Limited production of whole milk powder and accumulating dairy product inventories in Asia contributed to a slight increase in the price index, reports Georghii Kukhaleishvili, an analyst at the Association of Milk Producers of Ukraine.

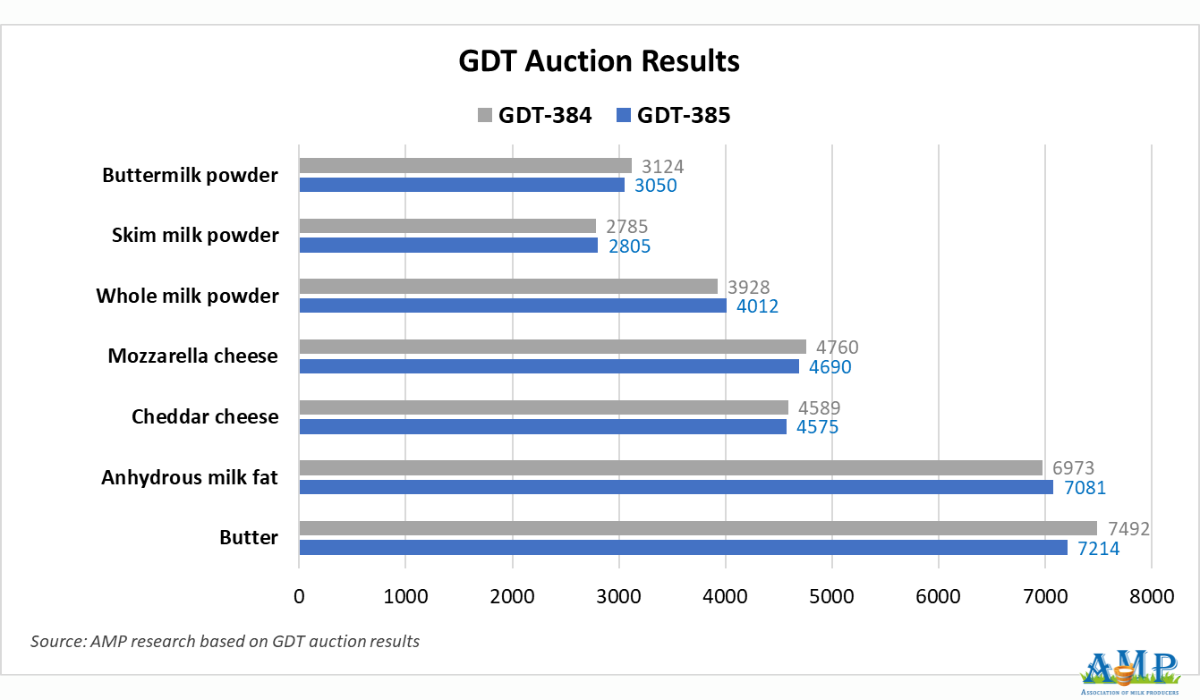

On Tuesday, August 5, the 385th GDT auction took place. The price index was 1268, an increase of 9 points (+0.7%) since the previous auction. The average price for dairy products was $4,249 per tonne, which is $131 more than the last auction. During the auction, 37,040 tonnes of commodities were sold, 12,750 tonnes more than in the last auction. The minimum offering was 34,745 tonnes, while the maximum was 41,828 tonnes. A total of 166 dairy market operators participated, 13 fewer companies than on July 15.

According to the auction results, the price for anhydrous milk fat was $7,081 per tonne, a 1.2% increase compared to the previous auction. According to the USDA, demand for milk fat in Europe was high at the end of July, and product stocks were limited. As reported by the NZ Herald, prices for anhydrous milk fat are influenced by fluctuations in whole milk powder prices. According to BusinessDesk, despite ongoing geopolitical tensions, some regions, particularly in the Middle East, continue to need to build up dairy product inventories, including milk fat. The auction organizers predict a 3.1% decrease in the price of anhydrous milk fat in September but expect a 1.9% increase in October.

The price for butter at this auction was $7,214 per tonne, a 3.8% decrease compared to the previous auction. According to the USDA, demand for American butter remains sluggish, both in the US and in export markets. Retail sales are stable, but demand from the food industry is lower than last year. Due to weak demand, some producers are selling cream to other milk processing enterprises instead of butter producers. Currently, not all butter production capacities are being used. Export demand for European butter is low because it remains more expensive than products from other producing regions.

In Oceania, butter demand is stable, although production is seasonally limited and stocks remain low. Futures contracts for butter from New Zealand are becoming more expensive, which indicates optimistic demand expectations in the near future. In New Zealand, butter prices have increased by almost 47% in a year and have doubled over the last decade, causing consumer dissatisfaction. The main reason is export demand, which accounts for about 80% of the retail price of butter, as 95% of New Zealand's dairy products are exported.

The dairy cooperative Fonterra does not plan to lower domestic prices, citing stable or growing global demand for butter, especially from Asian countries and China. Despite concerns about the availability of products for domestic consumers, the government is cautious about intervention, as high prices for dairy fats are an economic driver for New Zealand. According to the GDT forecast, butter prices may decrease by 1% in September and 4.1% in October.

The price for whole milk powder was $4,012 per tonne, an increase of 2.1% compared to the previous auction, amid a reduction in the product's production in producing regions, despite sluggish demand. As reported by the USDA, demand for the product in the US is low, and production has decreased. Prices for whole milk powder in Europe have fallen across the board, and demand for the product is declining. Products from other regions are sold at lower prices, which also reduces export demand for European whole milk powder. However, the production of raw milk in Europe is decreasing, which limits the production of milk powder. Some plant managers report that they are focused mainly on fulfilling current contracts, so spot inventories of whole milk powder remain low.

Whole milk powder prices in Oceania have remained stable during the reporting period. Production of the product remains insignificant due to seasonal factors, which is causing stock limitations. Futures prices in New Zealand have strengthened, and short-term contracts have become more expensive. Domestic demand remains stable. Demand for whole milk powder from South American producers is ambiguous. According to CLAL, Brazil reduced whole milk powder imports in January-June 2025 compared to the same period in 2024. At the same time, exports of the product from Argentina and Uruguay to other regions have increased in annual terms. Production is generally increasing thanks to a seasonal increase in milk yields.

According to the USDA forecast, a likely increase in demand from China could facilitate the export of whole milk powder from Latin America and contribute to higher world prices. The growth in demand from China for whole milk powder is traditionally influenced by the growth of the urban population, an increase in citizens' purchasing power, and a higher consumption of proteins and dairy products. This indicates a recovery in consumer confidence and the country's economy. The growth in the consumption of powdered milk formulas may be facilitated by the Chinese government's introduction of a state system of child care subsidies as part of the country's efforts to support families and stimulate the birth rate. An increase in China's whole milk powder imports could lead to a rise in global milk prices. According to the GDT forecast, the price for whole milk powder is likely to decrease by 4.8% in September but will likely increase by 4% in October.

Skim milk powder became more expensive, rising to $2,805 per tonne (+0.4%). According to the USDA, demand for skim milk powder in the US remains stable. Interest in the American product from buyers in Mexico remains high. However, sellers note that buyers are more focused on short-term needs, and a weak US dollar negatively affects export activity. Due to the seasonal decline in milk yields, skim milk powder production in Europe is decreasing. Demand for the product in Europe is also falling, although supplies to other countries remain stable. Skim milk powder production in Oceania is limited due to seasonal factors, and stocks remain low. Demand is expected to strengthen in the second half of the year, which is contributing to rising futures prices in New Zealand. Auction organizers expect the price for skim milk powder to increase by 8.4% in September and 0.7% in October.

Cheddar cheese decreased to $4,575 per tonne (-0.6%), and mozzarella cheese decreased to $4,690 per tonne (-0.1%). According to the USDA, in the US, demand for cheese in the domestic market has slightly weakened, but export interest in American cheese remains high, especially amid anticipation of changes in Trump's tariff policy. In Europe, demand for cheese from the food service sector remains stable. At the same time, export demand is mixed, partly due to the influence of the US's unstable trade policy, which reduces buyer activity. Cheese production in Europe has decreased amid the seasonal decline in milk yields, but the market is generally in balance between supply and demand. In Oceania, cheese production is limited, and stocks are low at the beginning of the new raw milk production season. Domestic demand for cheese is stable.

It is likely that global demand for cheese is being driven by the growing popularity of convenience foods and ready meals that use it. According to Orinsights Consultancy, the global cheese stick market is showing high growth. The market volume is expected to grow from $6.8 billion in 2025 to $18.92 billion in 2034, with a compound annual growth rate of 5.9%. According to Fonterra, in South Korea, cheese consumption has increased by 160% over the last decade, influenced by the popularization of a Western diet. The Fonterra cooperative holds a 30% share of the cheese market and a 40% share of the milk protein market in Japan, while domestic dairy production in the country has decreased by more than 10% since 2000 due to the unpopularity of farming among young people. Auction organizers assume that Cheddar cheese prices may increase by 1.8% in October. Mozzarella cheese prices are projected to decrease by 0.1% in October.

Buttermilk powder decreased to $3,050 per tonne (-2%). According to the USDA, the limited supply of buttermilk powder in the US is due to some producers not drying buttermilk but selling it in a condensed form. Demand in the US domestic market is stable, and demand from international buyers is slower due to the Trump administration's unstable trade policy and a weakening US dollar. According to the Future Market Insights Blog, the global buttermilk powder market has growth prospects. The market volume is projected to grow from $2.79 billion in 2025 to $3.94 billion in 2035. The product's popularity is growing due to its nutritional value, which makes it popular in modern diets. Auction organizers predict a 2.6% decrease in the product's price in September and a 4.3% decrease in October.

No information on lactose was published from the auction results. According to the USDA, lactose sales in the US remain high, and the market is vibrant both domestically and internationally. Some market participants note that demand is outstripping production, while others indicate a balance between sales volumes and demand.

The next GDT auction will take place on August 19.

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News