The presence of raw milk surpluses and unsold commodity products is putting pressure on procurement prices in Ukraine and globally. Stabilization of the market situation is likely at the end of the 3rd quarter of 2026 as the excess supply of dairy products gradually exits the market, reports Georghii Kukhaleishvili, analyst at the Association of Milk Producers (AMP).

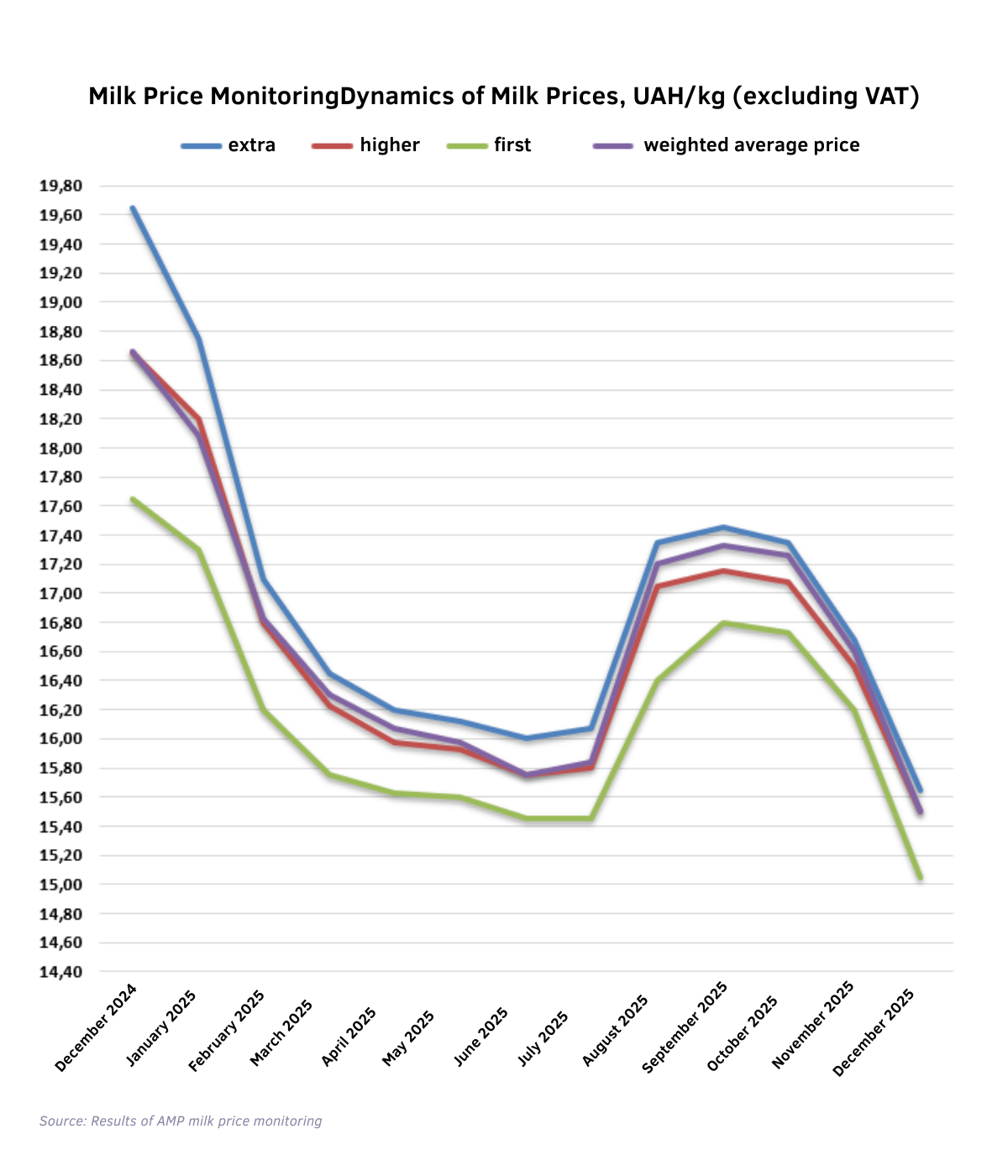

The average procurement price for Extra grade milk as of December 20 was 15.30 UAH/kg (excluding VAT), which is 1.00 UAH less than the previous month. The price range for this grade on farms varies from 14.80 to 16.00 UAH/kg (excluding VAT). The lower limit of the price range decreased by 1.20 UAH, and the upper limit decreased by 80 kopecks.

Higher grade milk costs an average of 15.20 UAH/kg (excluding VAT), down 90 kopecks compared to the previous month. Prices for high-grade milk fluctuate between 14.70 and 15.80 UAH/kg (excluding VAT). The lower limit of the price range decreased by 1.30 UAH, and the upper limit decreased by 50 kopecks.

The average price for First grade milk was 14.80 UAH/kg (excluding VAT), decreasing by 1.10 UAH relative to the previous month. The minimum price on farms was 14.00 UAH/kg, which is 1.80 UAH less than the previous month. The maximum price was 15.00 UAH/kg and remained unchanged compared to the previous month.

Accordingly, the weighted average price for the three grades was 15.20 UAH/kg (excluding VAT), which is 1.05 UAH less than the previous month.

Georghii Kukhaleishvili notes that the decline in procurement prices in Ukraine continues under the pressure of raw milk surpluses. In November, Ukraine produced 35,000 tonnes more raw milk than last year. These volumes were intended for export in the form of finished products. However, a crisis continues in export markets, and the supply of dairy products is outpacing demand. On average, a Ukrainian today consumes 200 kg of milk per year. However, due to the reduction in the number of domestic consumers caused by forced migration as a result of Russian shelling, a significant surplus of raw materials has appeared on the market.

Starting January 1, a further decrease in procurement prices is expected due to the raw milk surpluses that will accumulate at enterprises during the New Year holidays, a period traditionally characterized by a lull in market activity. Despite the decrease in the price of raw milk, the production of butter and skim milk powder remains unprofitable. Milk prices are falling not only in Ukraine but also in other dairy regions, including the US and European countries. The simultaneous increase in raw milk production in 2024–2025 across different regions of the world led to the emergence of commodity surpluses that markets cannot quickly absorb, which in turn drove down global prices for milk and dairy products.

Stabilization in both the finished dairy products market and the raw milk market is expected in the second half of 2026.

Press Service of the Association of Milk Producers

Follow us on LinkedIn

Related News: