Following the auction results, the price index decreased due to lower prices for most exchange-traded commodities, reports Georghii Kukhaleishvili, an analyst at the Association of Milk Producers (AMP).

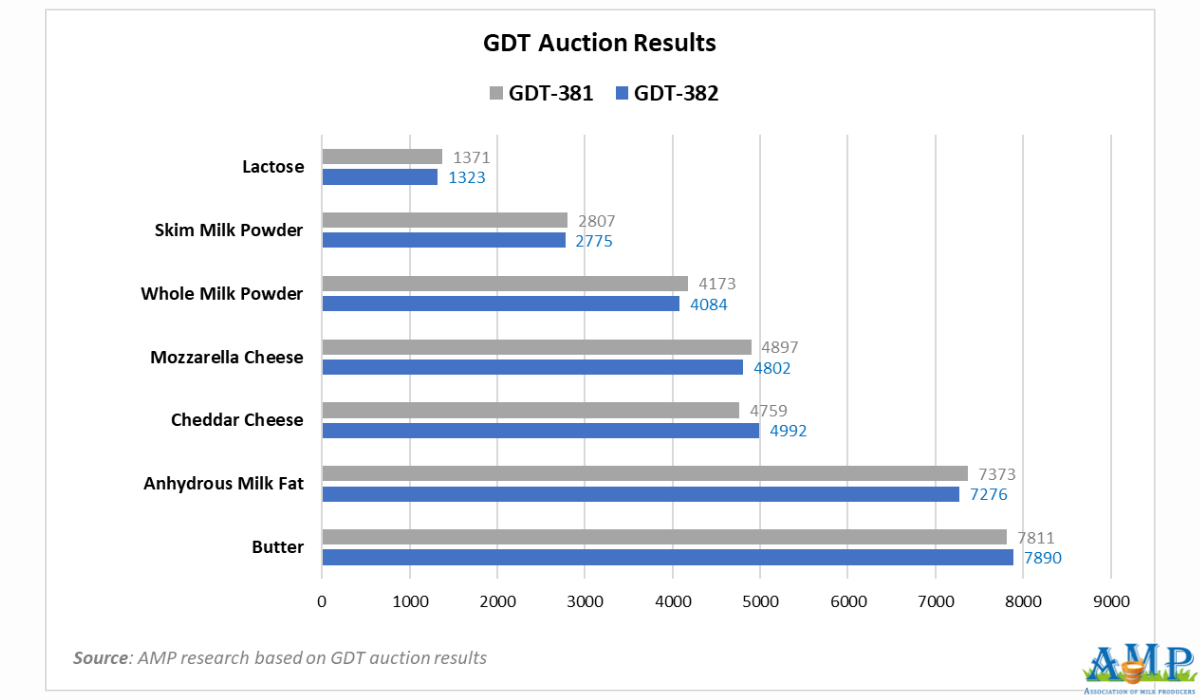

The 382nd GDT auction took place on Tuesday, June 16, with the price index reaching 1299, a decrease of 12 points (-1%) since the previous auction. The average price for dairy products was $4389 per tonne, which is $57 more than the previous auction's results. During the auction, 15,209 tonnes of exchange-traded commodities were sold, 1098 tonnes less than the previous auction. The minimum offer was recorded at 14,701 tonnes, and the maximum at 19,108 tonnes. 172 dairy market operators participated in the auction, 6 more companies than on June 3.

Following the auction results, the price for Anhydrous Milk Fat (AMF) was $7276 per tonne, a 1.3% decrease from the previous auction. According to USDA data, AMF prices in Europe increased in early June amid declining milk yields. According to the Food Production Solutions Association, AMF may see sufficient demand in developing markets due to its more affordable price compared to butter. According to Future Market Insights, the concentrated milk fat market could exceed $11.5 billion by 2035 with an annual growth rate of 8.1% (CAGR). Fonterra and Dairy Farmers of America are expanding production capacities to meet milk fat needs in developed and developing countries. Auction organizers predict a 1.1% price increase for AMF in July and a 0.8% decrease in August.

The price for butter at this auction was $7890 per tonne, a 1.4% increase from the previous auction. According to USDA data, the supply of cream in the US is currently sufficient and meets manufacturer demand. American dairy processors are building up butter inventories until the end of 2025. Demand for American butter is active in export markets due to more competitive pricing than producers from other regions. Butter prices are rising in Europe amid reduced raw milk production and dwindling stock levels. According to Infometrics CEO Brad Olsen, global supply issues and high demand for New Zealand butter are driving local market prices up. According to GDT organizers' forecasts, butter prices may increase by 3.6% in July and 4.7% in August.

The price for Whole Milk Powder (WMP) was $4084 per tonne, a 2.1% decrease compared to the previous auction. According to USDA data, WMP production is growing in South America, and demand for Argentine and Uruguayan products is active in Brazil and North African countries. In early June, WMP prices in Oceania decreased, and domestic market demand for the product exceeded buyer interest in foreign markets. In the US and Europe, domestic demand for WMP increased, and product prices strengthened. WMP production in the US is limited.

The decrease in WMP import volumes in China is attributed to increased domestic production and weak demand recovery. Since May 2025, drinking milk in China can only be produced from raw milk. The Chinese government has banned reconstituting drinking milk from milk powder to protect the interests of national producers amidst economic downturn, falling raw milk prices, deteriorating living standards in China, and reduced domestic dairy consumption. According to GDT forecasts, a 2.5% decrease in WMP prices is likely in July and August.

Skim Milk Powder (SMP) fell to $2775 per tonne (-1.3%). According to USDA data, SMP demand in the US is quite slow, although Mexican buyers have become more active, purchasing large volumes of American product. SMP inventories in the US are limited. In Europe, SMP prices are rising, and demand is quite active in the spot market. In early June, SMP prices weakened in Oceania, and export demand for the product slowed down. SMP is getting cheaper in South America. In Uruguay and Argentina, there is a significant supply of the product in the spot market, and demand from Brazil is active. Auction organizers expect a 0.4% price increase for SMP in July but a 0.8% price decrease in August.

Cheddar cheese increased to $4992 per tonne (+5.1%), while Mozzarella cheese decreased to $4802 per tonne (-1.9%). According to USDA data, despite stable cheese production in the US, high export demand keeps processing plants busy. Educational institutions are on vacation, which reduces the need for packaged milk, and more raw milk is directed to cheesemaking. Strong demand from international buyers compensates for weaker domestic demand, allowing for adequate product inventories to be maintained in warehouses. According to Supermarket Perimeter, demand for cheese is growing in Mexico and other Latin American countries, not only due to increased migration but also due to changing culinary preferences and the growing popularity of cheese dishes.

In Europe, cheese production is decreasing amid limited raw milk supply. Despite active demand for cheese in Southern European countries, European products are reluctantly purchased in export markets due to higher prices caused by the strengthening Euro. As reported by Assosia, the popularity of curd cheese is reviving among consumers in Britain. In early June, Cheddar cheese inventories in Oceania were limited, and demand for the product was slow in the domestic market but active in export markets. Auction organizers assume that Cheddar cheese may decrease by 3% in July but increase by 0.1% in August. A 1.9% price decrease for Mozzarella cheese is predicted for August.

Lactose decreased to $1323 per tonne (-3.6%). According to USDA data, lactose inventories in the US are limited, but spot market demand picked up last week. As reported by IndexBox, global demand for lactose and lactose syrup is growing. In the UK, consumption is growing slowly — with a projected CAGR of +0.3% to 66 thousand tonnes by 2035. In the Middle East, the market is developing faster — expected growth to 117 thousand tonnes and $176 million (CAGR +1.0% and +1.6%). The most dynamic market is the EU — volume growth of +2.5%, which will allow the market to reach 512 thousand tonnes. There is stable global demand for lactose, especially from the food and pharmaceutical industries. Auction organizers predict a 3.6% price decrease for the product in August.

Following the auction results, no data was published for dry buttermilk. According to USDA data, demand for dry buttermilk is gradually increasing, especially from ice cream manufacturers who are actively purchasing condensed buttermilk, reducing the volumes available for drying. Dry buttermilk inventories are decreasing, and spot supply remains limited, contributing to firm prices. American manufacturers are focused on fulfilling current contractual obligations, although some are already taking new orders. Export demand for the product is stable.

The next GDT auction will take place on July 1.

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News