Following the auction results, all commodity products became cheaper amidst rising milk yields in dairy regions, which contribute to product surpluses and price decreases, according to Georghii Kukhaleishvili, analyst at the Association of Milk Producers (AMP).

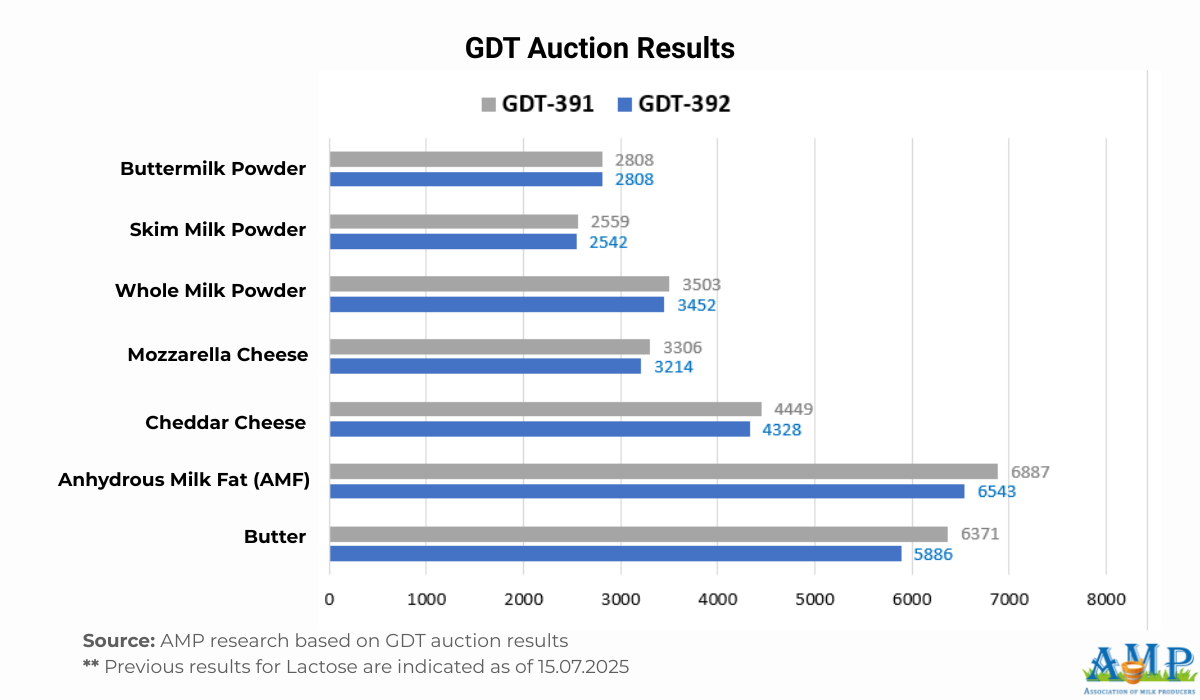

The 392nd GDT (Global Dairy Trade) auction took place on Tuesday, November 18th. The results showed that the price index was 1102, which is 33 points (-3%) less than the previous auction. The average price for dairy products was $3,678 per tonne, a decrease of $90 compared to the previous auction. 38,612 tonnes of commodity products were sold during the trading, which is 2,009 tonnes less than the previous auction. The minimum offer was recorded at 35,450 tonnes, and the maximum was 42,557 tonnes. 166 dairy market operators participated in the trading, which is 20 companies more than on November 4th.

Based on the auction results, the price for Anhydrous Milk Fat (AMF) was $6,543 per tonne, which is 5% less than the previous auction. As reported by the USDA, milk fat prices fell in Europe and Oceania at the beginning of November. Global milk supply is increasing, which facilitates the production of milk fat and weakens prices. According to the GDT forecast, AMF may decline by 7.3% in December and 4.9% in January 2026.

The price for Butter at this auction was $5,886 per tonne, which is 7.6% less than the previous auction results. As reported by the USDA, butter demand in the US is quite active in retail networks amid preparation for the New Year holidays, but sales are slow in the food service sector. American butter with over 80% fat is in demand in export markets due to attractive prices. However, the decline in butter prices continued in Europe and Oceania at the beginning of November.

Product stocks in European warehouses are high. Global prices for the commodity are falling, and export market demand is slow, with the exception of some activity in Asia, the Middle East, and the US. According to DCA Market Intelligence, demand for butter in the weeks leading up to Christmas is atypically low this year, unlike previous years when the market absorbed additional product volumes. Stocks of frozen butter are significant, and the expected price increase did not occur. Auction organizers expect butter prices may fall by 7.3% in December and 8% in January 2026.

The price for Whole Milk Powder (WMP) was $3,452 per tonne and decreased by 1.9% compared to the previous auction. According to the USDA, WMP prices fell in the US, the EU, and Oceania amid rising milk yields. Demand in export markets is stable, but buyers mainly purchase batches within existing contracts and do not order additional volumes. Brazil has slight demand for WMP in the spot market, which is offset by fairly active purchases in other South American countries. Auction organizers forecast a price reduction for the commodity of 2.9% in December and 2% in January 2026.

The price for Skim Milk Powder (SMP) was $2,542, which is 0.9% less than the results of the previous auction. As reported by the USDA, SMP prices were stable in the US and Oceania in November, but prices for the commodity fell in South America and Europe. Demand for the commodity in export markets is stable. Supplies are mainly carried out within previously concluded contracts. According to american traders, shipments to Asia have decreased compared to the same period last year. However, supplies to Mexico remain stable due to the activity of local buyers. According to the GDT forecast, the commodity may decline by 1% in December but increase by 0.4% in January 2026.

Cheddar Cheese fell to $4,328 per tonne (-2.7%), and Mozzarella Cheese fell to $3,214 per tonne (-2.8%). According to the USDA, demand for American cheese in export markets slowed. American cheesemakers have fulfilled orders ahead of the autumn and winter holidays and have reduced production volumes to usual levels. The reduction in European cheese prices contributed to increased demand in export markets. Due to attractive prices, European cheeses competed with the American product. Cheddar in Oceania became cheaper. Export prices for Cheddar decreased at the beginning of November amid weakening demand. Auction organizers expect Cheddar cheese may decline by 3.2% in December and 2.8% in January 2026, and Mozzarella cheese may decline by 1.6% in January 2026.

Lactose fell to $1,207 per tonne, which is 11% less than the July figure, when data for the product was last published. There is active demand for the product in the Southeast Asian market.

The next GDT auction will take place on December 2nd.

Press service of the Association of Milk Producers

Follow us on LinkedIn

Related News

TOP-5 Cows of Ukraine Were Announced at the International Dairy Congress–2025