Ukraine increased its beef export volumes in May amid high commodity prices in export markets and reduced production volumes in several countries. Demand for red meat traditionally rises with the start of the BBQ season after the May holidays, reports Georghii Kukhaleishvili, an analyst at the Association of Milk Producers (AMP).

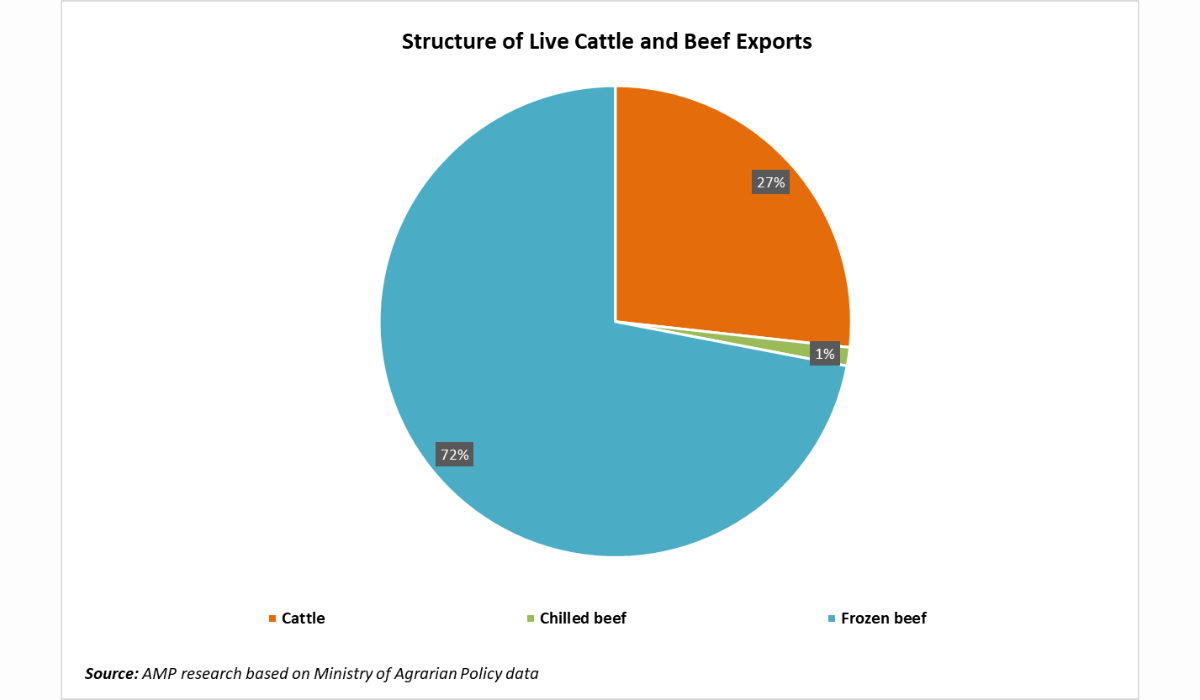

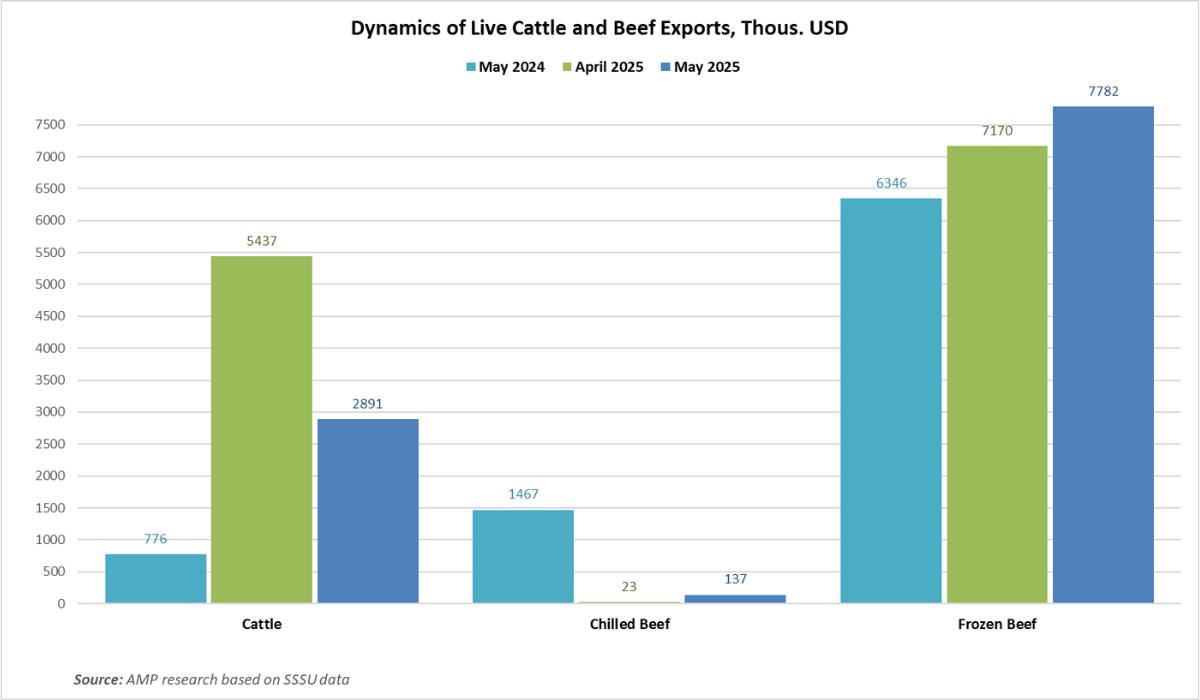

According to preliminary data from the State Statistics Service of Ukraine (SSSU), in May 2025, Ukraine exported approximately 1.4 thousand tonnes of live cattle, which is 25% less than in April 2025, but 166% more than in May 2024. The revenue from exported animals amounted to 2.89 million USD, 47% less than in April 2025 and 273% more than in May 2024. In January-May 2025, Ukraine exported 8.5 thousand tonnes of live cattle (+126%) for a total of 18.85 million USD (+196%).

In May 2025, Ukrainian exporters supplied 21 tonnes of fresh or chilled beef to foreign markets, which is almost 984% more than in April of the current year, but 91% less than in May 2024. Export revenue for the supplied goods was 137 thousand USD, 493% more than in April 2025, but 91% less than in May 2024. In January-May 2025, Ukraine shipped 65.5 tonnes of chilled beef (-93%) to foreign markets for a total of 407.1 thousand USD (-93%).

Natural export volumes of frozen beef from Ukraine in May 2025 amounted to 1.91 thousand tonnes, which is 6% more than in April of the current year and 19% more than in May 2024. Revenue for the supplied goods was almost 7.78 million USD, 9% more than in April 2025 and 23% more than in May 2024. In January-May 2025, Ukraine exported 7.96 thousand tonnes of frozen beef (+18%) for a total of 30.7 million USD (+8%).

Georghii Kukhaleishvili notes that global prices for cattle and beef are rising amidst reduced supply in producing regions. In the first half of 2025, global cattle markets are showing an upward trend. Prices in Europe increased particularly sharply in the first quarter, due to reduced domestic supply against stable demand. Currently, cattle prices in the EU have almost caught up with the high prices in North America, which are also gradually increasing. The main problems for farmers were diseases: bluetongue in Europe and the UK, and the New World screwworm parasite in Mexico, due to which the US temporarily closed its border to live cattle suppliers from the neighboring country.

According to Rabobank forecasts, global beef production in 2025 may decrease by 2%, specifically in Brazil (–5%) and New Zealand (–4%). A decline is also expected in the USA, Europe, and China, while Australia, on the contrary, may increase production. Meanwhile, Chinese importers, given trade tensions with the USA, are reorienting towards supplies from Australia, New Zealand, and South America. According to FAO, in China, cattle herd reduction has been ongoing since the end of 2023 due to rising production costs. Australia almost broke its beef export record in May – over 117 thousand tonnes (+30%) were exported to China alone. Roger Montgomery, founder of Montgomery Investment Management, believes that in the short term, a window of opportunity for beef exporters in the Chinese market, amounting to 2.5 billion USD in supply volumes, is opening.

Therefore, a portion of young cattle in Australia is being bought for fattening with an eye on future exports, primarily to China, South Korea, and Japan. Although, at the end of April, beef demand was weak in Japan. Inflation is shifting Japanese food preferences towards cheaper protein sources – pork and poultry. At the same time, the slaughter of Wagyu cattle is increasing, as fatteners seek a better price for carcasses.

Rabobank analyst Angus Gidley-Baird believes that despite the introduction of a 10% tariff on Australian beef imports in the USA, the demand for lean beef in the American market significantly outweighs the effect of the tariff. According to Meat and Livestock Australia, 167.72 thousand tonnes of beef have already been supplied to the USA since the beginning of the year, which is 32% more than last year. The USA is increasing its import of Australian beef because the supply of lean beef for the "burger season" is limited. The US cattle herd is at its lowest level since the 1950s due to drought and rising production costs for farmers. However, Bernt Nelson, an economist at the "American Farm Bureau Federation," warns that economic uncertainty amid record high beef prices may begin to put pressure on consumer demand in the USA. Cattle prices have repeatedly set new records in 2024, but due to high production costs, farmers' margins remain minimal. If consumer confidence or household financial well-being deteriorates, it could lead to lower demand, falling purchase prices, and financial losses among farmers.

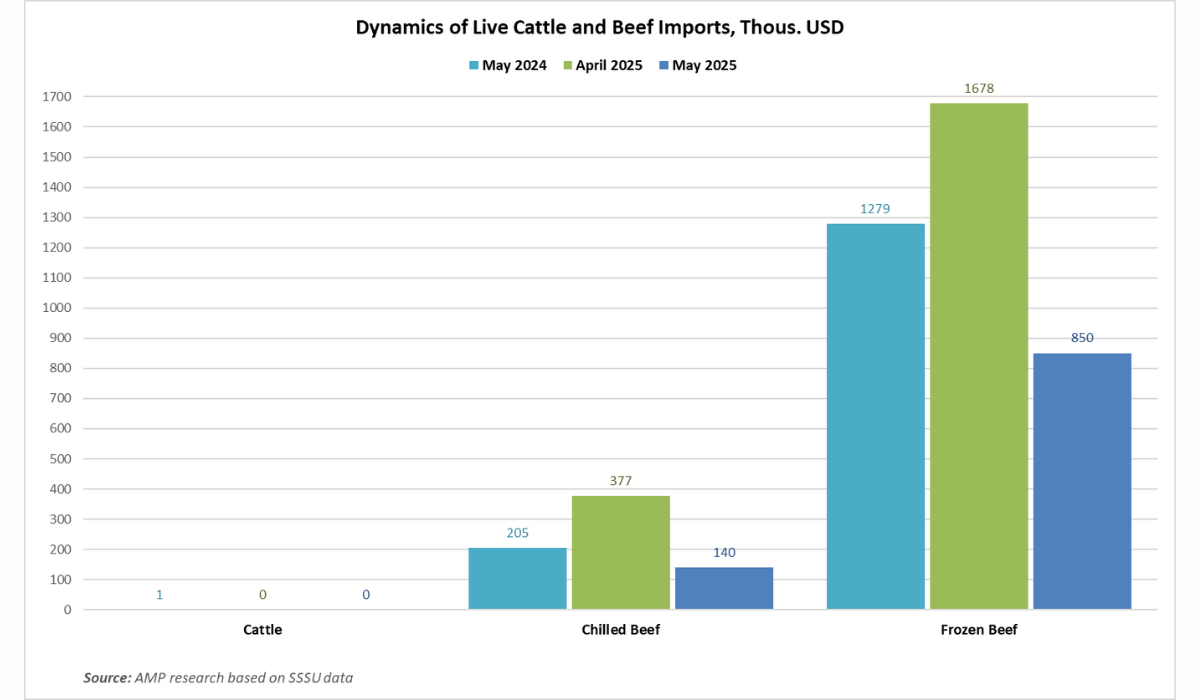

In May 2025, Ukraine did not import live cattle. Chilled beef import volumes decreased to 6.2 tonnes (-60%), and frozen beef import volumes decreased to 102.1 tonnes (-50%) compared to April 2025. Chilled beef import volumes decreased by 48%, and frozen beef import volumes decreased by 59% compared to May 2024. In January-May 2025, Ukraine reduced live cattle imports to 7 tonnes (-97%), but increased chilled beef imports to 55.8 tonnes (+7%) and reduced frozen beef imports to 669.3 tonnes (-40%) compared to the same period last year.

The foreign trade balance in May 2025 was positive, amounting to 9.82 million USD.

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News