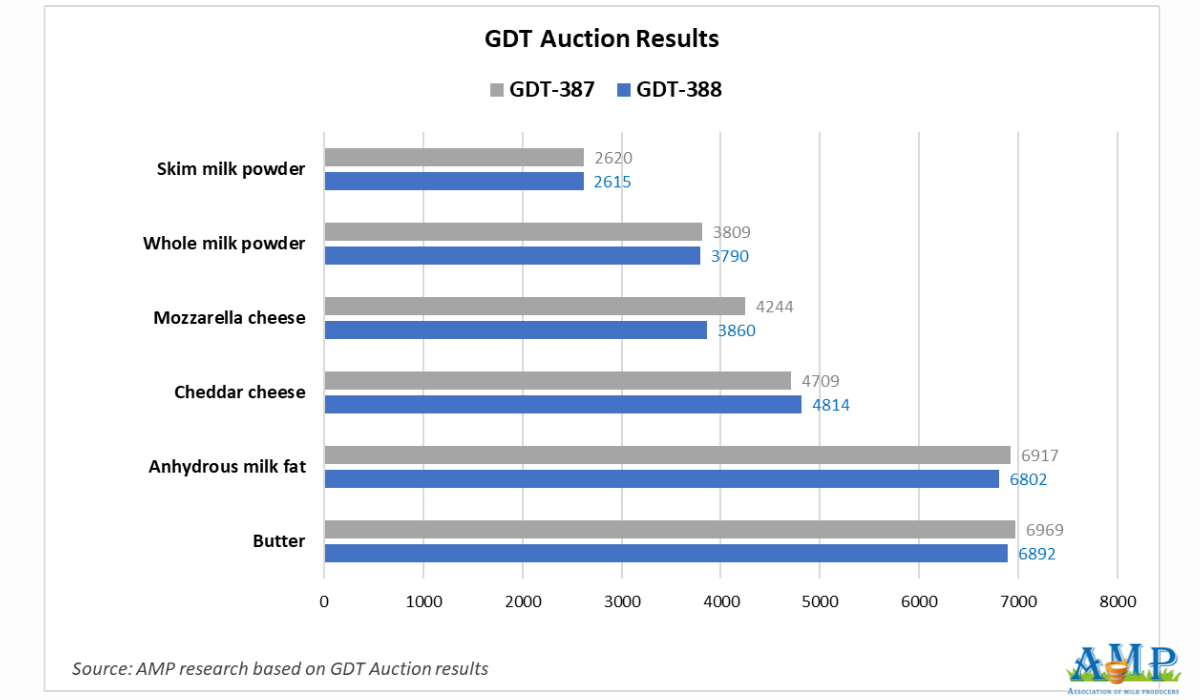

Following the auction, all products except for Cheddar cheese became cheaper. An atypical increase in milk yields in key dairy regions has led to a surplus of raw milk on the market, which has lowered global prices for commodities where supply exceeds demand, reports Georghii Kukhaleishvili, an analyst at the Association of Milk Producers.

On Tuesday, September 15, the 388th GDT auction took place, with the price index at 1199, a decrease of 10 points (-0.8%) since the previous auction.

The average price for dairy products was $4,041 per tonne, which is $2 less than the results of the previous auction. During the auction, 39,093 tonnes of commodities were sold, which is 2,372 tonnes less than the previous auction. The minimum offering was recorded at 36,884 tonnes, and the maximum at 44,757 tonnes. A total of 165 dairy market operators participated, which is 11 fewer companies than on September 2.

According to the auction results, the price for anhydrous milk fat was $6,802 per tonne, a 1.5% decrease from the previous auction. As reported by the USDA, prices for milk fat in Europe fell last week due to lower demand and larger stocks compared to the same period last year. The auction organizers predict a price decrease for anhydrous milk fat of 3.3% in October and 1.5% in November.

The price for butter at this auction was $6,892 per tonne, a 0.8% decrease from the previous auction's results. According to the USDA, the US butter market is seeing a "bearish trend." Increased cream supply, the closure of some milk processing plants for maintenance, and weak demand for butter from the food industry are pressuring prices. Milk processing plants are building up inventory, not operating at full capacity, and preparing for the autumn-winter sales season, which includes the major holidays of Thanksgiving, Christmas, and New Year. Vesper reports that prices for American butter are falling because it is being produced in larger volumes than the domestic market can consume. Demand for American butter in foreign markets is more stable.

In Europe, butter became cheaper last week due to lower demand for the product and larger stocks compared to last year. According to Vesper, the supply of butter in the EU market increased by 56.5 thousand tonnes compared to the first half of 2024, as a result of reduced exports, increased imports, and higher production volumes. In Oceania, butter also became cheaper amid rising raw milk production at the start of the new season and declining demand in export markets. Cheaper American butter has led to a decrease in buyer interest in the New Zealand product. According to the GDT organizers, butter prices may decrease by 0.6% in October and 0.4% in November.

The price for whole milk powder was $3,790 per tonne, a 0.8% decrease compared to the results of the previous auction. As reported by Vesper, the unprecedented increase in raw milk supply in key dairy regions like the US, Oceania, and Latin America has led to a softening of prices for whole milk powder. Milk surpluses exceed the processing capacity of local enterprises, forcing them to use the raw material for the production of low-margin products. A surplus of whole milk powder has appeared on the market, increasing competition for sales markets among producers from various dairy regions..

According to the USDA, despite the approaching season of reduced milk production in the Northern Hemisphere, yields are increasing in the US and EU, while Oceania is experiencing exceptionally high yields at the beginning of the new production season. Typically, milk production in Oceania peaks in October. Raw milk production is seasonally increasing in Latin America, which has led to a reduction in skim milk powder imports by Brazil. Milk processing plants in the US and EU are primarily fulfilling current contractual obligations, while demand for skim milk powder on the spot market is slow. According to the GDT forecast, a price decrease for whole milk powder is likely, with a 1.9% drop in October and a 0.7% drop in November.

Skim milk powder became cheaper, dropping to $2,615 per tonne (-0.3%). According to Vesper, a significant increase in raw milk production in the Southern Hemisphere and an atypical seasonal rise in yields in the Northern Hemisphere have led to a softening of prices for skim milk powder. Milk processing plants are using the raw milk surpluses to produce low-margin products. The increase in butter supply has led to a surplus of skim milk powder, which is a byproduct. According to the USDA, prices for skim milk powder fell last week in Oceania, the US, and Europe amid slow domestic demand. Demand for the product in export markets is also slow, with the exception of Mexico, which is buying significant volumes of skim milk powder from the US. The auction organizers expect the price for skim milk powder to increase by 0.5% in October and 0.3% in November.

Cheddar cheese became more expensive, rising to $4,814 per tonne (+2.2%), while mozzarella cheese became cheaper, dropping to $3,860 per tonne (-9.6%). According to the USDA, demand for cheese in the US is quite slow from the food industry, and competition among product suppliers is intensifying in export markets. The supply of raw milk is high, even with the increase in demand from producers of pasteurized milk at the start of the school year in American schools. Retail chains are actively purchasing cheese from American producers, preparing for the autumn-winter sales season. Prices for Cheddar cheese in Oceania have risen amid active demand in the region and in export markets.

According to Vesper, despite a certain increase in raw milk supply in Europe, cheesemakers are facing difficulties in selling their finished products, as a significant number of buyers are not in a hurry to sign contracts now and are waiting for prices for European cheeses to fall in the fourth quarter. The USDA reports that cheese production volumes in Europe exceed existing demand. The increase in milk yields in Germany and France has likely contributed to additional milk supply for cheesemakers. The auction organizers assume that Cheddar cheese prices may increase by 1.6% in October and 3.3% in November. A 9.6% price decrease for mozzarella cheese is projected for November.

The next GDT auction will take place on October 7.

Press service of the Association of Milk Producers

Follow us on LinkedIn

Related News