In the second half of June, raw milk prices slightly decreased due to weak domestic demand and reduced exports following the EU's reinstatement of quotas and duties. The future price dynamics will depend on the results of negotiations with the European Commission regarding increased quotas, reports Georghii Kukhaleishvili, an analyst at the Association of Milk Producers.

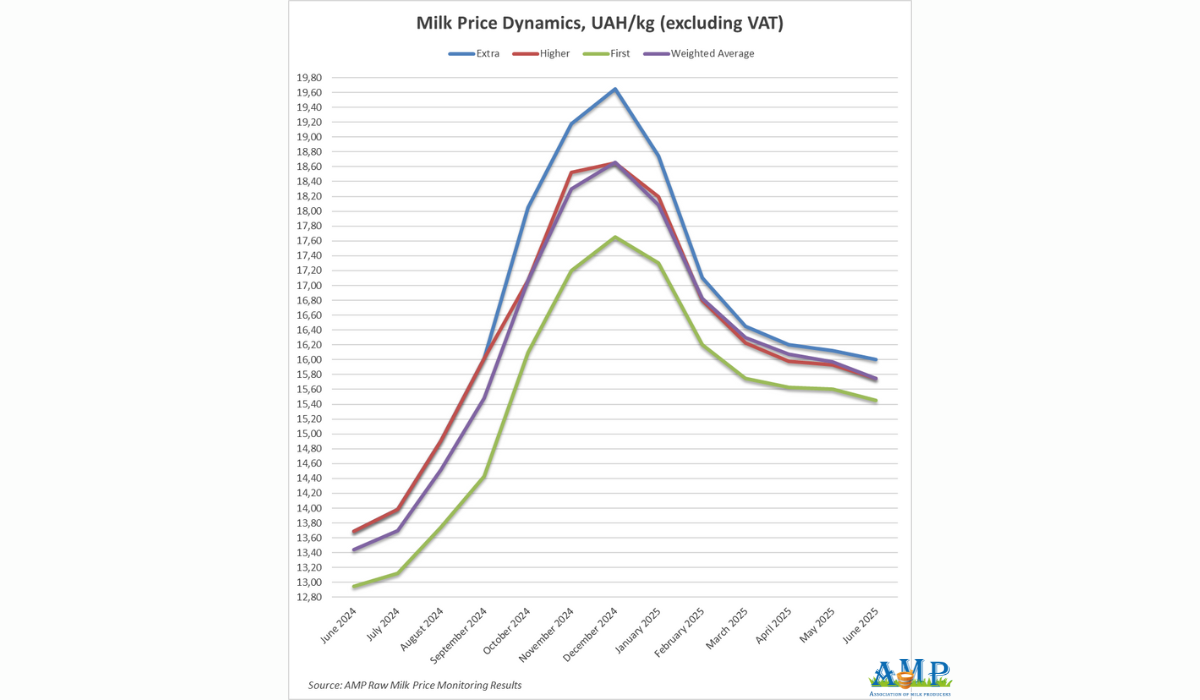

The average purchase price for extra grade milk as of June 23 was 16.00 UAH/kg excluding VAT, which is 17 kopiykas less than a month ago. The price range for this grade in farms varies from 15.50 to 16.50 UAH/kg excluding VAT and has not changed over the last month.

Higher grade milk on average costs 15.75 UAH/kg excluding VAT (-20 kopiykas). Prices for higher grade milk range from 15.30 to 16.20 UAH/kg excluding VAT. The lower and upper limits of the price range remained unchanged.

The average price for first grade milk was 15.45 UAH/kg excluding VAT and decreased by 20 kopiykas compared to the second half of last month. The minimum price in farms was 15.00 UAH/kg. The maximum price was 15.60 UAH/kg. The lower and upper limits of the price range remained unchanged.

Accordingly, the weighted average price of the three grades was 15.75 UAH/kg excluding VAT, which is 18 kopiykas less compared to the results of the previous monitoring.

Georghii Kukhaleishvili notes that in the second half of June, there was a certain decrease in milk prices relative to the second half of May. Compared to the first half of June, prices remained unchanged. There's no high demand for dairy products in the domestic market, and there are raw material surpluses. Rising milk prices are being constrained by a reduction in commodity exports in June due to the European Commission's abolition of autonomous trade measures (ATMs) for milk and dairy products from Ukraine, which since 2022 allowed domestic processing enterprises to supply their products to Europe without trade barriers. Since early June, Ukraine has exported the smallest volumes of dairy products in the last ten years.

It's likely that the quotas should be sufficient until the end of summer. In the first ten days since the abolition of ATMs, Ukraine exported to the EU 137 tonnes out of 5,833 tonnes of condensed milk within quotas, 254 tonnes out of 2,917 tonnes of milk powder, and 185 tonnes out of 1,750 tonnes of butter and anhydrous milk fat. For comparison, in May, Ukraine shipped 2.5 thousand tonnes of butter to European countries. How the situation in Ukraine's dairy market will change in autumn depends on the results of negotiations between the Ministry of Agrarian Policy and the Ministry of Economy with the European Commission regarding increasing or abolishing quotas, and the price dynamics will likely develop according to two scenarios.

If quotas are not increased, Ukrainian milk processing enterprises will have to reorient dairy product exports to other markets. Most likely, the Israeli-Iranian conflict around Tehran's nuclear program and the increased risks of maritime shipping through the Strait of Hormuz will negatively affect the markets of the Persian Gulf countries. According to traders, today Ukrainian dairy products cost 20-25% less than European ones, and the resumption of duties could lead to a reduction in revenue for Ukrainian companies. After the quotas expire, a probable suspension of dairy product exports to the EU, accumulation of unsold goods in warehouses for sale on the domestic market in the autumn-winter period is expected. In such a case, a decrease in domestic market prices should be expected to increase dairy product sales within the country, as well as attempts by milk processing enterprises to balance the cost of raw milk. In such a scenario, a significant increase in raw milk purchase prices during the autumn-winter season is unlikely.

However, if as a result of negotiations between Ukraine and the EU, we receive additional quotas in autumn, or if there's a return to a quota-free and duty-free regime for dairy products, Ukrainian companies will be able to increase dairy product exports, including maintaining high trade volumes for butter and skim milk powder. It's likely that the prices for these commodities will remain high, and demand for raw milk from milk processing enterprises may activate, which will contribute to an increase in raw milk prices.

Most likely, purchase prices will remain unchanged in early July, but if negotiations with the European Commission are successful, a price review upwards is likely in the second half of July.

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News