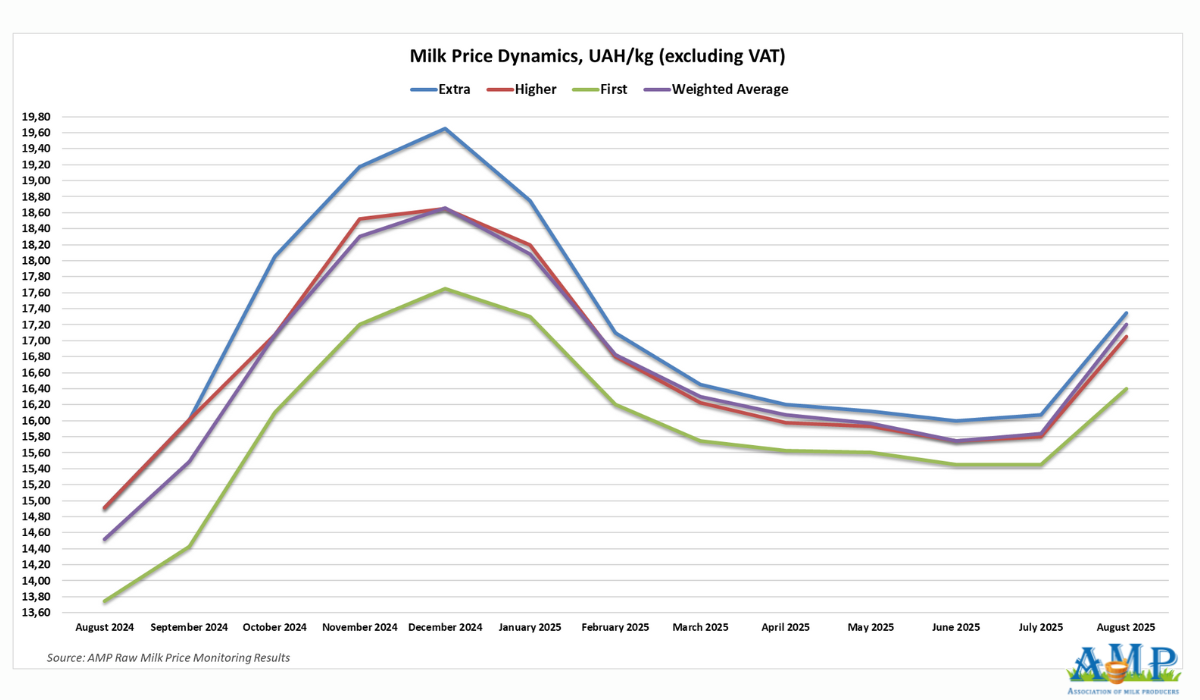

Weak domestic demand for whole milk products and uncertainty regarding the prospects of commodity exports to the EU will restrain the growth of purchase prices in Ukraine, reports Georghii Kukhaleishvili, an analyst at the Association of Milk Producers. As of August 25, the weighted average price for the three grades was 17.20 UAH/kg (excluding VAT), which is 1.20 UAH more than the previous monitoring results.

The average purchase price for extra grade milk as of August 25 was 17.35 UAH/kg (excluding VAT), which is 1.21 UAH more than a month ago. The price range for this grade on farms varies from 16.90 to 17.80 UAH/kg (excluding VAT). The lower limit of the price range increased by 1.40 UAH, and the upper limit increased by 1.10 UAH.

Higher grade costs an average of 17.05 UAH/kg (excluding VAT), a 1.2 UAH increase. Prices for higher grade milk range from 16.30 to 17.40 UAH/kg (excluding VAT). The lower limit of the price range increased by 1.00 UAH, and the upper limit increased by 1.05 UAH.

The average price for first grade milk was 16.40 UAH/kg (excluding VAT), which is 95 kopiykas more than in the second half of last month. The minimum price on farms was 15.70 UAH/kg. The maximum price was 16.80 UAH/kg. The lower limit of the price range increased by 70 kopiykas, and the upper limit increased by 1.20 UAH.

Georghii Kukhaleishvili notes that the increase in raw milk prices in the second half of August is related to a surge in demand from cheesemakers, as well as confectionery companies that use dairy products in their sweets. However, milk processing plants are mostly producing for their warehouses, and further growth in purchase prices depends on the prospects of commodity exports to the EU after the European Commission's cancellation of autonomous trade measures (ATMs) in June.

A significant increase in purchase prices in September-October 2025, as was the case in 2024, is unlikely if there is a delay in signing a new agreement between Ukraine and the EU to increase quotas for domestic dairy product exports. Currently, dairy product exports to the EU are suspended, and shipments to post-Soviet markets have decreased due to logistical barriers resulting from the war and competition from Russian and Belarusian companies. A certain decline in butter prices in the EU, amid increased milk yields in Oceania, the US, and Latin America due to favorable weather conditions, also works against Ukrainian suppliers. The increased supply of raw milk in dairy product exporting regions is putting pressure on global commodity prices.

The growth in purchase prices is also being held back by weak demand for whole milk products in the domestic market and an increase in the share of imported cheeses to 50%, which discourages domestic cheesemakers from increasing their production of finished goods. In early September, a slight increase in raw milk prices is likely in the lower and middle parts of the price corridor, but changes in the upper price range are unlikely.

Press service of the Association of Milk Producers

Follow us on LinkedIn

Related News