High raw milk supply in key dairy regions likely contributed to a decline in prices for most commodity products based on the results of the GDT auction, according to Georghii Kukhaleishvili, analyst at the Association of Milk Producers (AMP).

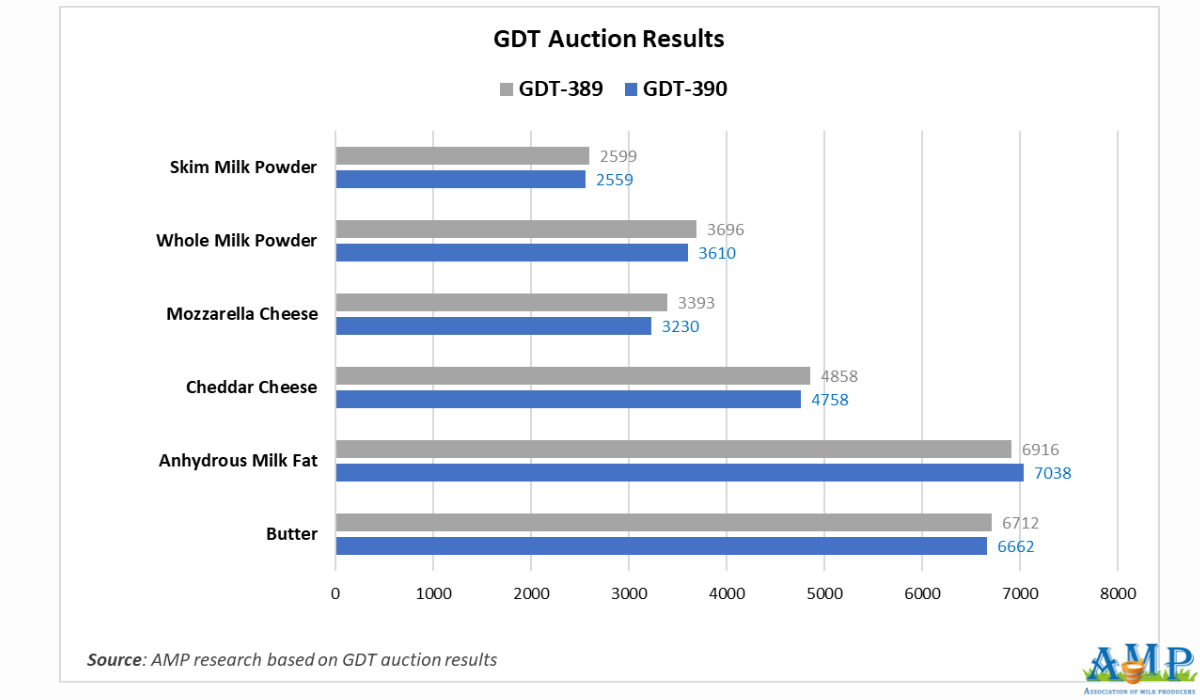

The 390th GDT (Global Dairy Trade) auction took place on Tuesday, October 21st. The results showed that the average price for dairy products was $3,881 per tonne, which is $40 less than the previous auction.

40,621 tonnes of commodity products were sold during the auction, which is 1,392 tonnes less than the previous auction. The minimum offer was recorded at 37,070 tonnes, and the maximum was 45,086 tonnes. 165 dairy market operators participated in the trading, which is two companies more than on October 7th.

BASED ON THE AUCTION RESULTS:

The price for Anhydrous Milk Fat (AMF) was $7,038 per tonne, an increase of $122 compared to the previous auction. According to the USDA, demand for milk fat in Europe is stable, and prices for the commodity strengthened in the lower range.

The price for Butter at this auction was $6,662 per tonne, a decrease of $50 compared to the previous auction. According to Vesper, butter prices have fallen globally due to an excess of milk in all major producing countries. New Zealand butter is more expensive than European or American butter. Because of this, price pressure on Oceania markets may intensify as the price difference grows. According to the USDA, butter prices in Europe have decreased by 24% over the last two months. Product supply increased due to a surge of cheap American butter into the European market. Under the new EU-US framework agreement, European countries are to import 20 thousand tonnes of US-made dairy products, including butter, duty-free annually.

According to the USDA, butter demand in the US is rising due to preparation for the holiday season. Butter production remains active, factories are operating at full capacity, and cream volumes are increasing due to the seasonal rise in milk fat content. Export market interest in 82% fat butter is strengthening. The American market is seeing a "bullish trend" due to high butter demand for holiday sales and foreign shipments. According to Oils & Fats International, butter exports are very active this year, especially from the US, where it is significantly cheaper than in the EU or New Zealand.

The price for Whole Milk Powder (WMP) was $3,610 per tonne, a decrease of $86 compared to the previous auction. According to the USDA, the situation in the US WMP market remains unchanged for several weeks, as demand for the commodity and trading activity are low. European WMP is losing attractiveness among buyers in export markets due to higher prices in Europe than from suppliers in other regions. According to NZX, New Zealand, US, EU, and Argentina markets are seeing increased milk and milk solids volumes compared to last year, which affected the weakening of milk powder prices. Actual milk production volumes in New Zealand grew stronger, and Fonterra sold less product than expected under contracts. The New Zealand cooperative expects to have a 16.5 thousand tonne surplus of WMP over the next 12 months.

Skim Milk Powder (SMP) also fell by $40 — to $2,559 per tonne. According to the USDA, demand for SMP in export markets is stable, with the exception of Mexico, where buyer activity and interest in the American product have revived. As reported by FoodNavigator, increased milk production in the US, EU, UK, New Zealand, and South America exceeds demand and is putting pressure on SMP prices. Prices for New Zealand and European commodities weakened due to slowing export demand.

Cheddar Cheese fell to $4,758 per tonne (down $100), and Mozzarella Cheese fell to $3,230 per tonne (down $163). According to FoodNavigator, high cheese supply on the world market led to a certain weakening of commodity prices. According to the USDA, cheese demand in the US is stable. Sales of some varieties, particularly aged cheese and Mozzarella, are growing. Exports remain strong, and production is mostly stable, although some plants temporarily halt for maintenance. Cheeses from suppliers in other regions are becoming more competitive compared to American cheese. In particular, lower prices for European cheeses and a weaker Euro exchange rate stimulate greater buying activity in export markets. Southern Europe is experiencing a slowdown in cheese demand amid the end of the tourist season. Demand for New Zealand cheeses in export markets has become more active.

The next GDT auction will take place on November 4th.

Press service of the Association of Milk Producers

Follow us on LinkedIn

Related News