The growth in revenue from Ukraine's dairy exports in April was likely driven by a favorable euro exchange rate, demand for certain products, and a seasonal decline in milk production in Oceania. At the same time, Ukrainian exporters face new barriers: China's ban on reconstituted milk, the US trade war, increased competition in third-country markets, logistical complications, and the foot-and-mouth disease outbreak in neighboring EU countries, according to Georghii Kukhaleishvili, an analyst at the Association of Milk Producers of Ukraine.

According to preliminary data from the State Statistics Service of Ukraine (SSSU), in April 2025, 11.94 thousand tons of dairy products were exported for a total of USD 38.68 million. Compared to March, the natural volumes of exports decreased by 3%, while compared to April 2024, they increased by 8%. Export revenue increased by 2% compared to March and by 46% compared to April 2024. In January-April 2025, Ukraine exported 43.09 thousand tons (+16%) of dairy products worth USD 128.45 million (+53%).

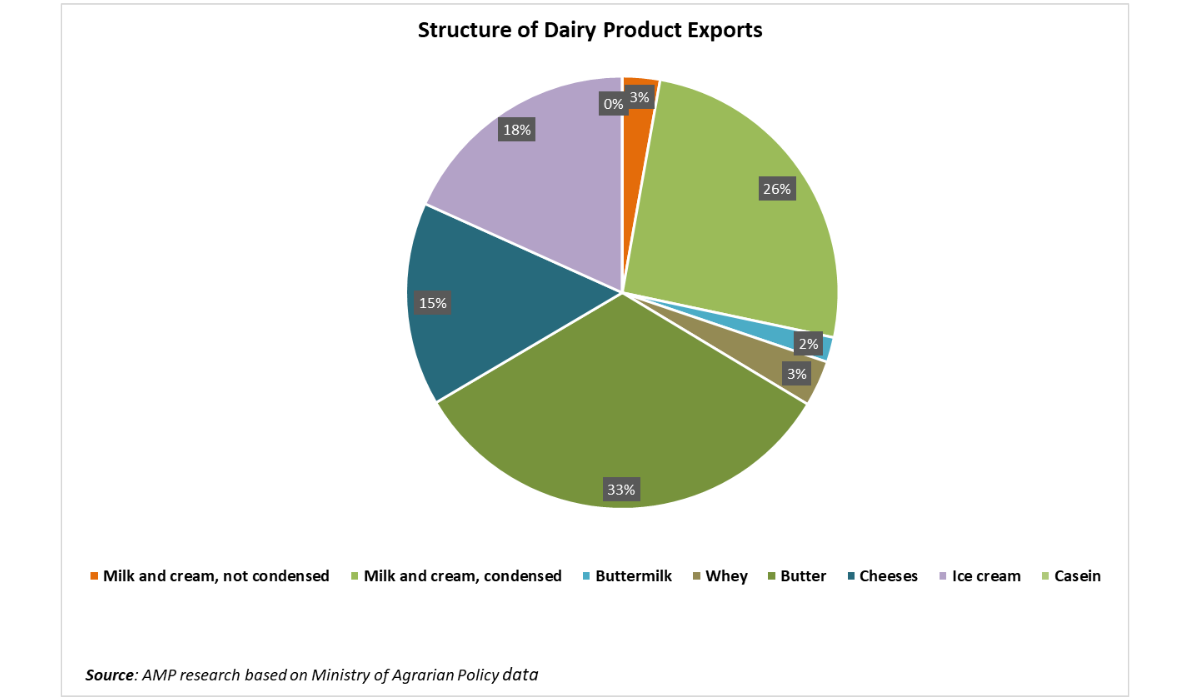

The main export categories in April were the following goods:

- Butter – 33%;

- Milk and cream, condensed – 26%;

- Ice cream – 18%;

- Cheeses – 15%.

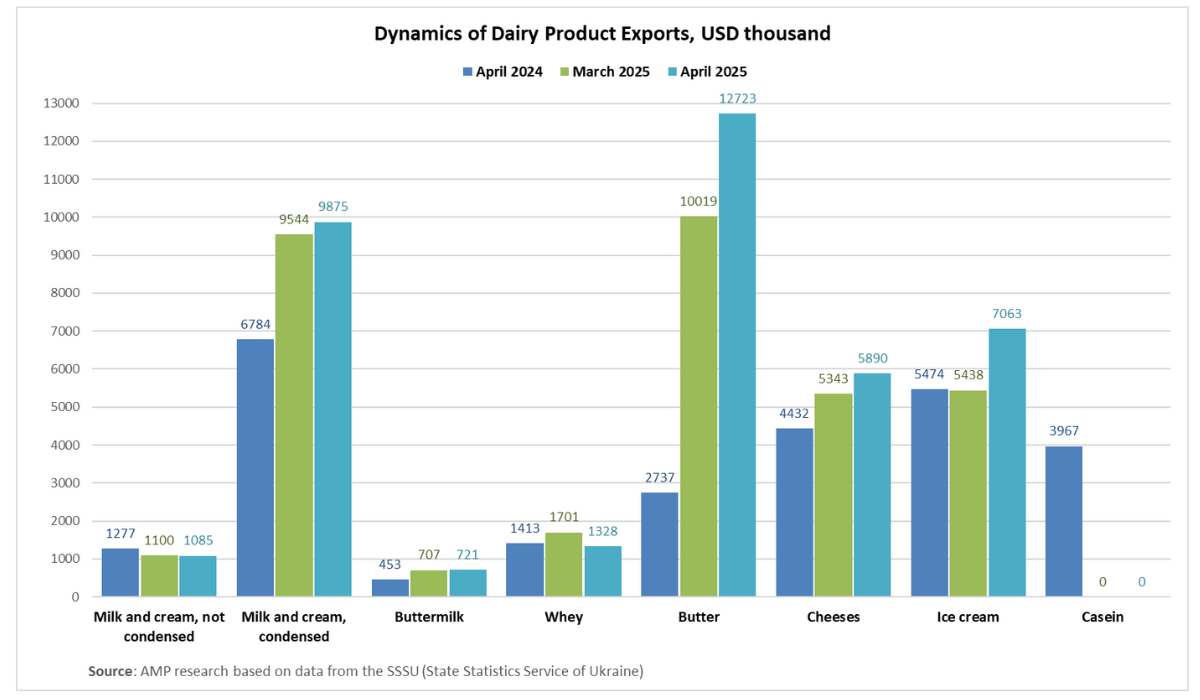

In April 2025, Ukraine increased the natural volumes of exports of buttermilk to 477 thousand tons (+12%), butter to 1.79 thousand tons (+27%), cheeses to 1.26 thousand tons (+10%), and ice cream to 1.89 thousand tons (+24%) compared to March. At the same time, the volumes of supplies of milk and cream, not condensed decreased to 1.22 thousand tons (-14%), milk and cream, condensed to 3.84 thousand tons (-1%), and whey to 1.43 thousand tons (-21%) compared to March of this year. In April, Ukraine did not supply casein to foreign markets. Compared to April 2024, the natural volumes of exports of milk and cream, not condensed (-42%) and whey (-34%) decreased.

Compared to March, the monetary revenue from shipped milk and cream, condensed increased to USD 9.87 million (+3%), buttermilk to USD 721.2 thousand (+2%), butter to USD 12.72 million (+27%), cheeses to USD 5.88 million (+10%), and ice cream to USD 7.06 million (+30%). Revenue from exported milk and cream, not condensed, decreased to USD 1.08 million (-1%), and whey to USD 1.32 million (-22%). Compared to April 2024, monetary revenue increased for exported milk and cream, condensed (+46%), buttermilk (+59%), butter (+365%), cheeses (+33%), and ice cream (+29%), but decreased for supplied milk and cream, not condensed (-15%), and whey (-6%).

In January-April 2025, Ukraine increased the natural volumes of exports of milk and cream, condensed to 13.30 thousand tons (+54%), buttermilk to 1.75 thousand tons (+39%), butter to 4.95 thousand tons (+259%), cheeses to 4.44 thousand tons (+23%), and ice cream to 4.78 thousand tons (+30%) compared to January-April 2024. Compared to the same period last year, the export volumes of milk and cream, not condensed, decreased to 6.48 thousand tons (-31%), whey to 6.21 thousand tons (-14%), and casein to 1.14 thousand tons (-40%).

Monetary revenue in January-April 2025 increased for exported milk and cream, condensed, to USD 33.90 million (+50%), buttermilk to USD 2.60 million (+57%), whey to USD 5.71 million (+18%), butter to USD 35.72 million (+301%), cheeses to USD 20.59 million (+31%), and ice cream to USD 17.31 million (+38%) compared to the same period last year. Compared to January-April 2024, revenue decreased for exported milk and cream, not condensed, to USD 5.06 million (-14%), and casein to USD 7.52 million (-36%).

Georghii Kukhaleishvili notes that in April, the foreign trade balance was positive due to an increase in butter exports. The increase in monetary revenue from exported goods may be due to the strengthening of the euro exchange rate. Contracts in euros concluded by Ukrainian exporters with EU companies were profitable. The likely increase in exports of butter, ice cream, buttermilk, cheeses, and condensed milk may be due to the seasonal reduction in raw milk production in Oceania, preparations for spring holidays, the tourist season, the vacation season, and summer holidays, when the number of visitors to public catering establishments and the consumption of ice cream and sweets increase.

The trade war initiated by the US President Donald Trump's administration and the increase in tariffs on European dairy products create prerequisites for a decrease in raw milk prices in Europe. Until recently, the United States imported large volumes of cheeses from France, Italy, and Ireland. European dairy processing enterprises will not be able to quickly reorient the export directions of their products.

Such large exporters of dairy products as New Zealand and the EU have to change the directions of their goods supplies due to the administrative measures of the United States and China, which will intensify competition in other sales markets. In particular, Ukrainian dairy processing enterprises with an outdated technological base are inferior in quality to suppliers of skimmed milk powder from Western countries.

Domestic exporters are losing their shares in the sales markets for processed cheese products. Processed cheese products were produced in large quantities for export to the CIS countries. However, the complication of logistics in wartime conditions affected the cost of Ukrainian goods, which are being squeezed out of sales markets by competitors from Russia, Belarus, and local producers.

The outbreak of foot-and-mouth disease in Hungary and Slovakia may lead to ambiguous consequences for Ukrainian dairy exporters. On the one hand, if the infection spreads in Ukraine, quarantine and a ban on the export of finished products will be introduced. On the other hand, if Ukraine, thanks to biosecurity measures, can avoid the spread of the disease, there are prospects for increasing the volume of dairy exports against the backdrop of the destabilization of the dairy market in Central and Eastern European countries under the influence of foot-and-mouth disease.

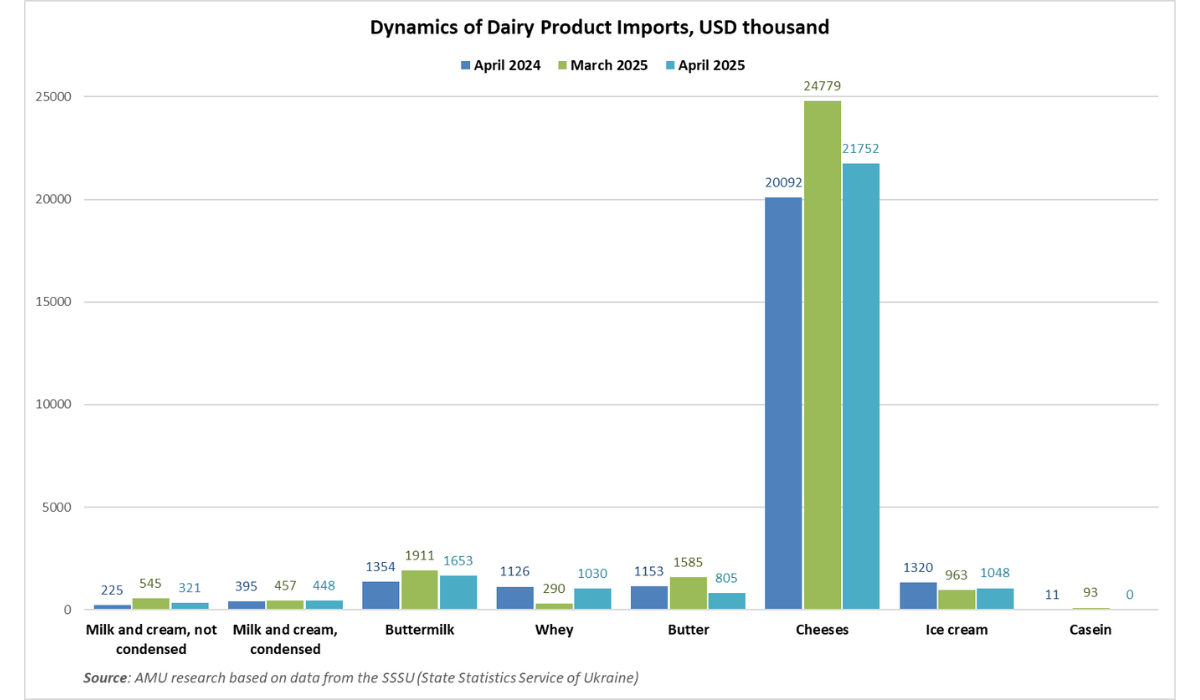

In April 2025, Ukraine imported 5.18 thousand tons of dairy products worth USD 27.05 thousand. Compared to March 2025, the natural volumes of imports decreased by 10%, and compared to April 2024, they decreased by 0.4%. In January-March 2025, Ukraine imported 20.55 thousand tons (+9%) of dairy products worth USD 102.30 million (+10). The largest share of total imports falls on cheeses (65%), and buttermilk is in second place (16%).

Due to the increase in cheese imports to Ukraine, there was a certain imbalance in foreign trade. In terms of tonnage, Ukraine exported 110% more dairy products than it imported. However, in monetary terms, the gap between export revenue and import costs is not so large. In particular, in January-April 2025, this difference was 26% in favor of exports. The likely reason for this imbalance is that Ukrainian exporters mainly sell cheap dairy products or at reduced prices to foreign markets. At the same time, the export margin is offset by large expenditures on the import of more expensive goods with high added value, including cheeses. Usually, dairy processing enterprises complain about expensive milk in Ukraine, although they are inferior in quality to competitors from developed countries due to an outdated technological base. However, they sell finished products at lower prices to compete more effectively in foreign markets.

The foreign trade balance in April was positive and amounted to USD 11.62 million.

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News