According to Rabobank, in the second half of 2024, the supply of raw milk improved in regions exporting dairy products amid declining demand from dairy processing enterprises during the traditional slowdown in purchasing activity on the global dairy market during the New Year holidays.

Production and Demand

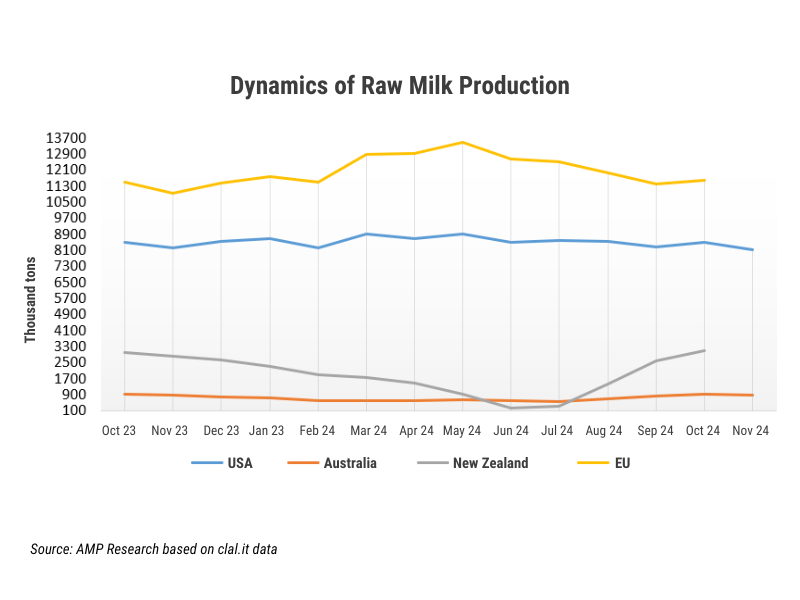

Europe: According to the USDA, the situation in the raw milk production sector in November was mixed. Rising production costs, cow diseases, and droughts in Mediterranean, Balkan, and Black Sea countries restrained milk production growth in Europe. Preliminary USDA data indicate that some European processing enterprises reported reduced milk production in December compared to the previous year. However, as AHDB reports, improved weather and encouraging prices led to an increase in raw milk supply in the fourth quarter, allowing milk production in 2024 to rise by 0.3% compared to the previous year. Preliminary USDA estimates suggest raw milk production in the EU could reach 145.6 million tons by the end of 2024.

Milk production in the EU is projected to decline in 2025, which may force processing reductions. According to USDA data, milk consumption in the EU is expected to decrease to 23.5 million tons (-0.3%) in 2025. This may lead dairy processing enterprises to prioritize milk for the most profitable products. Cheese production is likely to remain the main focus for EU dairy processors due to high domestic cheese consumption and stable export demand.

European farmers are concerned about the new Common Agricultural Policy and the implementation of the EU Green Deal, as stricter environmental protection and climate change mitigation policies may require additional investments and further reduce dairy farming profitability.

Last year, some European countries reduced their exports of commodity goods to China, which aims to increase its self-sufficiency in dairy products. In the first half of 2024, China reduced its dairy imports to 1.31 million tons, down 16.3% compared to the previous year. Specifically, the Netherlands exported products worth $768 million, down 45% from the first half of 2024. From January to July 2024, Poland exported dairy products worth $34.4 million to China, down 41% compared to the previous period. Szymon Borucki, spokesperson for the Polmlek Group, suggests that there are still opportunities for exporters in the Chinese dairy market, as the country is a major importer of whey for animal feed and specialized products such as WPC protein, lactose, and lactoferrin.

USA: According to clal.it, in November 2024, the USA produced 8.10 million tons of raw milk, down 5% compared to October and 1% less than November 2023. From January to November 2024, raw milk production totaled 93.88 million tons, down 0.3% compared to the previous year. Milk yields in California significantly decreased due to cow diseases, and in Wisconsin, known for its large dairy industry, yields also dropped.

According to the USDA, milk supply in the USA improved in December amid declining demand from dairy processing enterprises, which halted operations during the preparation and celebration of the New Year holidays when dairy market activity slows down. American farms saw increased milk yields due to favorable weather conditions. Demand for liquid milk and condensed skim milk decreased during school vacations and Christmas and New Year's celebrations.

Oceania: According to clal.it, in November, milk yields in Australia amounted to 868 thousand tons, down 6% compared to October and 0.3% lower than November 2023. Over 11 months of 2024, Australian farmers produced 7.61 million tons of raw milk, up 2.8% compared to the previous year. Poor weather and high production costs likely contributed to the yield reduction in November. According to Dairy Australia, rainfall in Western Australia and parts of New South Wales was above average, but in other regions, it was average or below average. November temperatures were above average across the country. The Australian Bureau of Meteorology forecasts above-average temperatures as summer approaches, which could lead to heatwaves.

Despite lower feed prices in November, they remained higher than last year. According to Dairy Australia's forecast, milk production in the 2024/2025 season may slightly decrease from 8.3 billion liters in the previous season. Australia's export opportunities have increased this season, as local high-priced dairy products have become more competitive in foreign markets due to rising dairy product prices in other countries.

According to USDA data, raw milk production in New Zealand increased under favorable weather conditions and met market demand amid declining milk production in other regions. According to clal.it, from January to October 2024, milk yields in New Zealand totaled 16 million tons, up 1.2% compared to the previous year. According to Expana Markets, New Zealand suppliers are likely to compete with EU and Belarusian competitors in supplying powdered milk to Algeria at the end of the first and beginning of the second quarter of 2025. In November 2024, the Algerian procurement agency ONIL held a tender for the supply of whole milk powder, skim milk powder, and dehydrated milk fat.

Certain opportunities exist for New Zealand exporters in China. According to AHDB, milk production growth in China is slowing due to declining purchase prices, the negative impact of drought in the third quarter, and the exit of local dairy farmers from the industry. The domestic milk supply in China is decreasing. According to Rabobank estimates, milk yields in China could decrease by 0.5% year-on-year in the second half of 2024 and by 1.5% in 2025. This situation could lead to a 2% increase in China's dairy imports. The Fonterra cooperative has invested $150 million in a new UHT cream plant aimed at meeting demand in China and other Asian countries.

Dairy Market Prices

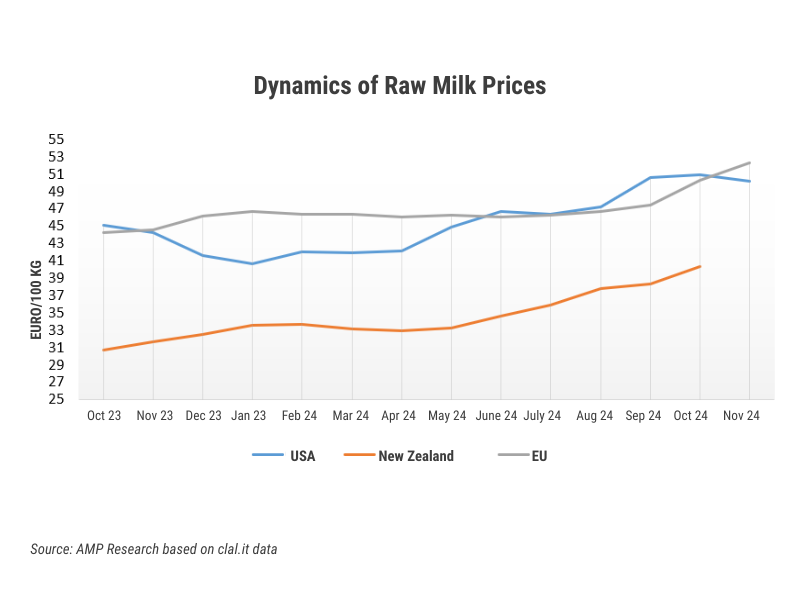

Europe: According to preliminary European Commission data, the average price of raw milk in the EU in November 2024 was 52.33 euro cents per kg, up 1.2% compared to October. Compared to November 2023, milk prices in the EU rose by 13.2%. Purchase prices in the EU gradually increased due to limited raw milk supply in member countries.

USA: According to clal.it, in November 2024, the price of raw milk in the USA was 50.19 euros per 100 kg, down 1.49% compared to October 2024 and up 13.99% compared to November 2023. Likely, purchase prices in the USA declined in November due to slowing demand for raw milk from dairy processing enterprises.

Oceania: According to Rural Bank, the average milk price in Australia this season is around 8.10 Australian dollars per kg of dry milk residue. According to clal.it, in October, raw milk in New Zealand cost 40.30 euros per 100 kg, up 5.14% compared to September 2024 and up 31.06% compared to October 2023. The increase in raw milk prices was likely related to rising prices for commodity goods on export markets.

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News