Following the auction, the price index increased amid reduced milk powder stocks in producer regions, a decrease in commodity offerings, and a rise in the number of auction participants, reports Georghii Kukhaleishvili, an analyst at the Association of Milk Producers of Ukraine.

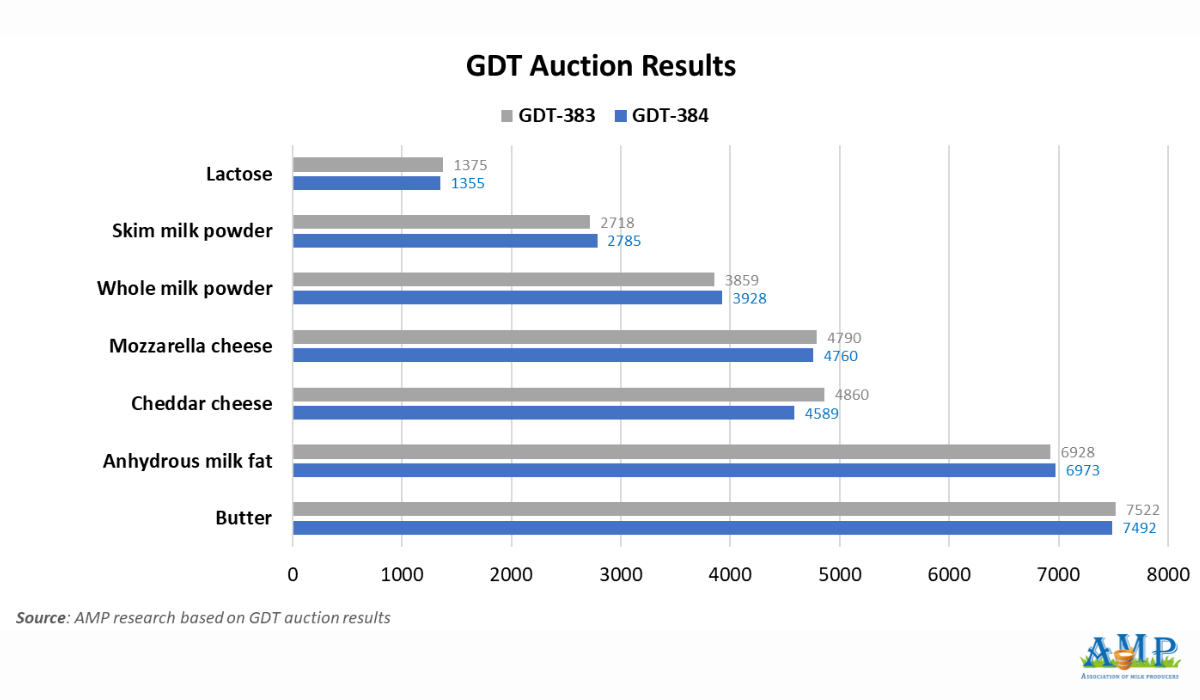

On Tuesday, July 15, the 384th GDT auction took place, according to the results of which the price index was 1259, an increase of 13 points (+1.1%) since the previous auction. The average price for dairy products was $4380 per tonne, which is $106 higher than the previous auction's results. During the auction, 24,290 tonnes of commodities were sold, 1,415 tonnes less than the previous auction. The minimum offering was recorded at 22,781 tonnes, and the maximum at 28,705 tonnes. A total of 179 dairy market operators participated in the auction, 18 more companies than on July 1.

According to the auction results, the price for Anhydrous Milk Fat was $6973 per tonne, which is 0.8% more compared to the previous auction. According to USDA, in early July, dairy fat prices in Europe remained unchanged, although its stocks also remain low. As reported by AInvest, developing countries such as China and Middle Eastern countries are actively adopting Western baking culture, leading to an increase in dairy fat imports. Auction organizers predict a 7.4% decrease in anhydrous milk fat prices in August but a 1.5% increase in September.

The price for Butter at this auction was $7492 per tonne, which is almost consistent with the previous auction's results. According to USDA, demand for butter in the US has slowed, especially from food service companies. Butter sales in supermarkets were more active. Export demand for American butter is quite active. However, as AInvest reports, the strengthening US dollar makes American dairy exports less competitive, while producers from Europe and New Zealand, with weaker national currencies, are lowering prices. Taking advantage of the available raw milk supply, American milk processing companies are increasing butter stocks. According to market participants, demand for butter in Europe and neighboring regions remains consistently high, but its stocks are meager, and production is limited. According to AInvest, the reduction in butter production in Europe is not only due to decreased milk yields but also because producers have focused on producing hard cheese, which yields higher profits.

As reported by USDA, in early July in Oceania, butter prices decreased by $500 per tonne at both ends of the price range. Despite low production levels due to reduced yields, the lower price threshold is beginning to account for long-term contracts planned for the autumn peak in milk production. Product stocks remain limited. In recent years, the increase in butter consumption has been driven by the spread of white label products and consumers' rejection of margarine and vegetable fats, as well as the popularization of Western baking culture in China and the Middle East, which affects the growth of butter imports. Demand for butter in Asia is growing. For example, China is actively purchasing products from New Zealand, the EU, and the US. According to GDT organizers, butter prices may decrease by 2.1% in August and 3.1% in September.

The price for Whole Milk Powder was $3928 per tonne, an increase of 1.7% compared to the previous auction's results. As reported by USDA, raw milk supply in the US is decreasing due to heat and reduced cow productivity, and whole milk powder production remains limited and focused primarily on fulfilling existing contractual obligations. Demand for the product from South America is stable from Algerian and Brazilian buyers. The availability of whole milk powder in the region is inconsistent, and some producers indicate that spot supply is extremely limited until the end of August. In Western Europe, whole milk powder production is declining amid reduced milk yields, and sales are primarily by contract. Spot supply is limited.

In Oceania, whole milk powder production is decreasing, and domestic prices remain at the upper limit of the price range. Domestic and export demand for the product decreased in early July. Economic difficulties in China, particularly real estate problems and weak consumer demand, have led to reduced dairy product consumption. Expectations for growth in dairy demand in the country no longer seem as optimistic. In May 2025, whole milk powder imports fell by 13% compared to last year, and overall consumption remains lower than in 2023 and 2024. According to GDT forecasts, whole milk powder prices are likely to increase by 3.2% in August but decrease by 1% in September.

Skim Milk Powder decreased to $2785 per tonne (+2.5%). According to USDA, interest in American skim milk powder continues to decline in export markets, although last week saw an increase in inquiries from Mexican buyers. Spot lots of skim milk powder are available in the American market, but some manufacturers have limited inventories. Due to reduced milk production volumes, some US enterprises cannot ensure full utilization of drying equipment. In early July in Europe, there were almost no available spot lots of skim milk powder due to reduced production. Domestic demand for skim milk powder in Oceania remains stable or slightly weaker, with domestic prices slightly exceeding export prices.

Export demand for skim milk powder from Oceania has slightly decreased, especially concerning contracts for the second half of the year. It's worth noting that only European skim milk powder was traded for August contracts, while Oceania's product was only for September contracts. According to AHDB, despite slowing growth, China will remain the world's largest importer of skim milk powder. Demand for skim milk powder from South American producers is stable, although some market participants note that spot supply is limited. Buyers from Brazil and Algeria remain active. Auction organizers expect skim milk powder prices to decrease by 0.7% in August and 0.2% in September.

Cheddar Cheese decreased to $4589 per tonne (-5.6%), and Mozzarella Cheese decreased to $4760 per tonne (-0.7%). According to USDA, cheese production in the US is gradually increasing after the Independence Day holiday. Domestic demand for cheese is stable, although retail and foodservice sales are weaker. Export demand for American cheese is growing as it remains price competitive. In Europe, demand for cheese from buyers in Southern and Eastern Europe is increasing, while export demand remains stable. Cheese production in Europe fluctuates from stable to slightly lower. Spot inventories of cheese from some producers and distributors are limited. Domestic cheese prices in Oceania remain high, while export prices have decreased. Current cheese inventories in Oceania are limited.

According to AHDB, despite economic difficulties, China will remain the world's largest cheese importer. As reported by Future Market Insights, the global cream cheese market is expected to grow to $11.3 billion by 2035, with a compound annual growth rate of approximately 5.9%. This may be related to increased demand for tasty and versatile dairy spreads with new flavors, as well as increased use of cream cheese in home cooking, bakeries, cafes, and fast-food chains. Auction organizers suggest that Cheddar cheese prices may decrease by 7.7% in September. Mozzarella cheese prices are projected to decrease by 0.6% in September.

Lactose decreased to $1355 per tonne (-1.5%). According to USDA, demand for lactose in export markets remains high, and American market participants say it is difficult to meet all needs. Demand for lactose is particularly active from companies in South America, South, and Central Asia. Product stocks are limited in the spot market. However, some lots are selling the product at prices below the usual level. Auction organizers forecast a 1.5% decrease in the product's price in September.

No information on Buttermilk Powder was published from the auction results. According to USDA, demand for buttermilk powder in the US is currently moderate and is expected to remain low until autumn. Producers are focused on fulfilling contracts and preparing for increased demand in the fourth quarter. Stocks are limited, and spot availability of the product remains low due to seasonal production decline.

The next GDT auction will take place on August 5.

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News