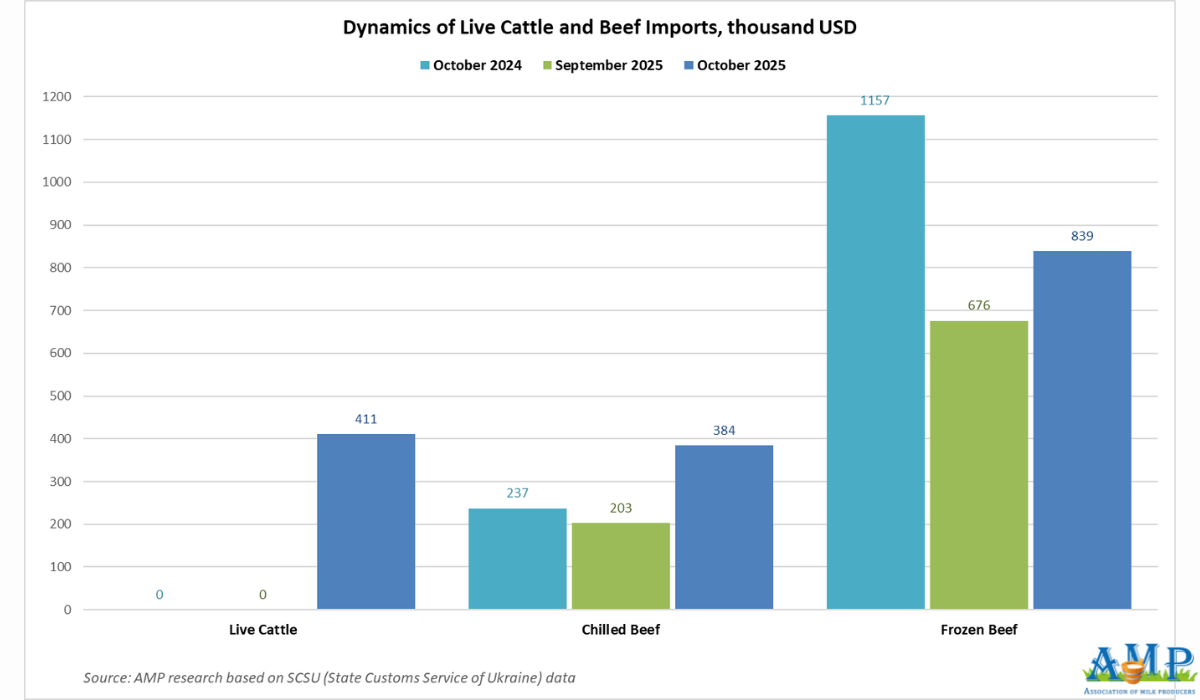

In October 2025, Ukraine imported 42 tonnes of live cattle. Ukraine did not import live cattle last month or last year. Import volumes of chilled beef increased to 14 tonnes (+27%), and frozen beef increased to 90 tonnes (+25%) compared to September 2025. Import volumes of chilled beef decreased by 13%, and frozen beef decreased by 55% compared to October 2024. From January to October 2025, Ukraine increased the import of live cattle to 554 tonnes (+18%), but reduced the import of chilled beef to 120 tonnes (-3%) and frozen beef to 1.16 thousand tonnes (-45%) compared to the same period last year.

The foreign trade balance in October 2025 was positive at $12.86 million.

Press service of the Association of Milk Producers

Follow us on LinkedIn

Related News