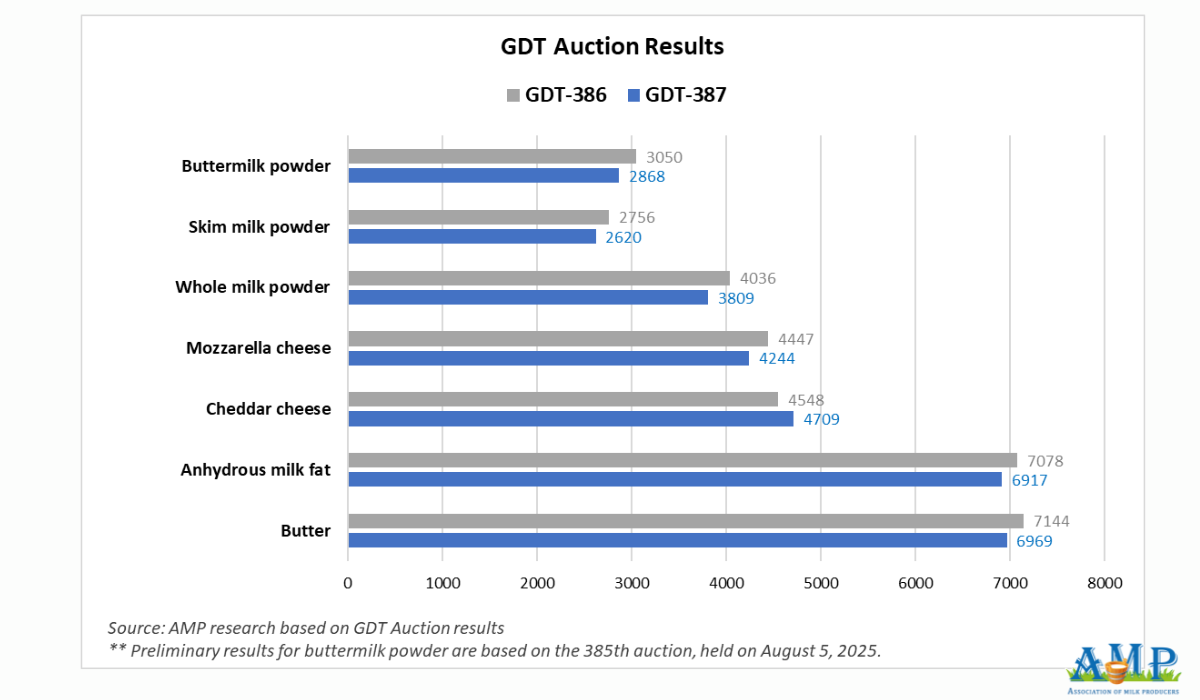

Following the auction, the prices for all commodities, with the exception of Cheddar cheese, fell. Skim milk powder, whole milk powder, and buttermilk powder saw the largest price drops amid increased milk yields in key dairy regions and moderate demand in export markets. Prices for milk fats continue to decline, reports Georghii Kukhaleishvili, an analyst at the Association of Milk Producers of Ukraine.

On Tuesday, September 2, the 387th GDT auction took place, with the price index reaching 1209, a decrease of 5 points (-4.3%) since the previous auction. The average price for dairy products was $4,043 per tonne, which is $248 less than the results of the previous auction. During the auction, 41,465 tonnes of commodities were sold, which is 4,912 tonnes more than the previous auction. The minimum offering was recorded at 37,909 tonnes, and the maximum at 46,290 tonnes. A total of 154 dairy market operators participated, which is 6 fewer companies than on August 19.

According to the auction results, the price for anhydrous milk fat was $6,917 per tonne, a 2.6% decrease from the previous auction, likely due to increased milk yields in New Zealand and the US and a higher supply of finished products. However, according to the USDA, prices for milk fat in Europe have increased due to active export demand. The auction organizers predict a price decrease for anhydrous milk fat of 1.5% in October and 3.9% in November.

The price for butter at this auction was $6,969 per tonne, a 2.5% decrease from the previous auction's results. According to the USDA, there is a sufficient supply of cream in the US domestic market, and some producers are increasing butter production and replenishing warehouse stocks before the fourth quarter of 2025 in preparation for the holiday season. Retail butter demand is stable, but wholesale sales have been weaker. There is active export demand for high-fat American butter. In Europe, demand for butter slowed last week, and prices for the product decreased.

Despite the increase in milk yields and butter production in Oceania at the start of the new season, domestic demand remains weak. Lower prices for American butter and a cheaper alternative in the form of anhydrous milk fat create certain barriers for local producers in export markets. However, according to The Daily Blog, consumers are complaining about butter prices in New Zealand, which have increased by 50% over the last year due to last year's rising prices for the product in export markets and active demand from China's 500 million-strong middle class. According to the GDT organizers, butter prices may decrease by 3.5% in October and 3.1% in November.

The price for whole milk powder was $3,809 per tonne, a 5.3% decrease compared to the results of the previous auction. According to the USDA, prices for whole milk powder in the US and Europe have decreased slightly, as producers are focused on fulfilling current contracts, and spot sales are limited. Demand for the product is stable. Demand for products from Oceania is active in North and Southeast Asia, the Middle East, and Latin America. In South America, whole milk powder production is growing amid increasing milk yields. According to the GDT forecast, a price decrease for whole milk powder is likely, with a 3.7% drop in October and a 5.9% drop in November.

Skim milk powder became cheaper, dropping to $2,620 per tonne (-5.8%). According to the USDA, demand for skim milk powder in the US is stable, but prices for the product have weakened. Purchases from Mexico have become more active, but overall export volumes have remained unchanged. Producers expect demand for whole milk powder from the confectionery industry to increase. In Western Europe, prices and domestic demand for skim milk powder remain stable. Interest in export markets is quite moderate. Production of the product in Europe is limited. In Oceania, prices for the product have decreased. Shipments of whole milk powder to North Asia have been reduced amid increased supplies from other regions. In South America, skim milk powder production is increasing amid rising milk yields. The auction organizers expect the price for skim milk powder to decrease by 2.0% in October and 4.5% in November.

Cheddar cheese became more expensive, rising to $4,709 per tonne (+3.6%), while mozzarella cheese became cheaper, dropping to $4,244 per tonne (-4.6%). According to the USDA, demand for cheese from retail buyers in the US remains stable, while demand from the food service sector is weaker compared to last year. A certain increase in sales was expected ahead of Labor Day, which is celebrated on the first Monday of September each year. Export demand for American cheese remains high. The consumption of packaged milk is expected to increase with the start of the school year, which will likely limit the availability of raw milk for cheesemakers and could intensify competition. In the EU, demand for cheese is stable in retail chains and the food service sector, especially in Southern Europe. Interest in European cheeses in export markets is mixed due to changes in the euro exchange rate. In Oceania, prices for Cheddar cheese have decreased, and domestic demand remains stronger than export demand. The auction organizers assume that Cheddar cheese prices may increase by 5.9% in October and 4.7% in November. A 5.1% price decrease for mozzarella cheese is projected for November.

Buttermilk powder became cheaper, dropping to $2,868 per tonne (-6.3%). According to the USDA, export demand for buttermilk powder remains stable. Market participants note that it is easier to obtain the product from traders than directly from producers. Some producers are directing their main volumes toward fulfilling current contractual obligations. The auction organizers predict a price decrease for buttermilk powder of 2.8% in November.

The next GDT auction will take place on September 16.

Press service of the Association of Milk Producers

Follow us on LinkedIn

Related News