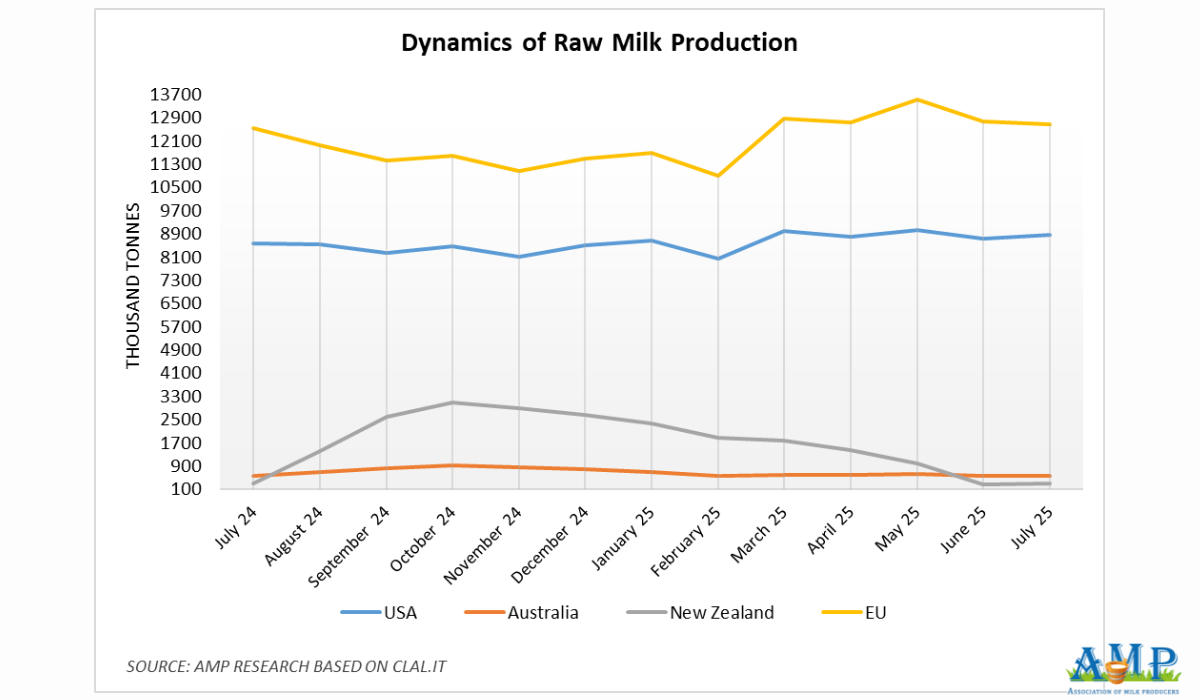

From January to July, the EU's raw milk production decreased due to cow diseases and unfavorable weather. Drought has also led to lower yields in Australia. Conversely, the US and New Zealand increased their raw milk production, which has contributed to some softening in butter prices.

PRODUCTION AND DEMAND

Europe: According to clal.it, milk yields in the EU in July 2025 were 12.67 million tonnes, down 0.2% from June but up 1.2% from July 2024. From January to July 2025, the EU produced 87.63 million tonnes of raw milk, a 0.3% decrease from the same period last year. The USDA reports that milk production in the Northern Hemisphere remained seasonally low. In some European countries, cow health has been a serious issue, negatively impacting raw milk production on farms. France, in particular, is grappling with a lumpy skin disease outbreak. About 1,000 head of cattle were culled, and a vaccination campaign has covered 100,000 cows in key cheese-producing regions. The outbreak has caused a drop in milk production and the imposition of trade restrictions. For example, the UK has halted imports of raw milk cheeses from France, including Reblochon and Beaufort.

According to Ornua's forecast, European milk production will likely grow by 0.5% annually, but weather conditions could be a limiting factor. AHDB data shows that due to lower milk yields in Germany and the Netherlands, the EU increased its dairy product imports by 3.5% in the second quarter of 2025 compared to the same period last year. According to Ornua, milk yields in Germany declined in May (-1.6%) and June (-2.1%) relative to last year's figures.

However, some market participants note that the rate of decline in European milk production began to slow in late August. According to Ornua, Ireland has significantly increased milk production in recent months after a low base. In June, milk yields in Ireland rose by almost 5%. In Poland, raw milk production was high in the second quarter and increased by 1.9% in June.

The USDA reports that interest in European cheeses in export markets is mixed due to changes in the euro exchange rate. According to Expana Markets, EU suppliers participated in a tender by the Algerian agency ONIL and secured large volumes of skim milk powder. Shipments of 35,000 tonnes of skim milk powder from the EU to Algeria are scheduled for November 2025 to December 2026.

United States: According to clal.it, the US produced 8.72 million tonnes of raw milk in July 2025, an increase of 2% from June and 3.5% from July 2024. From January to July 2025, US milk yields totaled 61.25 million tonnes, a 1.4% increase from the same period last year. The USDA reports that milk production in the US was sufficient to meet the needs of milk processors. According to Ornua, milk production has been stable, with yields expected to increase in the second half of the year. While bird flu negatively impacted production last year, the increase in US milk yields this year was one of the factors contributing to a 2.1% rise in global milk production in June. Milk production only decreased in the Northeast, Central US, and California.

High fat components in the milk have provided a substantial supply of cream, for which demand is growing, especially from butter producers. With the start of the school year, demand for raw materials from producers of packaged milk has also increased. At the same time, demand for raw milk from ice cream producers has decreased. Demand for concentrated skim milk may continue to be high despite a reduction in its supply. Mexico has increased its purchases of American skim milk powder. Export demand for American cheese remains high, as it is more affordable than cheeses from other regions.

Oceania: According to clal.it, milk yields in Australia were 556 thousand tonnes in July 2025, a decrease of 1.6% from June and 4% from July 2024. The USDA reports that Australia's milk yields are declining due to unfavorable weather. For the 2024/25 season, raw milk production was 8.31 million tonnes, down 0.7% from the previous year. The largest drops in milk yields occurred in the states of Victoria, Tasmania, and South Australia, while production increased in New South Wales. Due to the drought, farmers, particularly in northern Victoria, are facing high prices for irrigation water.

As reported by clal.it, milk yields in New Zealand were 312 thousand tonnes in July 2025, a 20% increase compared to June and a 0.6% increase compared to July 2024. From January to July 2025, New Zealand's milk yields totaled 9.02 million tonnes, a 1.4% increase from last year. According to Ornua, milk production in New Zealand surged in June due to improved pastures and attractive farm-gate prices. A new record was set in July. Overall, yields in the first two months of the 2025/26 season have grown by 6.7%. The market has conditions for yields to grow beyond expectations.

The USDA reports that in July, New Zealand increased its shipments of butter and milk powder to China and Japan. Despite rising milk yields and butter production in Oceania at the start of the new season, domestic demand remains weak, and lower prices for American butter are creating certain barriers in export markets. The Daily Blog reports that consumers are complaining about butter prices in New Zealand, which have increased by 50% over the past year due to last year's rising prices for the product in export markets and active demand from China's 500 million-strong middle class. According to Ornua's forecast, raw milk production in China is expected to decrease in 2025 due to lower farm-gate prices for farmers.

DAIRY MARKET PRICES

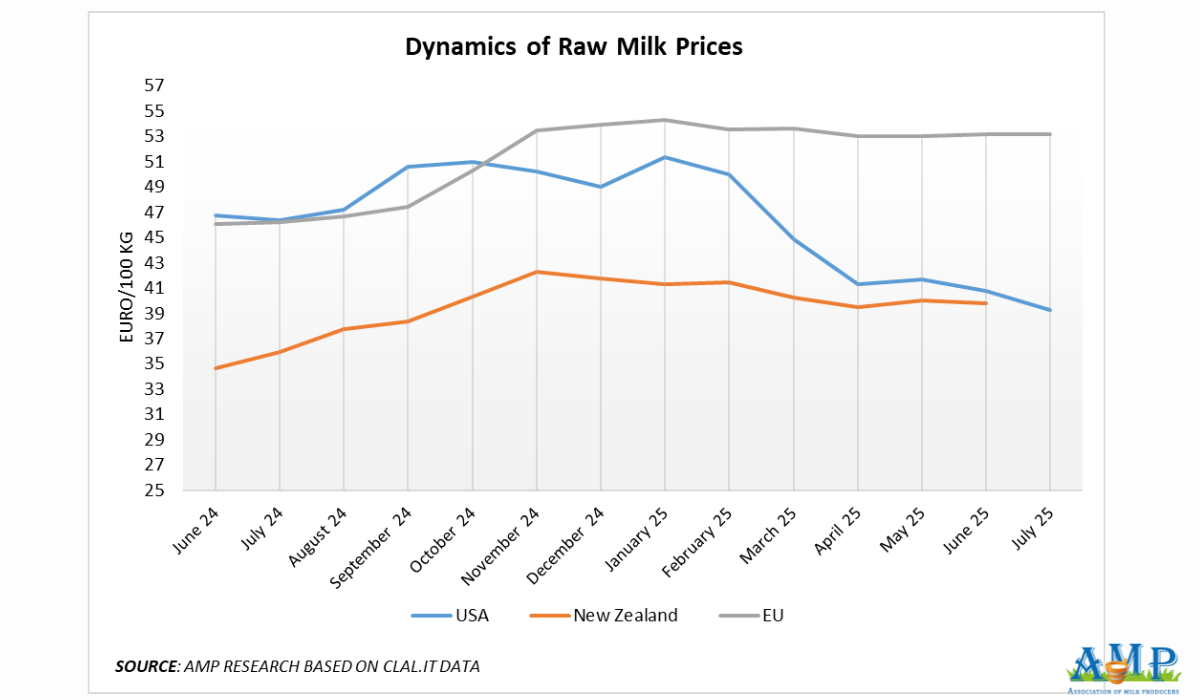

Europe: According to the European Commission, the average price for raw milk in the EU in July 2025 was €53.17 per 100 kg, an increase of 0.5% from June 2025. Compared to July 2024, milk in the EU has become 14% more expensive. The moderate increase in raw milk prices in the EU is due to a reduction in raw milk production in several European countries.

United States: According to clal.it, the price for raw milk in the US in July 2025 was €39.27 per 100 kg, a decrease of 3.6% from June and 15.28% from July 2024. The decrease in raw milk prices is likely due to increased milk yields.

Oceania: According to the Milk Value Portal, farm-gate prices in Australia for the 2025/26 season are expected to be between A$8.90 and A$10.00 per kg of milk solids. The USDA reports that the forecast raw milk price in New Zealand has been lowered to NZ$10.27 per kg of milk solids due to fluctuations in global commodity prices.

Follow us on LinkedIn

Related News